Sector Rotation

Technology Starting to Look Weak

One of the hallmarks of a bull market is sector rotation. I am sending out this update because we are starting to see the early signs of money moving out of technology, which has led this year’s market rally, and into lagging sectors/industry groups.

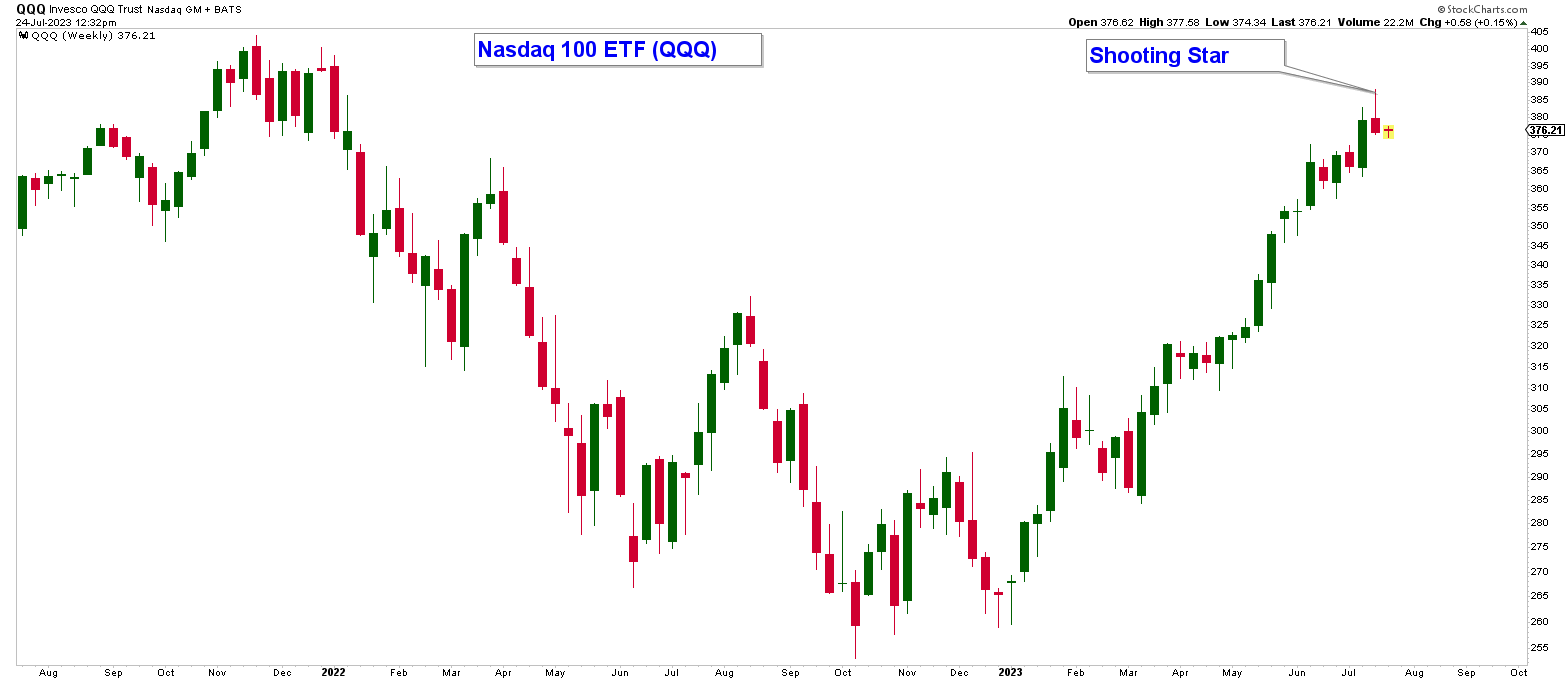

Below is a weekly chart of the Nasdaq 100 and last week’s candle is called a shooting star, a loss of momentum candle that suggests a possible change in trend.

