Market Summary

I am going to try something new this month and make the written part of this month’s update more of a summary. And for those of you who want to view some of the charts that have shaped our analysis, you can view the video link below.

What the technicals are suggesting about the market:

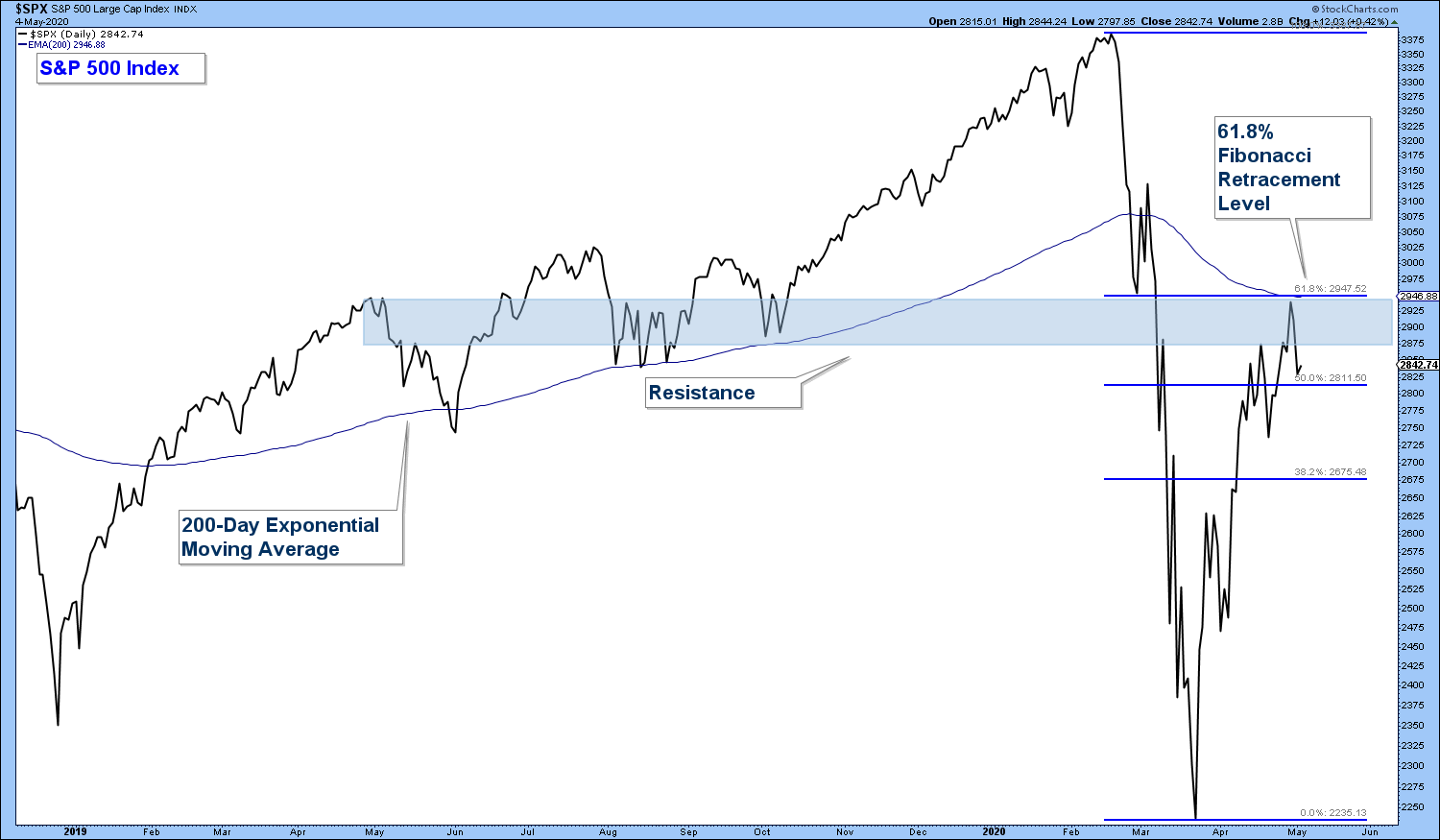

• The S&P 500 has had a strong bounce after a 33% drop (chart below). The index now sits under it’s 200-day moving average, resistance and the 61.8% Fibonacci Retracement level. If the market is going to roll-over, this would be the area that I would expect that to occur.

• We have now exited what historically has been a seasonally strong period for the stock market. The fact that the stock market is down over the best months of the year is worrisome. We have now entered the worst seasonal period for stocks (May through October). As the saying goes: sell in May and go away.

• We are still in a deflationary economic environment. This is not supportive of higher stock prices.

• High Yield bond funds have been falling recently while the stock market has advanced. This is a bearish warning sign.

• The economy is experiencing severe stress and this is evident in the Transportation Indexes under-performance. Once the economy exits this recessionary environment, I would expect this index to display relative strength. We are not seeing that yet.

• Negative momentum divergences are starting to show up on the Nasdaq 100 Index. This index has been a leader and one of the few bright spots in the market. The fact that momentum may be rolling over is definitely something to watch going forward.

Bottom Line

The market is at a level where I would expect it to fall. Most of the technical evidence is bearish. If we are wrong and the market actually advances with strengthening technicals, then we will reassess our market thesis. I am open to this possibility, but I view it as a very low odds scenario.

There will be an opportunity on the other end of this bear market. The key is to have your capital intact to take advantage of those opportunities when they occur.

Client Account Update

All client accounts are currently 100% invested in a money market fund. I still view broad stock market risk to be high and thus the risk/reward relationship is not skewed in our favor based upon my analysis.

I will continue to reallocate our client accounts strategically based upon our ongoing analysis of markets.

Video Market Analysis

Click on the link below to view our technical analysis in more detail. In the video, I take you through a number of charts that highlight what we are seeing in the stock market.

Now is the time to reevaluate your retirement account allocations, not later after you have incurred substantial losses.

If you are worried about how your retirement accounts are allocated, shoot me an email and we can schedule a virtual meeting to review your holdings and investment strategy.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

All charts provided by: StockCharts.com