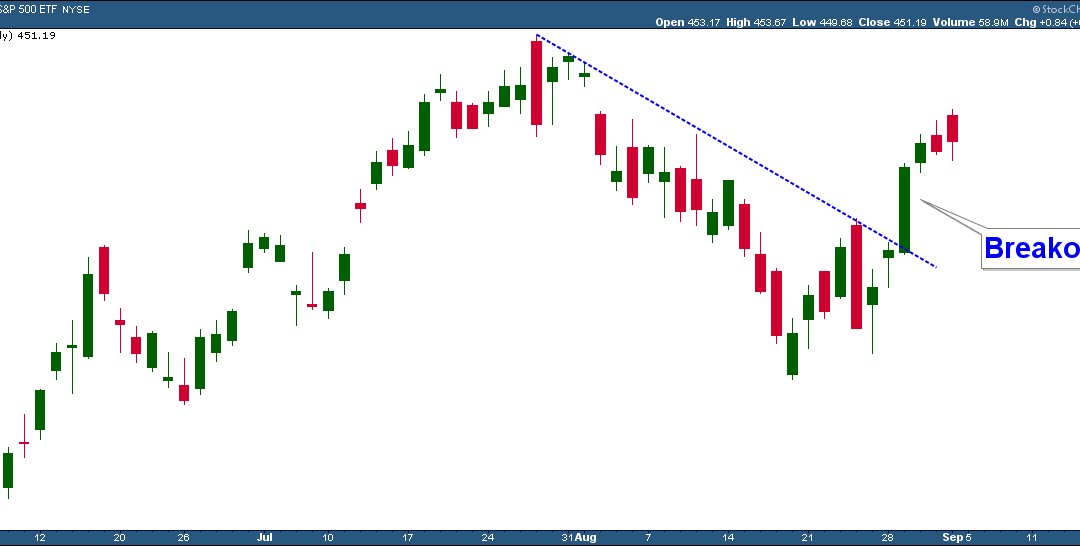

Stock Market At Major Inflection Point In our August 7, 2023 Market Update, Stock Market Weakness Likely, I mentioned the market was at the top of its uptrending channel and was likely to correct to the lower half of that channel. Here we are two months later...