The Bottom Line

Bias:

Long-Term Positive and Short-Term Positive for Stocks.

- The short-term pullback we had been watching in the market for the past 4 weeks has been resolved to the upside. This is yet another sign that we are in a strong bull market.

- Long-term, stocks are in an uptrend and we are in a bull market.

- The weight of the evidence continues to suggest that stocks are going higher in the near future.

Client Update

Client accounts are fully invested and allocated in Preferred Income Funds, and Equity Funds.

Market Technicals

“The stock market is in a short-term period of consolidation within a longer-term uptrend. Since the market bottomed at the beginning of last year, each time stocks have consolidated they have eventually broke-out to the upside.”

This trend of upside breakouts out of short-term consolidation patterns has continued. Stocks advanced last week, rising above their downtrend line and coming within striking distance of a new 52-week high.

As long as the S&P 500 is above support at around 2400, our long-term view of the market should remain bullish.

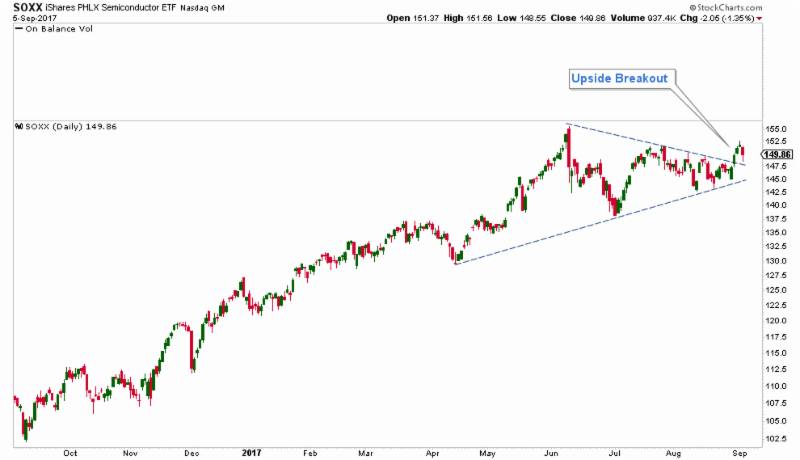

In last week’s newsletter, I noted that the Semiconductor Index tends to lead the market and thus we can look at this index for clues as to the direction of the broader stock market.

As noted last week, the SOXX (iShares Semiconductor Index Fund) had formed a wedge pattern which is a continuation pattern that typically gets resolved in the direction of the prior trend, which in this case is up.

Last week the wedge did get resolved to the upside, which is bullish for the broader market and suggests that we can expect higher stock prices in the coming weeks.

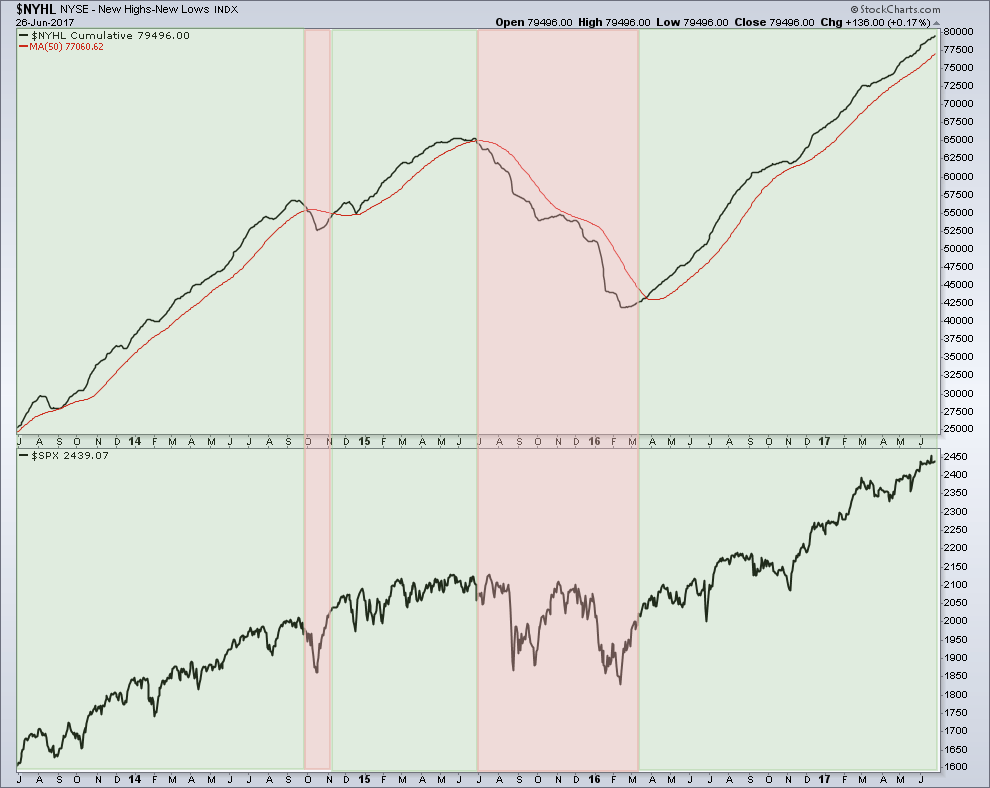

Stock Market Breadth – Positive

The NYSE – New Highs-New Lows Line does a good job of identifying long-term market breadth, as you will notice in the chart below. The index did dip a little recently, however, it has turned up and is solidly above its 50-day moving average line.

The weight of the evidence continues to be bullish for stocks. At some point, this will change and when it does, I will have no problem flipping to a bearish bias and reallocating client accounts to a more defensive posture. However, market technicals continue to signal that we are in a bull market and thus we should be invested in stocks.

Retirement Calculator

Are you on track to hit your retirement income goal?

* This is one of the better free retirement calculators that I have found online. Be patient after hitting the link. It takes about 20 seconds to load.

If you have any questions, please feel free to contact me.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.