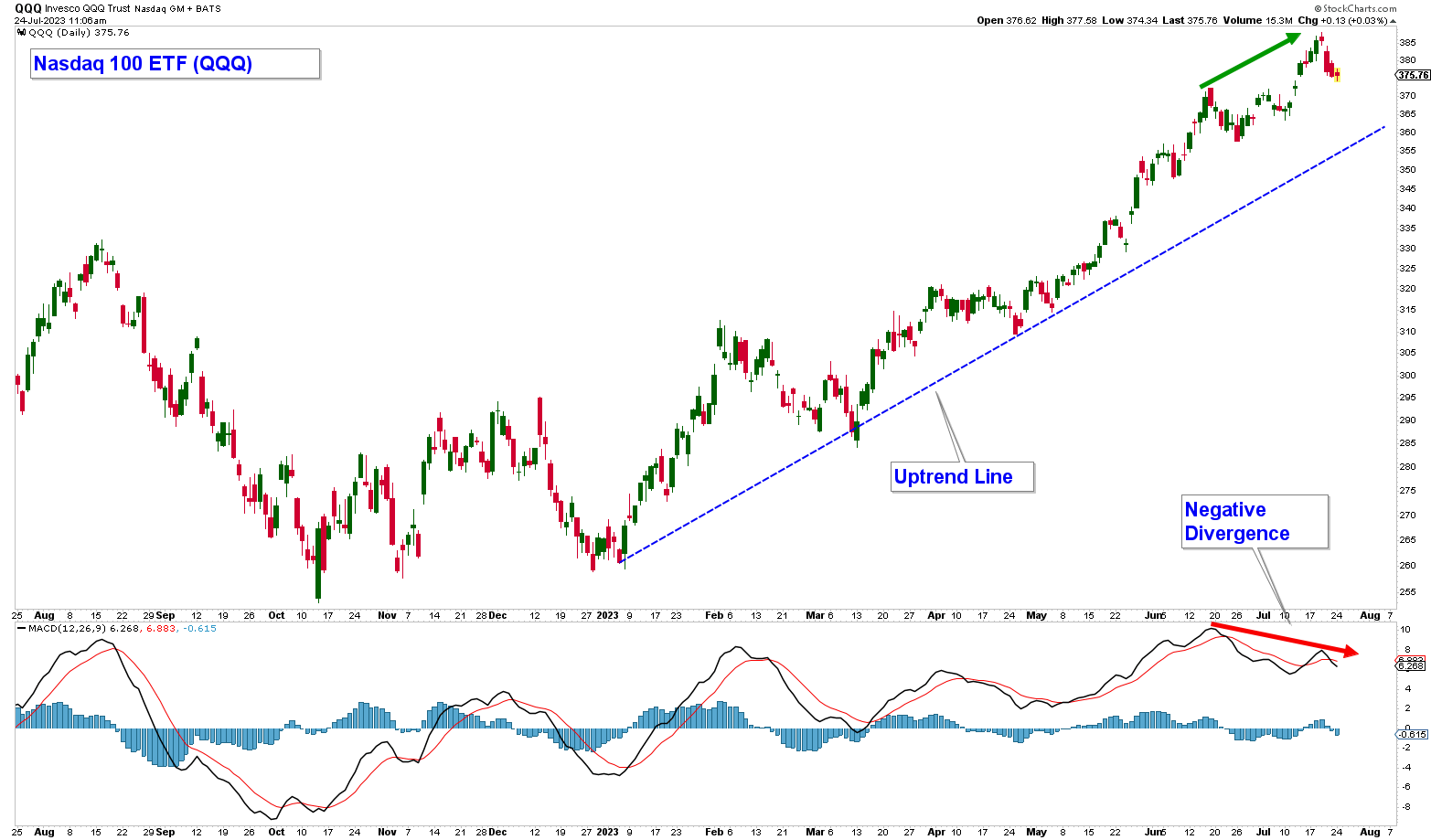

Negative Momentum

Below is a daily chart of the Nasdaq 100 with the MACD (momentum) indicator in the lower panel. The MACD has rolled over and is displaying a negative divergence with the price chart. This all suggests the odds of a pullback in the index is elevated in the near term.

