Summary

In last week’s newsletter, we wrote:

“The short-term market weakness that was signaled by market internals as far back as mid-July has subsided. Market internals are now positive and odds favor higher stock market prices as long as last week’s lows are not violated.”

This past week we saw stocks continue to slowly creep higher and some major indexes hit new all-time highs. While stocks are short-term overbought, and could pullback to some degree, any pullback would be viewed as a buying opportunity as long as the lows of early November are not violated.

Stock Market Price Action

Below is a chart of the S&P 500 and as you will notice, prices advanced just above recent highs (resistance). This puts the S&P 500 at an all-time high.

In addition, both the Russell 2000 (Small Cap Index) and the Dow Jones Industrial Average (see charts below) have advanced strongly above their recent highs hitting new all-time highs as well.

In summary, price action is positive.

Market Internals

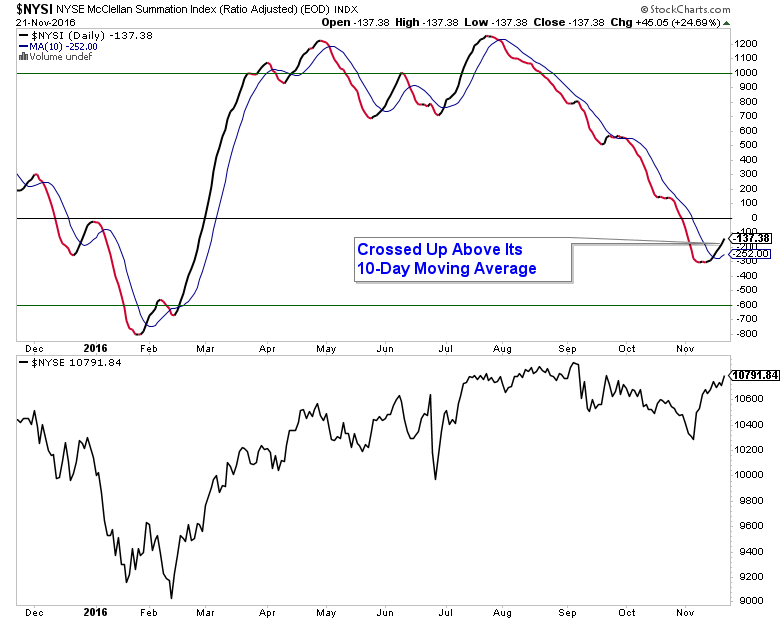

Market breadth recently turned positive. Below is a chart of the NYSE Summation Index (in the top panel) and it has turned up and advanced up above its 10-day moving average. Historically these advances have accurately signaled recent market bottoms.

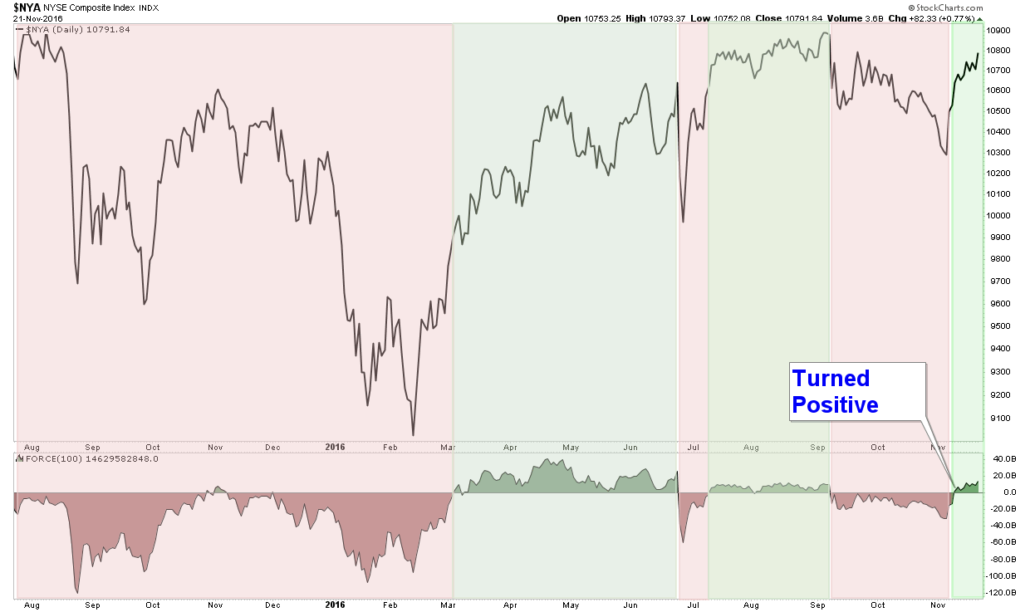

The Force Index which is a volume-based momentum indicator turned positive recently as signaled by a move up above the zero line. As you will notice in the chart below, the Force Index has done a pretty good job of confirming market advances and declines.

