In a recent newsletter, I asked readers to email me questions that they had about the bond/stock market. I received some good ones, and have been meaning to answer them in a newsletter. So I will do that today. Here is one that I thought was good, particularly given what is going on in markets currently. Here is the question:

“In your newsletter, you said that your analysis suggests that the current environment is negative for bonds, and positive for stocks for the next 3 – 6 months. What are your longer-term views?”

Forecasting out longer than 6 months is more difficult and usually less accurate; however, it can be done if we look at things on a more macro level. Instead of looking at market breadth, price action and other things that will drive the market in the short-term, we have to look at the business cycle.

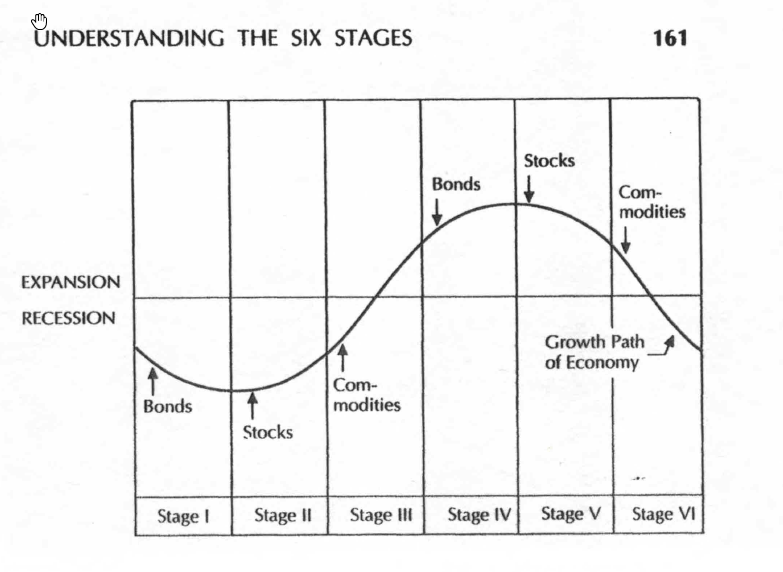

There are six stages of the business cycle and each phase determines which asset classes do well or poorly. Below is a chart that I copied from Martin Pring’s book: The All-Season Investor. Martin Pring is a world renown technician who has written many books and I still follow his work today.

In the chart, the sine curve represents the growth path of the economy over a full cycle. A full business cycle can take many years to get through, and thus presents a much longer look at asset class performance than the 3-6 months that I normally focus on in my newsletters. The arrows refer to the peaks and troughs of the stock, bond, and commodity markets. Certain asset classes usually peak or bottom during certain stages of the cycle. Because of this, knowing what stage we are in is very important.

This chart implies that each stage is similar in length and in reality they are not. A single stage can last for months or can last for years. Also, there are times when some markets fall out of sequence. However, there is a relationship that different assets have with the business cycle and these relationships influence performance. This is very important knowledge to have when allocating investment accounts!

So what stage do you think we are in now?

I believe we are without question in stage 4. So how does this knowledge help us today? Well, in stage 4 bonds top out and start to decline, and stocks/commodities continue to advance. This is what I have been preaching about for months – Stocks and Commodities are ripping higher and bonds are falling. This is why our client accounts do not currently hold interest rate sensitive bonds and haven’t for a long time. This is also why we are overweight stocks.

What else does this chart imply that will help us manage our investments over the coming months and years?

What is the next asset class to top out in the sequence? Yes, stocks. Normally as the economy grows, inflation rises and the Fed raises interest rates to control inflation. The raising of interest rates slows the economy and eventually, the economy begins to contract, which result in slowing economic growth, declining corporate profits and thus falling stock prices. So while it is a good time to be overweight equities, we have to be vigilant in monitoring those technicals that will forewarn us that stocks are starting to weaken as they progress into a period of decline.

Keep those good questions coming.

The Bottom Line

Bias:

Positive for Stocks

Negative for Interest Rate Sensitive Bonds

• Stocks both domestically and internationally are in an uptrend and we are in a bull market.

• When the S&P 500 is hitting all-time highs, international markets are advancing strongly, and market breadth is positive – there is no other way to view the market other than positive!

• I am seeing more evidence of long-term reversals in trend that suggests:

1. Rising stock prices

2. Rising bond yields and thus lower prices for Interest rate sensitive bonds.

3. A falling dollar

4. Rising commodity prices

• The thing to keep in mind is these are long-term trends. Treasury yields have fallen for over 35 years and commodity prices have fallen for about 10 years. If these trends are reversing to the upside, they could have long-term implications.

• October Newsletters addressing the early moves in yields, bonds, and commodities:

Bonds a Ticking Time Bomb I – October 4, 2017

Bonds a Ticking Time Bomb II – October 25, 2017

• Long-term, the weight of the evidence continues to be bullish for stocks. At some point, this will change and when it does, I will have no problem flipping to a bearish bias and reallocating client accounts to a more defensive posture. However, market technicals continue to signal that we are in a bull market and thus we should be invested in stocks aggressively.

Client Update

I continue to view stock market risk as low, thus our accounts have high stock market exposure.

I have continued to add to our equity holdings by buying stock funds that have pulled back and are in long-term up-trends.

We do not hold any interest rate sensitive bond funds.

Email me to schedule your free, no obligation retirement account allocation review.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.