Sectors On The Move

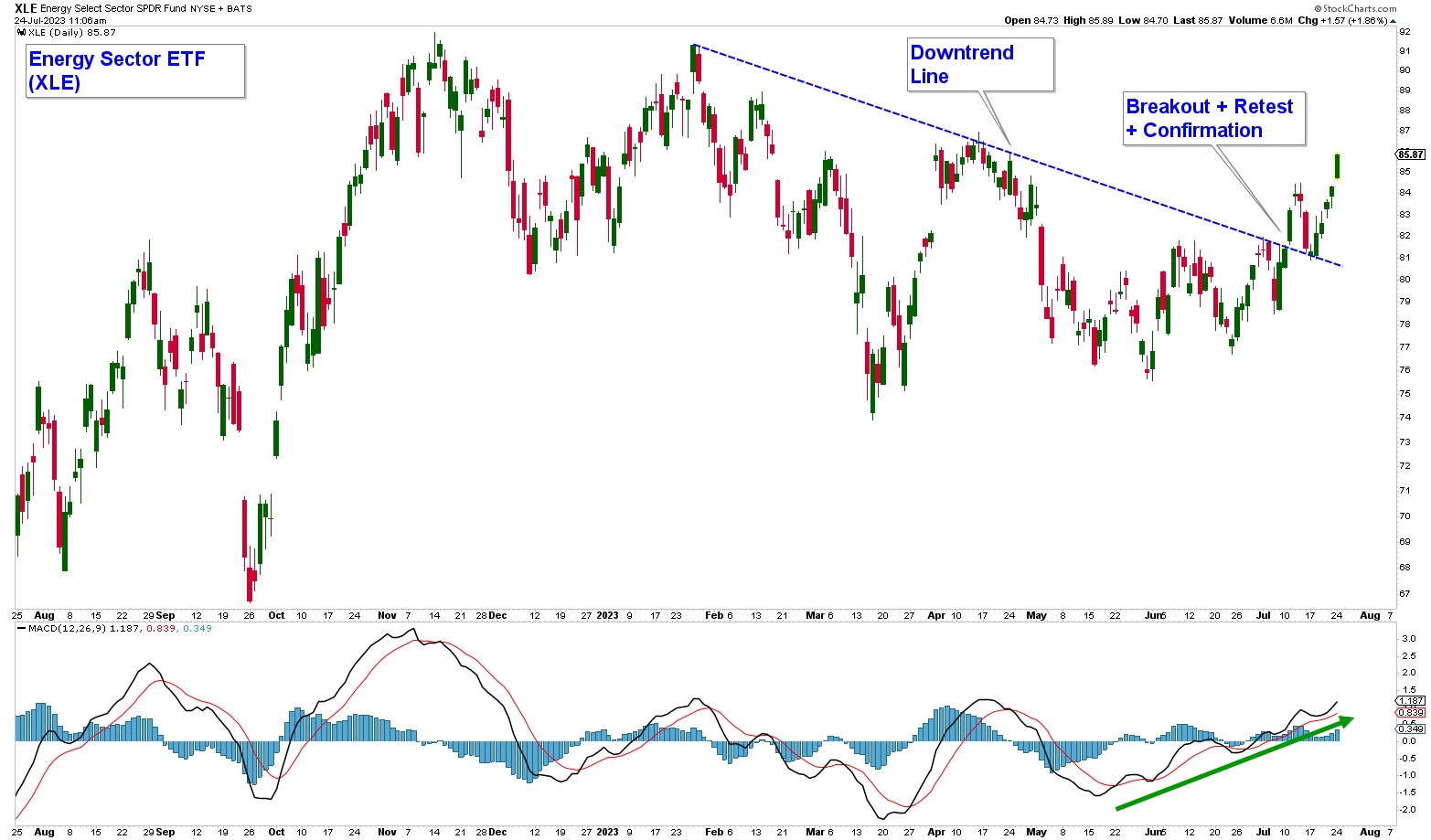

Energy

Below is a chart of the Energy Sector ETF (XLE) in the upper panel and the MACD in the lower panel.

XLE has advanced above its downtrend line, retraced to that line, and advanced to a new short-term high. Additionally, the MACD has crossed above zero and is above its moving average.

