Coin Flip (originally published 7-5-16)

Market Update

Two weeks ago I wrote about how stocks were fluctuating between support and resistance. Last week stocks fell below support after the British voted to exit the European Union (Brexit). However, after falling over 5%, stocks quickly bounced back strongly and again are sitting right below resistance.

Stock market internals are still mixed and I view stock market risk to be neutral. If I had to guess the odds of the market advancing from here, I would say it is a coin flip.

In last week’s abbreviated newsletter I stated that the VIX had jumped to a level that had signaled past short-term stock market bottoms. This signal ended up being accurate in that stocks did immediately bounce. Notice in the chart below the VIX reached about 26 and stocks bounced strongly. Now that volatility has subsided, the VIX has moved back down and is now sitting right below it’s 50-day moving average. I view periods when the VIX is below it’s 50-day moving average as positive for stocks and above as negative. In addition, extremes on the upside or downside can also signal short-term turning points in the market as it did last week. In the chart below, I have notated periods where the VIX was decisively above it’s 50-day moving average in red, and below in green. The S&P 500 is in the lower panel. The VIX has just dropped below this line (which is positive for stocks) and is now sitting just beneath it. Even though this is positive, the VIX is barely beneath this average so what happens over the coming week(s) will be more telling as to the strength of the stock market.

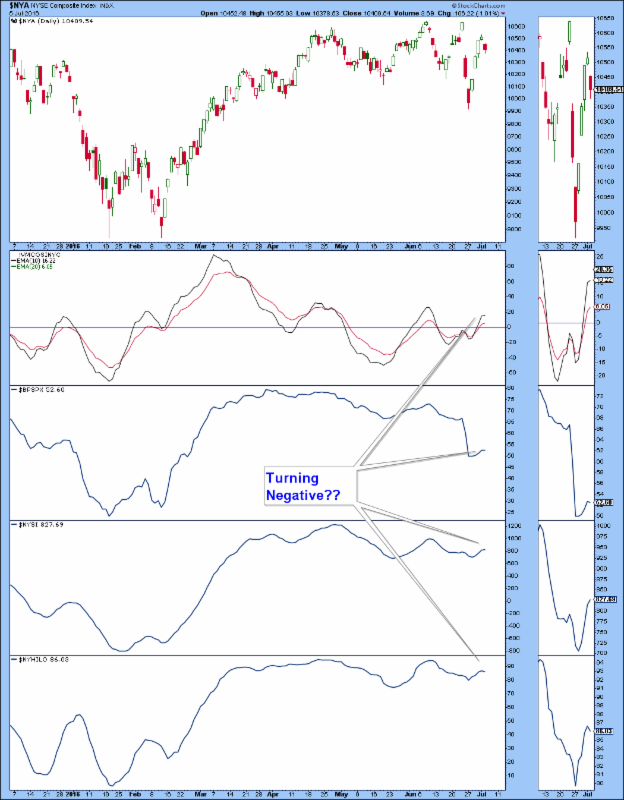

Stock market breadth indicators are currently trending up; however, as of today it looks like they could be in the process of turning back down.

In the chart below, the 21 Day Rate of Change chart, which is a momentum indicator, is in the lower panel and SPY (S&P 500 ETF) is in the upper panel.

The Rate of Change line is below 0 which is negative for stocks, however it is only marginally below 0 and it would not take much to move this indicator back above zero into positive (Bullish) territory.

Not only are market internals mixed, most are at key inflection points. What happens over the coming couple of weeks should provide clues as to the longer term direction of the stock market.

The Bottom Line

Bias: Neutral for Stocks

Stocks are stuck in a range and market indicators are mixed, some being positive for stocks while others are negative. Under these types of circumstances it is very important to manage risk effectively. In my opinion, there is about a 50% chance that stocks could fall substantially. Because of this, risk management strategies are paramount.

Client Update

Client accounts are fully invested in mostly lower volatility bond funds, including: High Yield Municipal Bond Funds, Floating Rate Funds, Preferred Security Funds, and High Yield Funds. For the most part, our accounts have trended up with very minor volatility.

On A Personal Note

We made it home on Friday from our honeymoon, and the next day adopted a dog from California Labs and More Rescue. Her name is Butter and we love her to death!! She was rescued from Mexico with her mother and 7 litter mates. All of them were very ill and only Butter, her mom, and one sibling survived.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.