The Bottom Line

Bias:

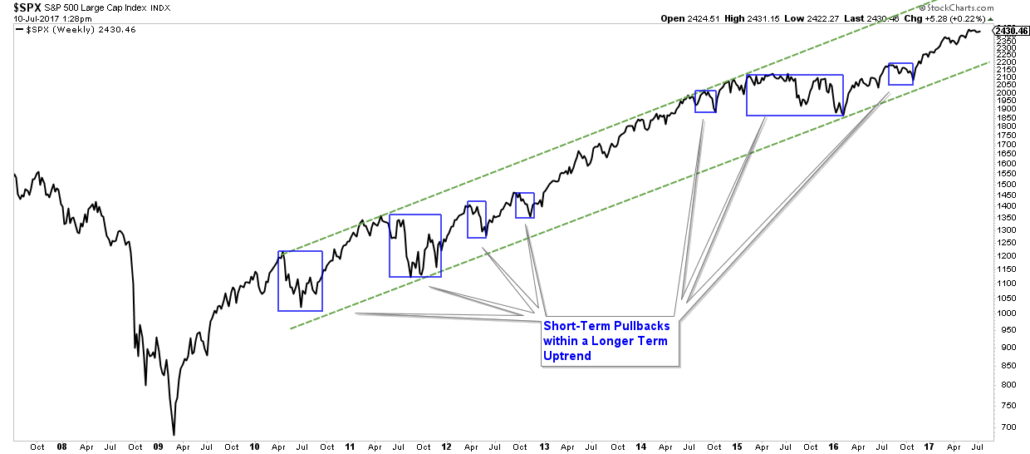

- The stock market is in an uptrend on both a short and long-term basis.

- While the summer months are typically bad for stocks and sentiment is currently negative, the weight of the evidence is Bullish for the stock market.

Client Update

Client accounts are fully invested.

Nothing has changed over the past week with regards to my view of the stock market. My bias is still positive on both a short and long-term basis. For a concise summary, as to the major points that support this positive bias, you can view last week’s newsletter.

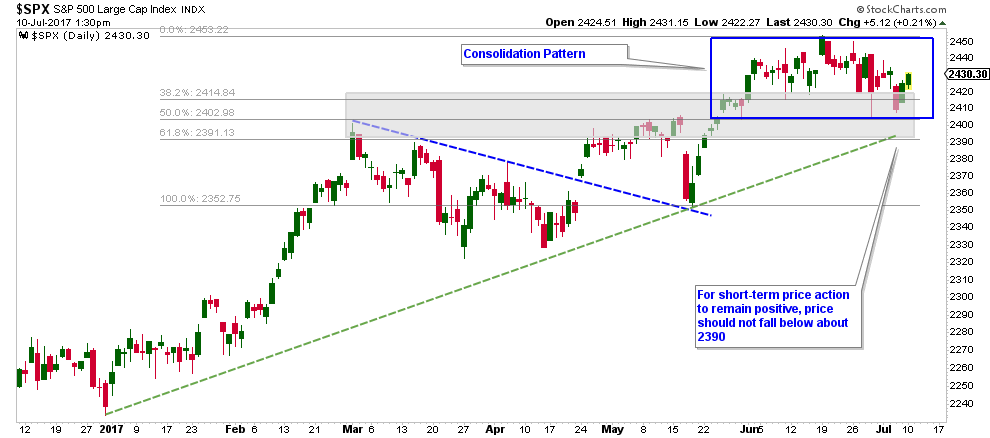

On a short-term basis, the market is digesting past gains in a very positive way – by moving mostly sideways. I believe we may be close to breakout of this consolidation pattern soon for a couple of reasons that I won’t bore you with here. I don’t know if this consolidation will resolve itself by a move up or down. However, given that the weight of the evidence is positive for stocks, I think odds are higher that the breakout will be to the upside.

As long as the S&P 500 does not retrace more than about 61% (an important Fibonacci retracement level) of the previous advance, my short-term bias for the market should remain positive.

Technical analysis is not a crystal ball that can be used to determine exactly where the stock market is headed. It is just a tool that allows us to determine the odds of where stocks are likely headed. A better way to put this might be that it helps us determine what the underlying risk is in the market. This knowledge helps us to properly allocate our investment accounts.

My personal investment strategy is to increase stock market exposure during times when the market is displaying signs of low risk and decrease our market exposure during times of high stock market risk.

Currently stock market risk, in my opinion, is low thus I believe now is the time to be fully invested with allocations to equities that match our risk tolerance. As conditions change, so will the amount of risk that we take in our client accounts. Our goal is always to manage risk for our clients so that they don’t have to worry about the major losses that can occur during major stock market corrections.

Your Fear of Retirement Could Be Ruining It

If you have any questions, please feel free to contact me.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.