The S&P 500

The Federal Reserve has been increasing interest rates as a means to manage inflation by reducing overall demand in the economy. This strategy is intended to stabilize economic conditions. However, there is a concern that such actions might inadvertently lead to a recession.

It is worth noting that historically, the stock market has experienced its most substantial declines during recessionary periods. The uncertainty surrounding the impact of these interest rate hikes has been acting as a deterrent to significant growth in the stock market.

With the economic situation as a backdrop, let’s take a look at what market technicals are suggesting about the health of the stock market.

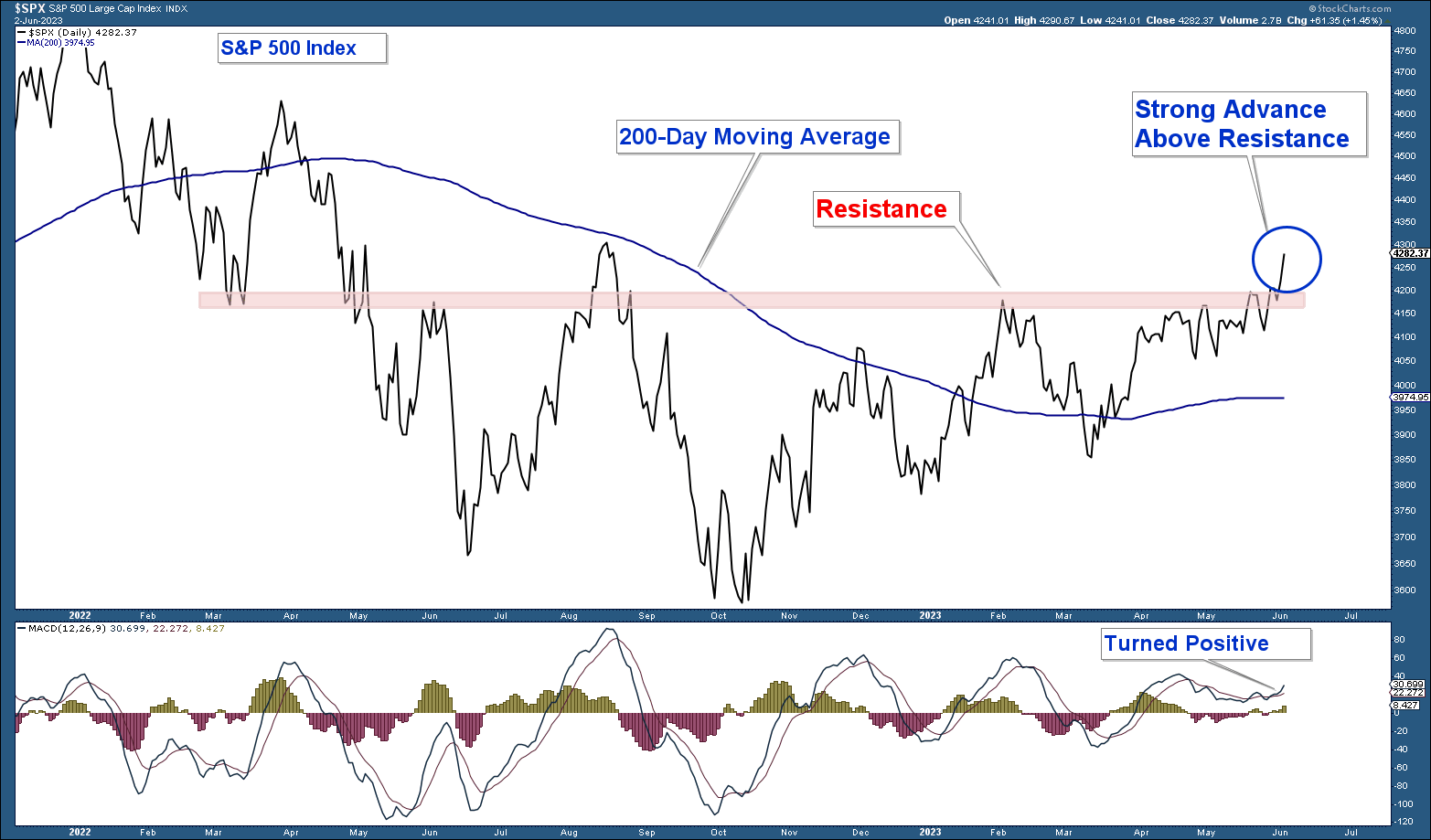

First, let’s look at a chart of the S&P 500 Index which is our market proxy. Here are my takeaways from the chart.

- The index is still above its 200-day moving average.

- The index is still in a structural uptrend.

- The index has advanced strongly above an important area of resistance.

Conclusion: As long as the S&P 500 is above its 200-day moving average the market is bullish from a price perspective.

Risk-On vs Risk-Off

A strong stock market is often characterized by a risk-on environment, which means that investors tend to favor stock categories that offer higher potential returns, even though they come with greater downside risks.

As we discussed in previous newsletters, the stock market displayed a bullish risk-on shift in January. However, this sentiment diminished in the months that followed.

