Market Update

Price Action – The S&P 500 Index (market proxy)

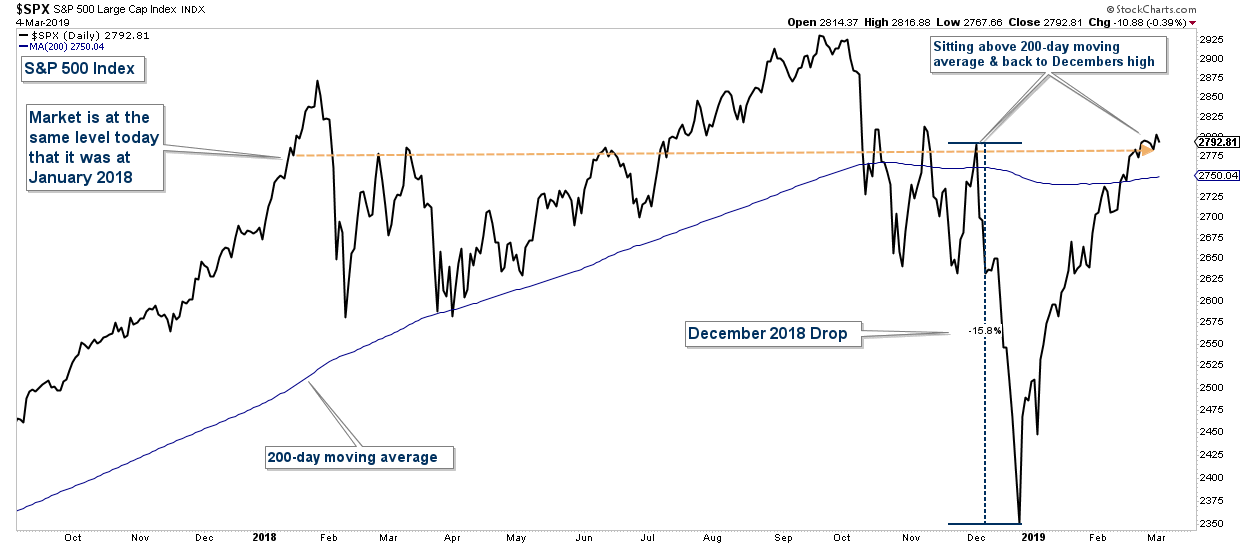

The month of February saw stocks continue to advance. The move off the December lows has been impressive. However, if you zoom out and look at the market from a longer-term perspective, stocks have basically moved sideways. The S&P 500 is now back to where it was in January of 2018.

Now let’s zoom in to analyze the recent advance off the December lows. The move higher has taken the index back to the highs of December, and just above its 200-day moving average.

From a price perspective, stocks have basically moved sideways over the past 14 months. The January/February 2019 bounce has been strong, but it has only gotten us back to the highs of December.

By most measures, the market is due for some type of pullback or consolidation. How market technicals behave during the next short-term market pullback will be extremely helpful in forecasting longer-term market strength or weakness.

Market Breadth

Most longer-term market breadth indicators have hit levels that typically suggest a stock market bottom is in place and a new uptrend has begun.

Summary

The bulk of the evidence is suggesting that stock market risk has subsided and stocks are set to advance over the intermediate term. On a short-term basis, however, the market is due for some type of pullback/consolidation.

Client Account Update

Over the past month, I sold all of our Treasury Bond Funds and Gold holdings. We have progressively purchased stocks to the point where our client equity exposure is about 20%. Unless the technical picture changes, any pullback in stocks will be viewed as an opportunity to increase our stock holdings.

Summary of How I Manage Client Accounts:

- I do not use a buy-and-hold approach like most financial advisors. I believe this strategy, while good for young investors, can have severe adverse consequences for those in or near retirement.

- I use technical analysis to manage risk and preserve principal during major stock/bond market corrections.

- I have two basic models that I use to manage client accounts. One is conservative and appropriate for investors that are in or near retirement, and an aggressive model for younger more aggressive investors.

- I am a risk manager and will increase our risk level when risk in the market is low, and decrease our risk when risk in the market is high.

If you have any questions, or if you want me to review your retirement account allocations, please feel free to contact me.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.