The Bottom Line

Bias:

Long-Term Positive and Short-term Positive for Stocks.

- The stock market is in an uptrend on both a short and long-term basis.

- While the summer months are typically bad for stocks and sentiment is currently negative, the weight of the evidence is Bullish for the stock market.

Client Update

Client accounts are fully invested and mainly allocated in Preferred Income Funds and Equities.

Market Technicals

Long-Term Price Action – Positive

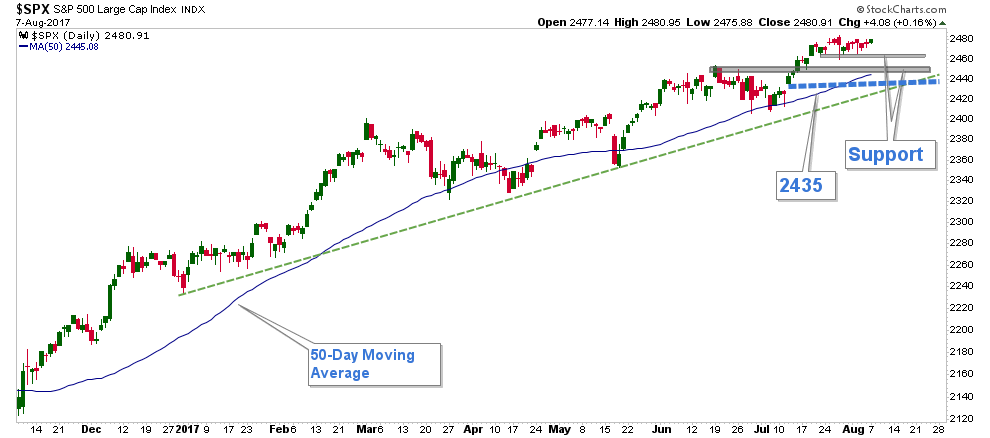

The stock market is above both it’s 50 and 200-Day Moving Average (see chart below). This is indicative of a long-term uptrend and is bullish.

Short-Term Price Action – Positive

On a short-term basis, the market continues to advance to new highs, consolidate/pullback, then advance to higher-highs. This trend has continued with an advance to fresh highs that was hit at the end of last month, and since then stocks have been moving sideways. This type of price action is bullish.

What would change my positive short-term stock market bias? The S&P 500 is currently sitting above a couple of layers of support (as noted in the chart below) and it’s 50-day moving average. If the index drops below about 2435, that would put it below both layers of support, it’s 50-day moving average, possibly below its uptrend line (green dashed line), and would be a greater than 61% retracement of the previous up-leg which is an important Fibonacci Retracement level.

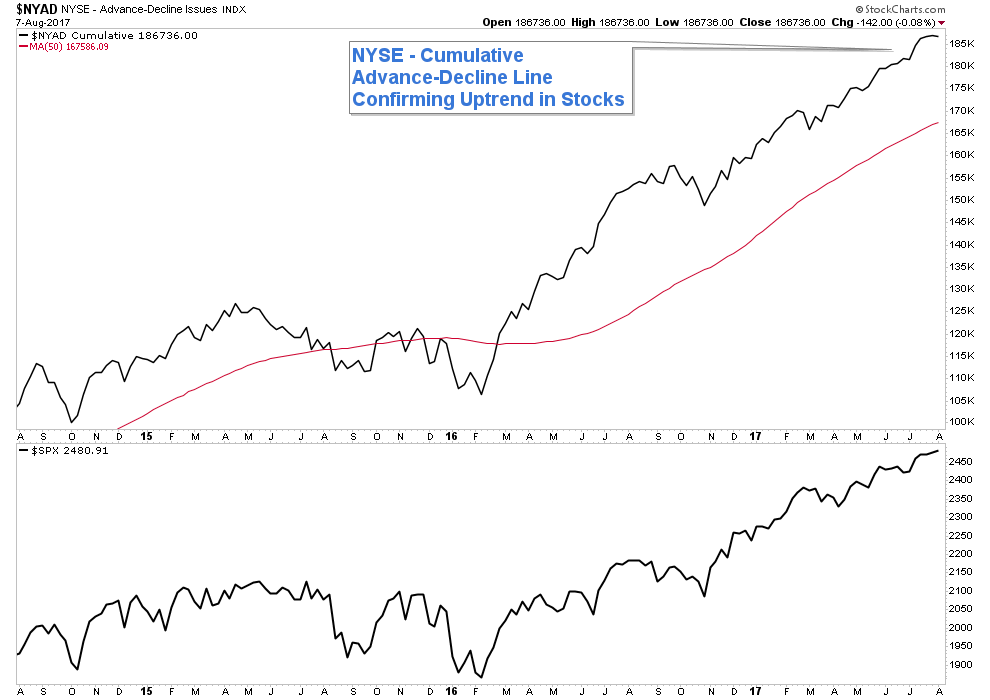

Long Term – Positive

Long-term market breadth is positive as indicated by the Cumulative Advance-Decline Line (top panel in the chart below).

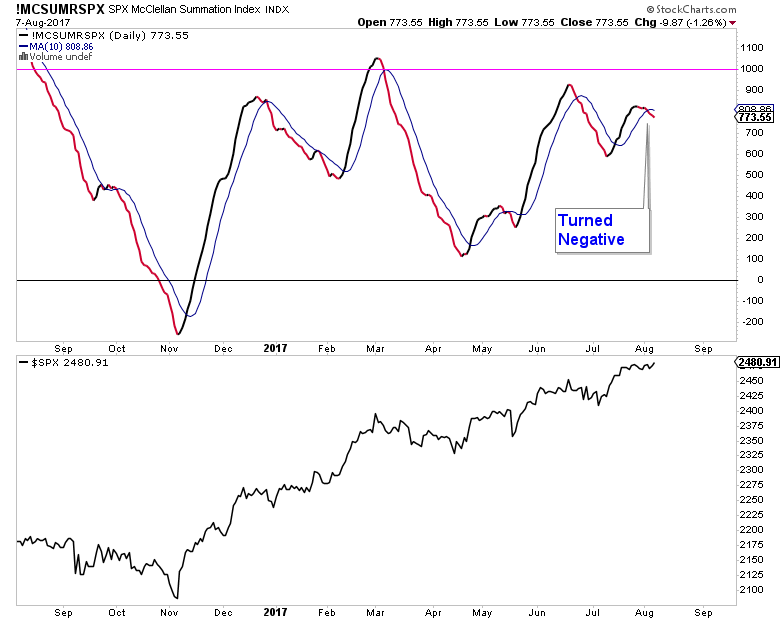

Short Term – Negative

Below is a chart of the S&P 500 Summation Index along with the S&P 500 in the panel below it. The Summation Index has dropped below its 10-day moving average and is trending lower. Historically when this has occurred, it has accurately forewarned of impending short-term stock market weakness.

I am viewing this negative breadth indicator with a grain of salt because in strong bull markets it is not near as effective in predicting market weakness.

In summary, we are in a strong bull market and hitting new highs and this is Bullish! While we have seen some short-term deterioration in market breadth, this alone does not change my strong positive bias on the market. What would change my bias would be further market breadth deterioration and the S&P 500 dropping below 2435.

In summary, we are in a strong bull market and hitting new highs and this is Bullish! While we have seen some short-term deterioration in market breadth, this alone does not change my strong positive bias on the market. What would change my bias would be further market breadth deterioration and the S&P 500 dropping below 2435.

If you have any questions, please feel free to contact me.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.