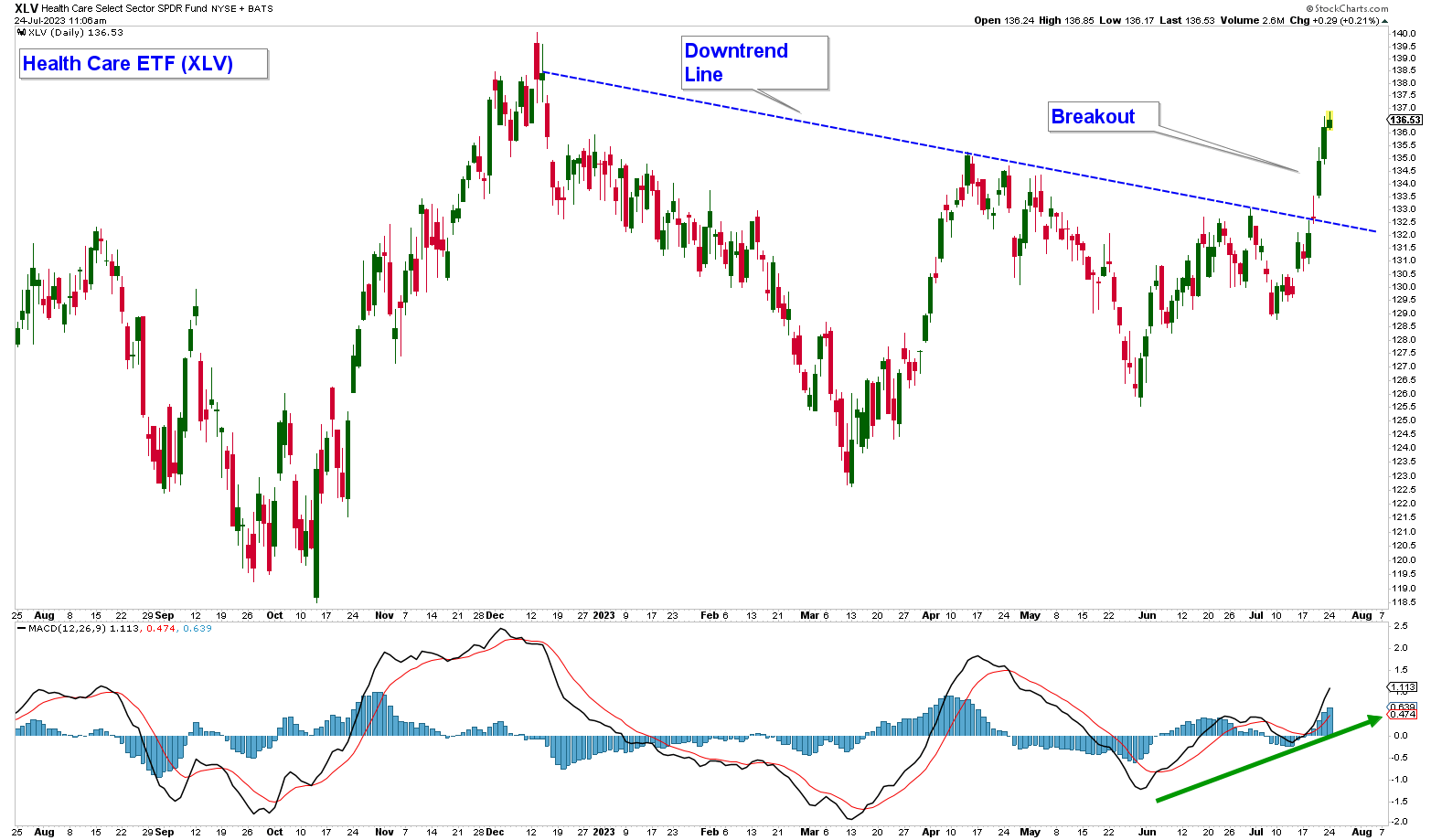

Healthcare Sector

The Healthcare Sector (XLV) has advanced above its downtrend line and its MACD is advancing above its moving average.

