Market Update

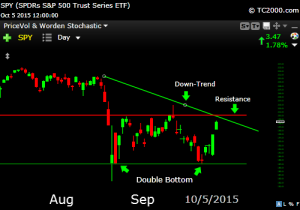

Weekly Market Update Last week stocks fell to the lows of August and subsequently bounced off those lows forming what is referred to as a double bottom. This is a bottoming pattern that gives traders confidence to invest in stocks because the market has proven twice that there are buyers at that level or a floor by which stocks don’t seem to be able to fall below. So now the question is whether this is the final low for stocks or just a temporary low.

The market pop of the last four days puts stocks in an overbought condition, right at the top of it’s downtrend line, and just below resistance. If last week’s bottom was the final bottom, then stocks should be able to power through the above mentioned trend-line/resistance and continue to go up even though stocks are overbought. On the other hand, if the advance in stocks that we have seen over the past week is just a normal bounce in a down-trending market, stocks should soon start to weaken.

Client Update

Currently, we have most client accounts invested primarily in money market funds. Money market funds are safe investments that do not fluctuate in price and are a good place to park our money while we wait for stock and bond market conditions to improve.