Deflated Bounce

Deflated Bounce In last week’s newsletter I wrote about how stocks had become oversold and market breadth had turned positive, which signaled a potential bounce was likely.

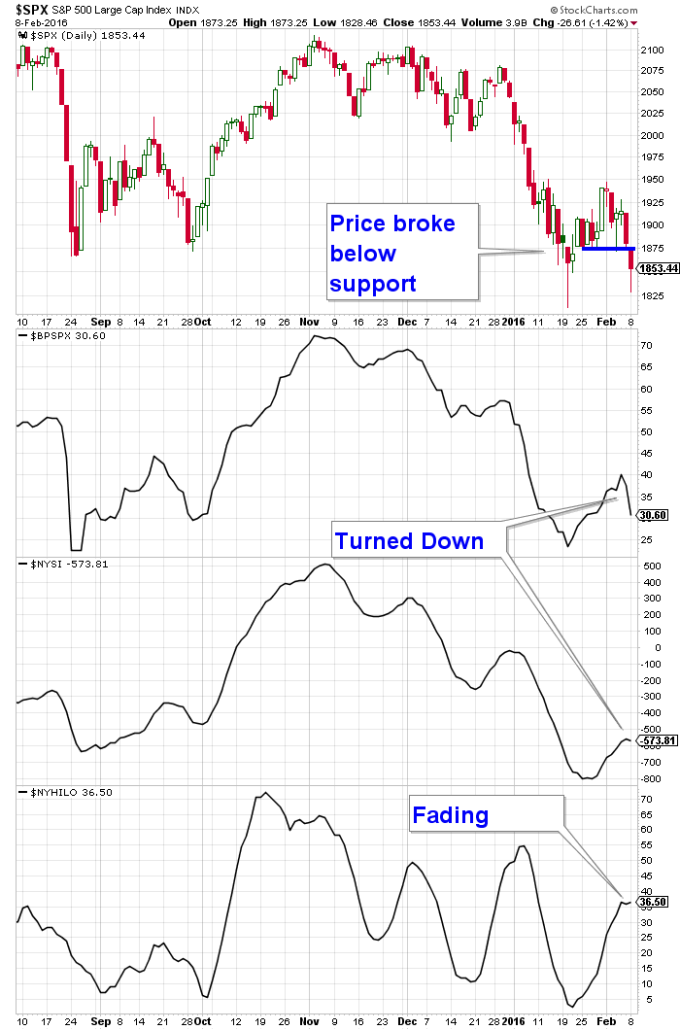

The bounce we got was anemic. Instead of bouncing strongly, stocks traded sideways before falling dramatically through support. Stocks are now back in a downtrend and momentum is to the downside.

Below are the three breadth indicators that are a major component of my buy and sell signals. Two of the three have recently turned negative and the third one is fading.

Deflated Bounce The fact that the market could not stage a more meaningful bounce given how oversold stocks had become, suggests a very weak stock market.

Client Update

Aggressive accounts are invested 100% in a Money Market Fund.

Conservative accounts are 30% invested in High Yield Municipal Bond Funds, and 70% invested in a Money Market Fund.

Risk is extremely high and now is the time to protect principal.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066