Market Update

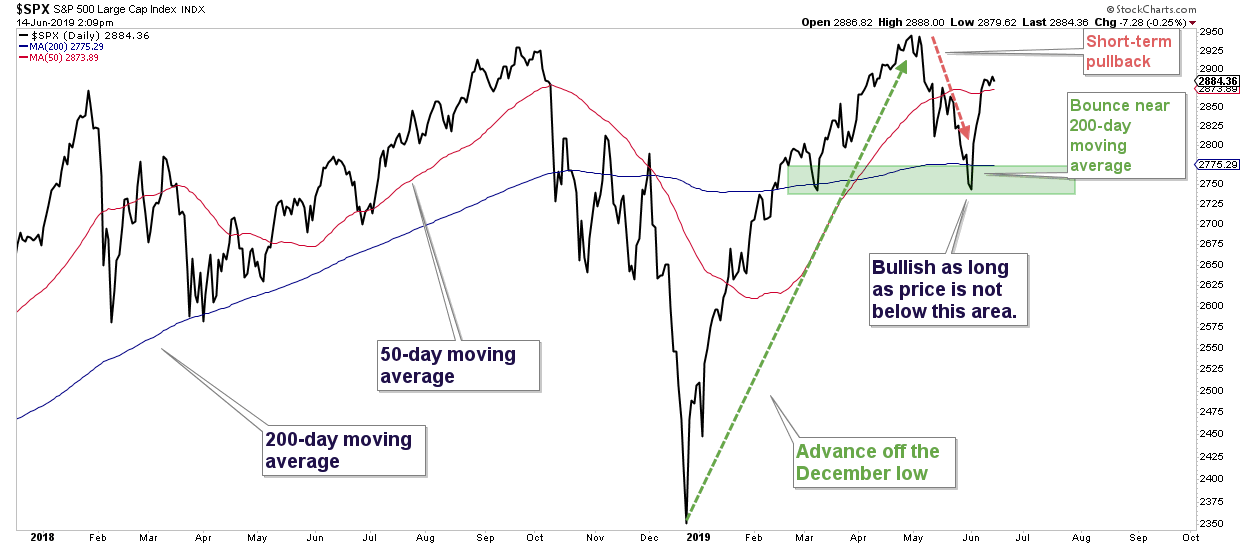

The weight of the technical evidence remains bullish. Market breadth is still positive and the market (S&P 500 index) is trading above both it’s 200 and 50-day moving averages.

The pullback in stocks that occurred last month was minor relative to the previous advance off the December 2018 lows. The market retraced about a third of the previous advance last month. As long as the market is above May’s low and the 200-day moving average, price is bullish.

Client Account Update

Our client equity exposure is between about 63% – 67% for our conservative accounts and 80 – 133% for our aggressive accounts. This is on the high side and reflects our current bullish short-term bias.

Our current equity holdings are primarily made up of individual stocks that, on average, have very good relative price action compared to the market. We hold a number of defensive stocks that are not being as adversely affected by trade war worries and/or an economic slowdown. For example, we hold stocks in such industry groups as household & personal products, property & casualty insurance, packaged foods, and farm products.

Also, our stock holdings are not static. Each holding has a stop price (a price that if hit, the holding will get sold). This is one of the primary ways that I manage risk in our client accounts. As stocks get sold, our market exposure will naturally get reduced as long as we don’t use cash to buy additional equity positions.

Keep in mind, we are investing in securities that don’t go up in a straight line. Some volatility is to be expected. The focus of our investment style is minimizing the large drawdowns in client accounts that can occur during “major” stock market stress.

Summary of How I Manage Client Accounts:

- I do not use a buy-and-hold approach like most financial advisors. I believe this strategy, while good for young investors, can have severe adverse consequences for those in or near retirement.

- I use technical analysis to manage risk and preserve principal during major stock/bond market corrections.

- I have two basic models that I use to manage client accounts. One is conservative and appropriate for investors that are in or near retirement, and an aggressive model for younger more aggressive investors.

- I am a risk manager and will increase our risk level when risk in the market is low, and decrease our risk when risk in the market is high.

If you have any questions, or if you want me to review your retirement account allocations, please feel free to contact me.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.