Believe it or not, wood is a good economic indicator and thus has historically been pretty accurate at forecasting impending economic/stock market weakness.

When the economy transitions from strength to weakness, one of the first industry groups to feel the effects is the lumber industry. Lumber is used for the production of many things that are sensitive to economic demand like housing.

With that in mind, let’s look at a chart of Weyerhaeuser Company (stock symbol: WY). WY is one of the world’s largest private owners of timberlands. WE is engaged in the growing and harvesting of timber and the manufacture, distribution, and sale of forest products, real estate development and construction, and other real estate related activities.

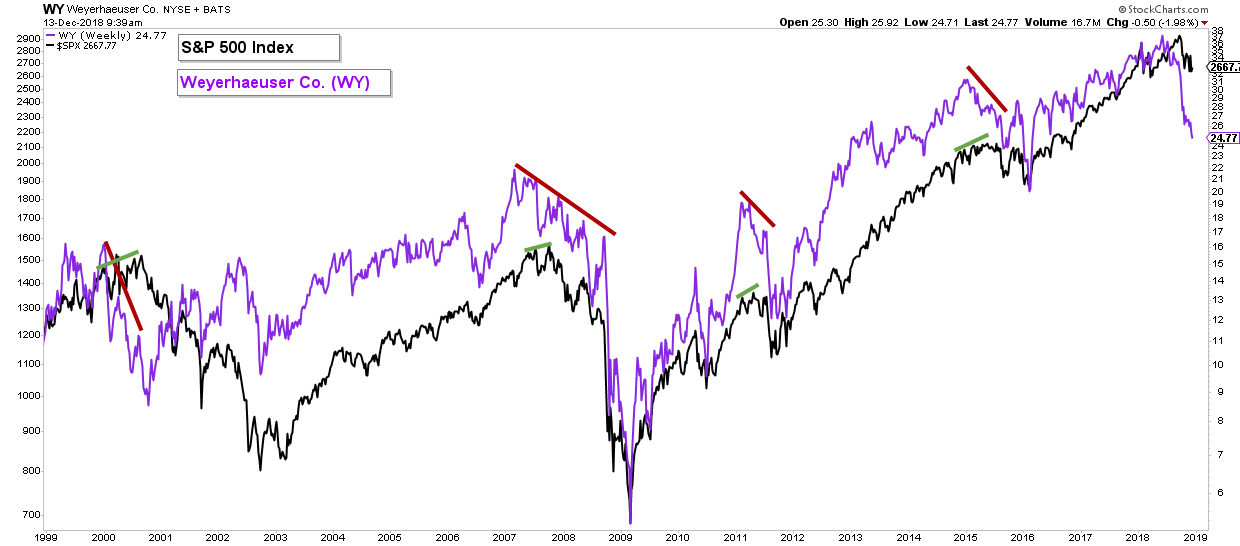

Below is a chart of WY (purple) transposed over the S&P 500 Index (black) going back 20 years. I have drawn red lines at major historical tops in WY and drawn green lines where the S&P 500 advanced while WY was falling (Negative Divergence). Notice how WY has fallen prior to the stock market in the 5 corrections I have highlighted (including the current correction which is not notated) over this time period.

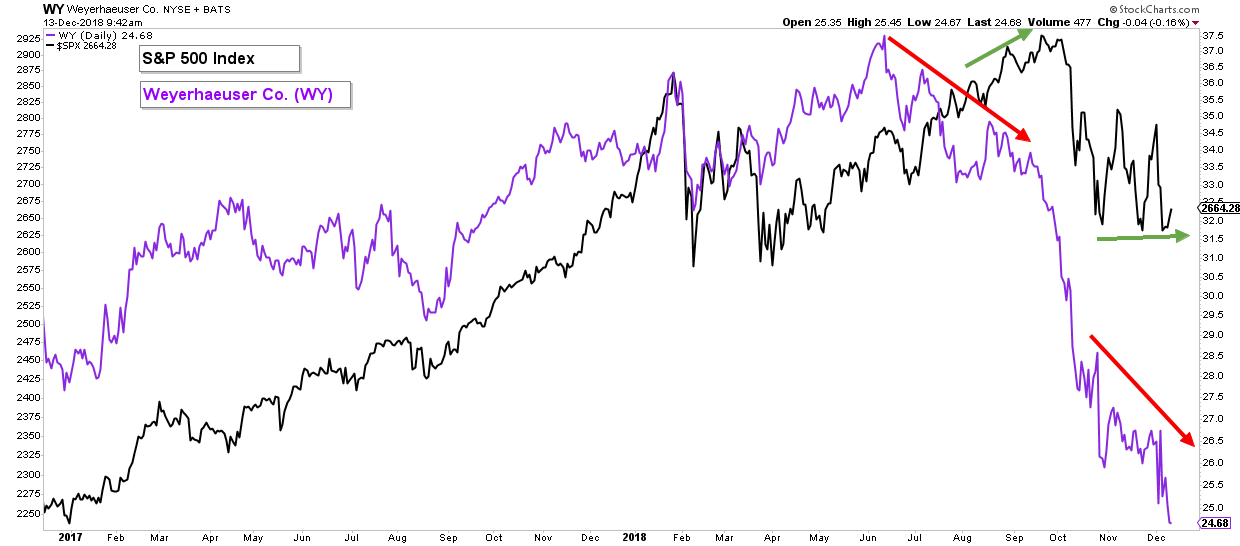

Below is that same chart but covering the past two years. Let’s see what WY is suggesting about the current drop in stocks. Notice the first red arrow which points out where WY topped out. As you will notice, WY peaked about 4 months prior to the S&P 500 Index.

Now focus your attention to the last couple of months on the chart. The S&P 500 has moved sideways trying to form a bottom; however, WY has continued to fall. This continued weakness in WY is suggesting that maybe the broader stock market has further to fall.

I never look at just one indicator or chart to determine my macro thesis on the markets. I instead use a weight of the evidence approach. At this point, the bulk of the evidence is still suggesting that stock market risk is elevated and stocks could have further to fall.

Having been at this for a long time, I have learned that when risk is this high it is best to be defensive. What that means for our clients is that we are sitting in cash.

The biggest difference between how I manage money for my clients and the traditional buy-and-hold method used by most investors is Risk Management. Our focus is on preserving capital during major stock and bond market corrections.

If you have any questions or would like me to review your portfolio, please feel free to contact me.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.