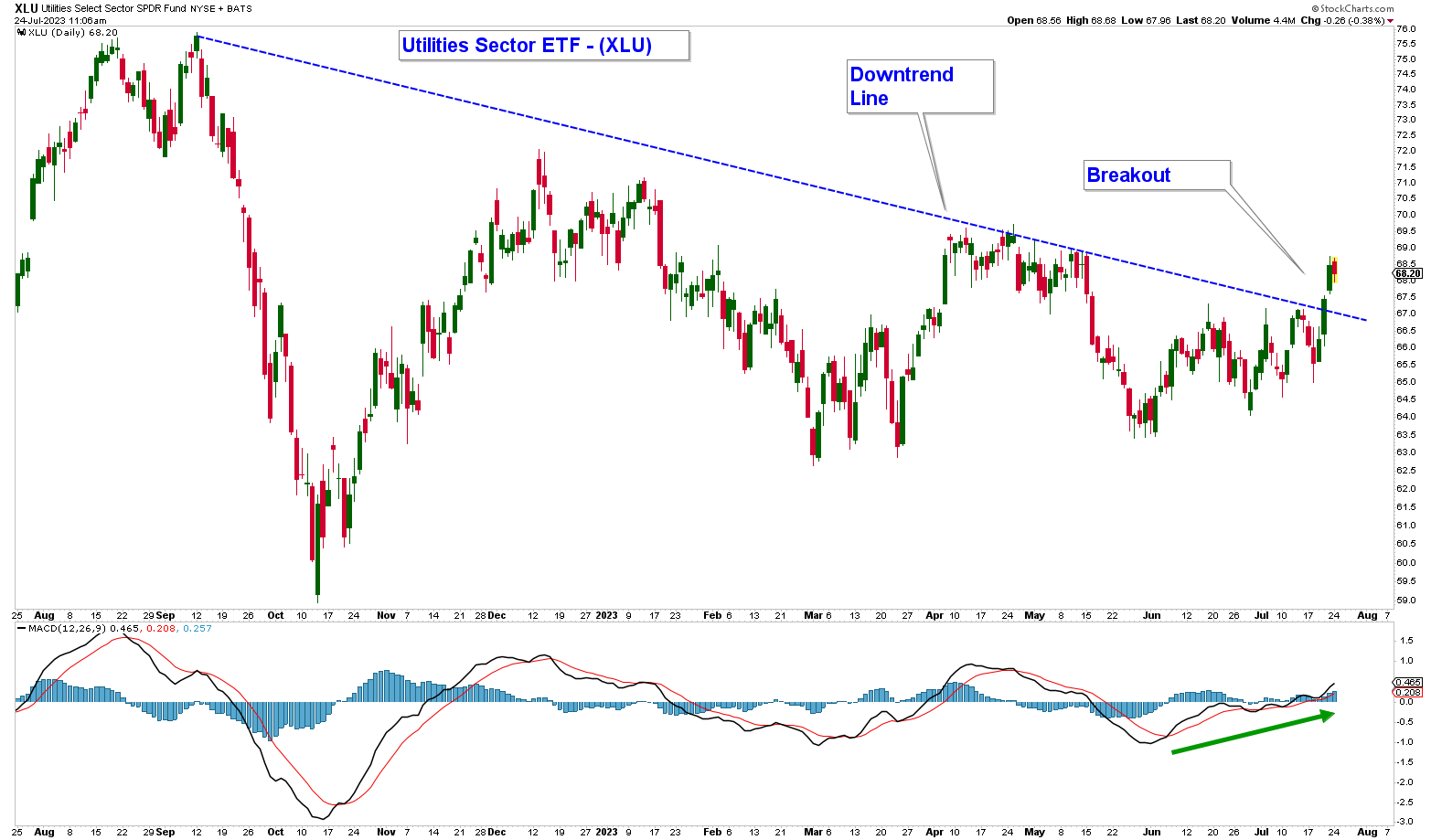

Utility Sector

The Utilities Sector (XLU) has advanced above its downtrend line and its MACD is advancing above its moving average.