Recently, we have witnessed a resurgence of risk-on bullishness, coinciding with the S&P 500 breaking through a significant resistance level.

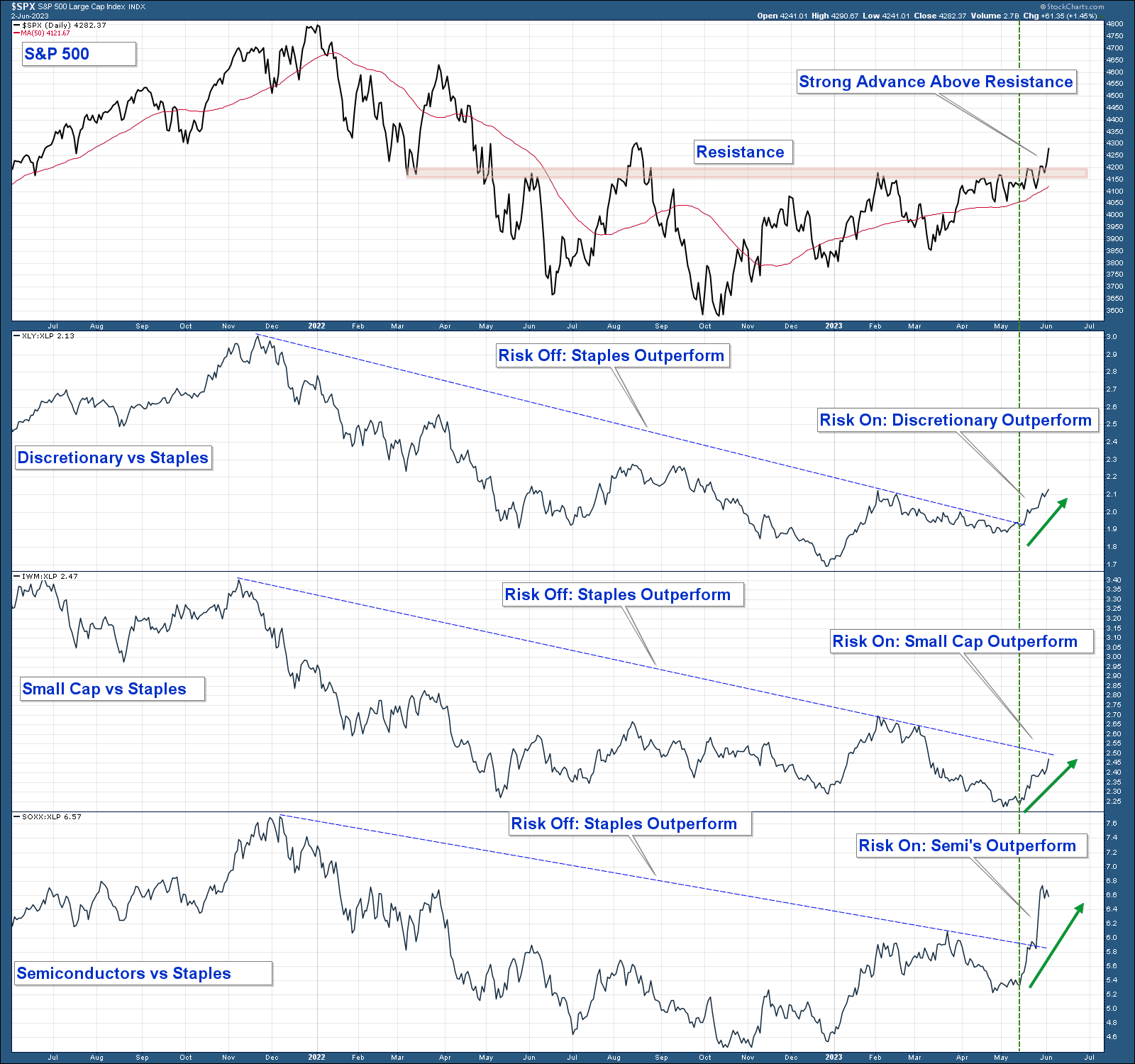

In the chart below, I have plotted the relative strength of three risk-on funds in comparison to the Consumer Staples ETF (XLP). Here are the key takeaways from the chart:

- When the risk-on group is outperforming the line is rising and when it is falling it indicates that the risk-off Consumer Staples sector is outperforming.

- All three risk-on indexes underperformed last year which was indicative of a weak stock market.

- All three risk-on indexes began to strongly outperform in January; however, that outperformance reversed course in the months that followed.

- More recently (at the green vertical line), all three risk-on funds have exhibited strong outperformance prior to the S&P 500 surpassing a major resistance level.

Conclusion: The fact that risk-on assets are outperforming as the stock market advances above resistance is a bullish sign. It suggests that market participants are embracing higher-risk investments, indicating a positive outlook for the stock market.

Market Breadth

The Fly In The Ointment

While the technical indicators mentioned above suggest a positive market outlook, there is a notable concern that hinders a more bullish sentiment: poor market breadth. Despite the advancement of major market indexes, this progress is primarily driven by a small group of mega-cap stocks, while the majority of stocks within those indexes are not participating in the upward movement.