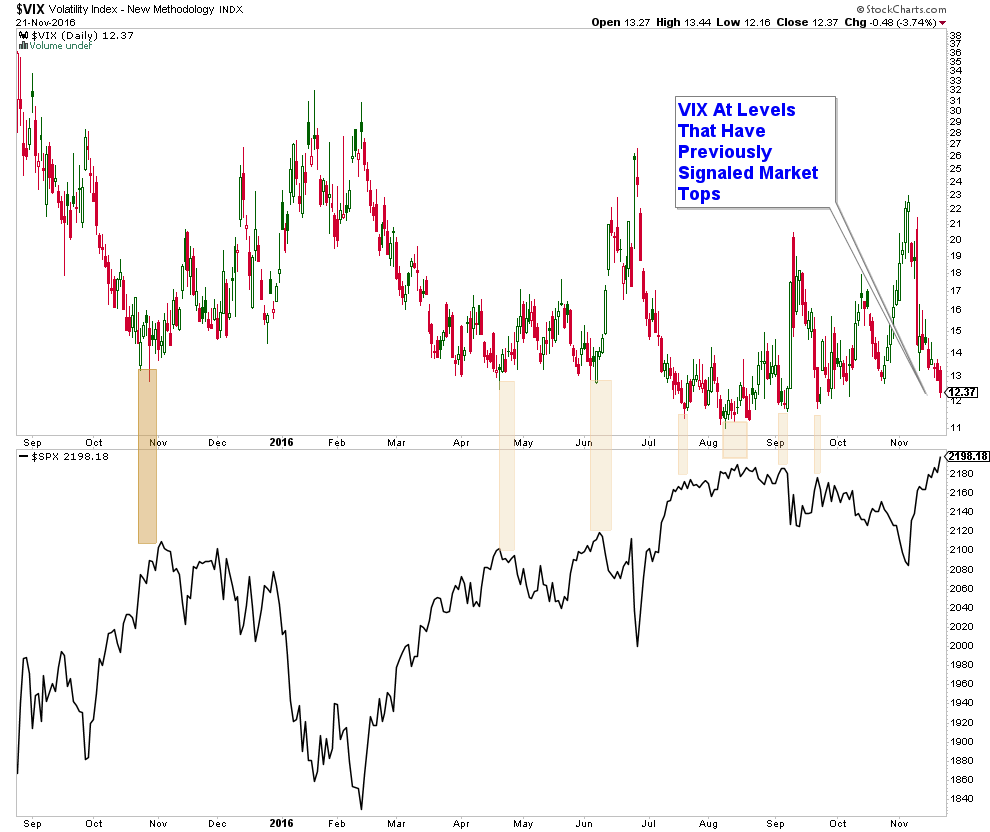

The VIX (see chart below) is warning that investors are overly complacent and the market is susceptible to a short-term correction. Today the VIX closed at 12.42 which is about the level that has signaled previous stock market pullbacks this year. While this is something that I will watch, I am not overly concerned given how strong other market internals are behaving.

In addition, November and December are the 3rd and 2nd seasonally strongest months of the year for stocks historically.

The Bottom Line

Bias: Positive for stocks and negative for most bonds.

- Stock market price action is positive. While stocks are short-term overbought, and could pullback to some degree, a pullback would be viewed as a buying opportunity as long as the lows of early November are not violated.

- Market internals are positive and odds favor higher stock market prices.

Client Update

TD Ameritrade accounts are between 35% – 50% invested in Stock Funds and about 30% in a Floating Rate Fund. I will be looking to continue to strategically reallocate client accounts to a more growth oriented allocation in the coming weeks.

The Happiest Retirees Have Learned This Lesson

There’s more to retirement life than just finding your passion

If you have any questions, please feel free to contact me.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.