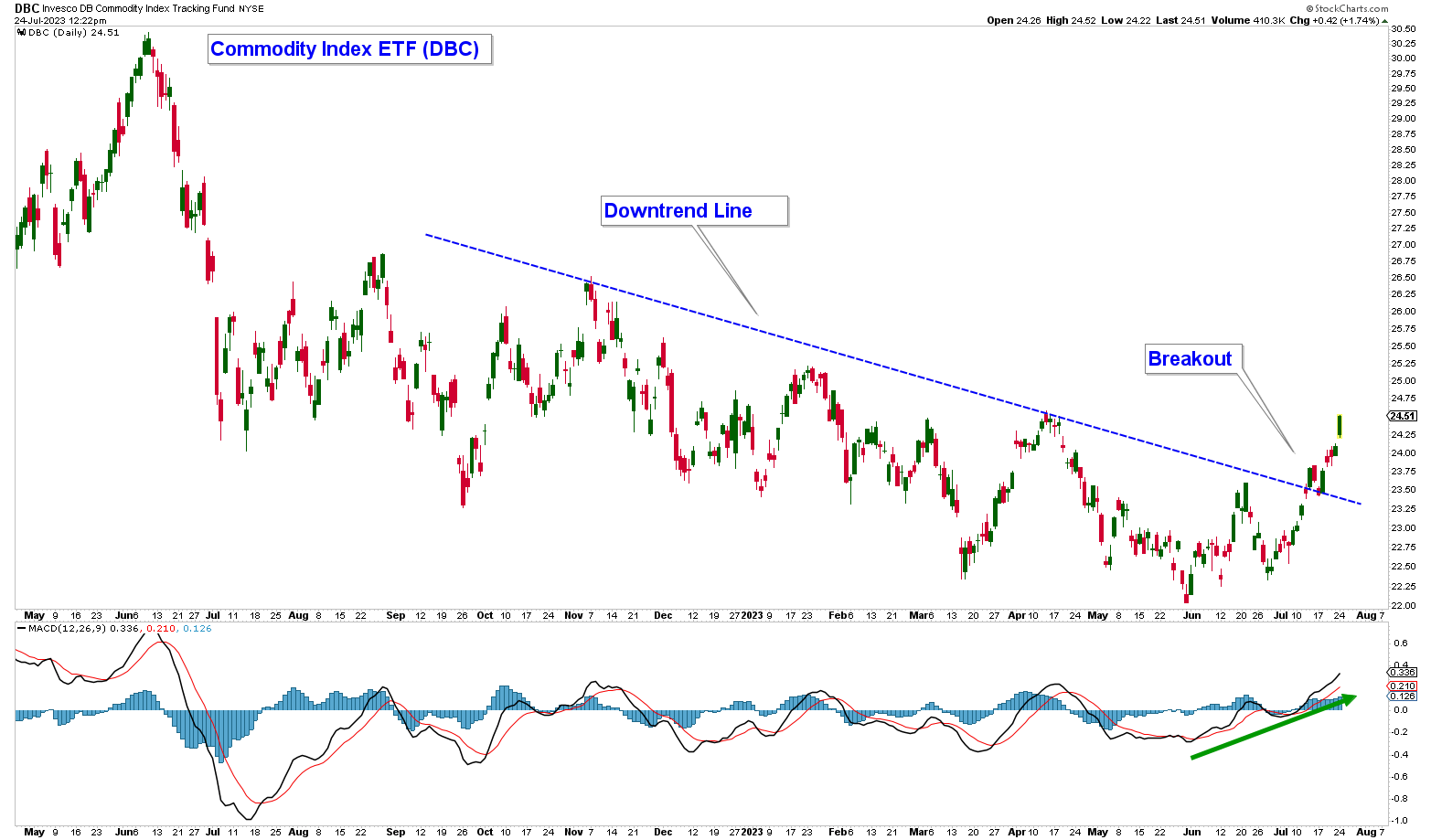

Commodity Index

Below is a chart of the Commodity Index ETF (DBC) and like the charts above, it has broken out of a downtrend with positive momentum.

Client Account Update

Over the past few weeks, I have added holdings in those sectors that are showing signs of strength and recently shorted market indexes (mainly the Nasdaq 100) as a hedge.

I will continue to rebalance client accounts based on our ongoing analysis of market technicals.

CAN WE HELP YOU?

HERE’S AN EASY WAY TO FIND OUT:

We want clients who are a good mutual fit. To find out, we offer a no-pressure complimentary consultation. If we can help you and you want to work with us, that’s great. But if you don’t, we will give you free asset allocation direction on your retirement accounts, at no charge and with no strings attached.

If you are interested, send us an email to set up your complimentary zoom meeting.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.