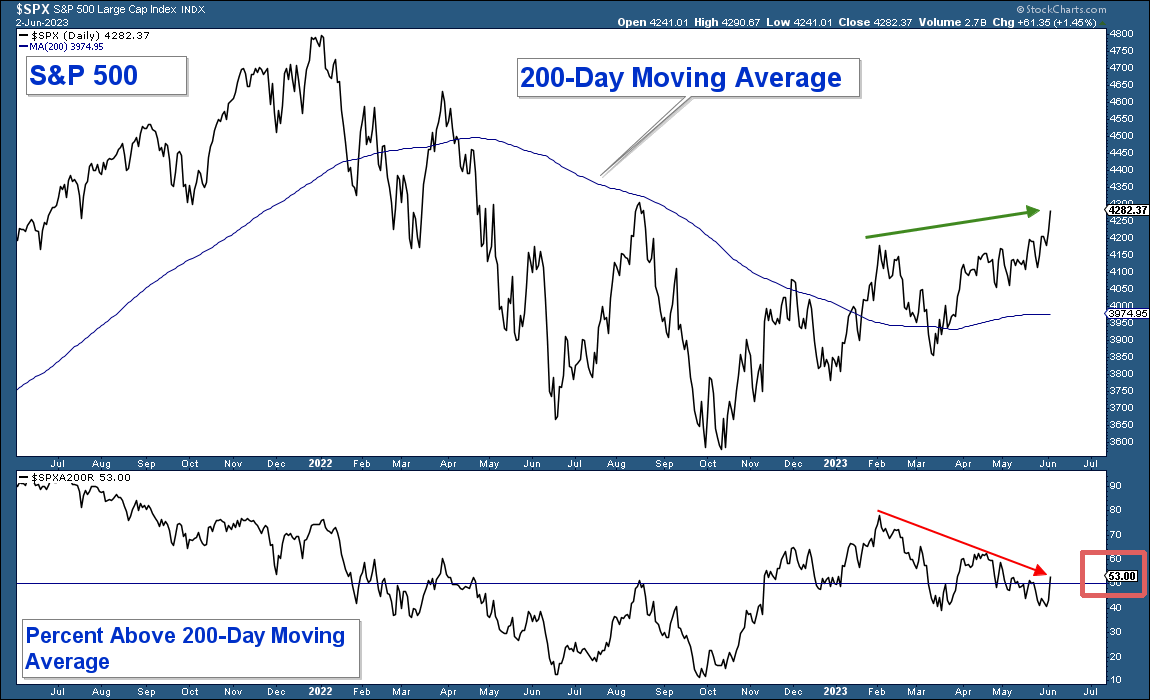

To illustrate this point, I have included a chart below. The upper panel represents the S&P 500 Index, while the lower panel shows the percentage of stocks within that index that are trading above their respective 200-day moving averages. Here are the key observations from the chart:

- In January, there was a significant increase in the percentage of stocks above their 200-day moving averages, aligning with other positive technical signals. However, this strength was short-lived and has been declining since early February.

- While the S&P 500 Index has surpassed its February peak (green arrow), the percentage of stocks within that index above their respective 200-day moving averages has been declining (red arrow) and is well below its January peak.

- Despite the index being comfortably above its 200-day moving average, only 57% of the stocks within that index (red rectangle) are trading above their respective moving averages.

Conclusion: The market continues to face the challenge of poor market breadth, where the majority of stocks are not participating in the market’s upward movement. This is an important factor to consider when evaluating the overall market condition.

Conclusion

The current market environment is characterized by partial advancement rather than a uniform upward, positive trend in market technicals. Let’s summarize both the bullish and bearish aspects to gain a comprehensive understanding.

On the bullish side, major indexes are displaying structural uptrends, indicating overall positive market conditions. Additionally, the S&P 500 is trading above its 200-day moving average, suggesting sustained price strength. Furthermore, risk-on segments of the market have recently started to outperform again, signaling increased investor confidence in higher-risk investments.

However, it is essential to acknowledge the bearish factors as well. There is a significant risk of a major recession, and if this risk materializes, it would lead to substantial declines in stock market prices, probably surpassing the 2022 October lows.

Additionally, market breadth, which measures the participation of individual stocks in the market’s performance, is currently poor. This implies that the market’s overall strength is driven by a limited number of stocks, while the majority are not sharing in the upward movement.

Client Account Update

Given this combination of positive and negative indicators, it is essential to give utmost priority to risk management strategies in the current market environment. By actively managing risks, we can navigate the uncertainties prevailing in the market and safeguard our investment portfolios.

In line with this risk-conscious approach, both our conservative and aggressive models are allocated defensively.

Given that market technicals have slightly improved, I will be looking to gradually add equity exposure to the extent that underlying market technicals display strength.

CAN WE HELP YOU?

HERE’S AN EASY WAY TO FIND OUT:

We want clients who are a good mutual fit. To find out, we offer a no-pressure complimentary consultation. If we can help you and you want to work with us, that’s great. But if you don’t, we will give you free asset allocation direction on your retirement accounts, at no charge and with no strings attached.

If you are interested, send us an email to set up your complimentary zoom meeting.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.