Bond Market Dislocation – A Tight Fed – And Falling Stock Prices

The pervading theme amongst many notable macroeconomic experts is that the continued dislocation in the bond market (too many sellers of bonds and not enough buyers) which has resulted in rising yields as stocks have fallen will result in a crisis. This is not far-fetched and the canary in the coal mine could be what we just saw play out in the UK.

Britain’s Financial Disaster Is a Warning to the World

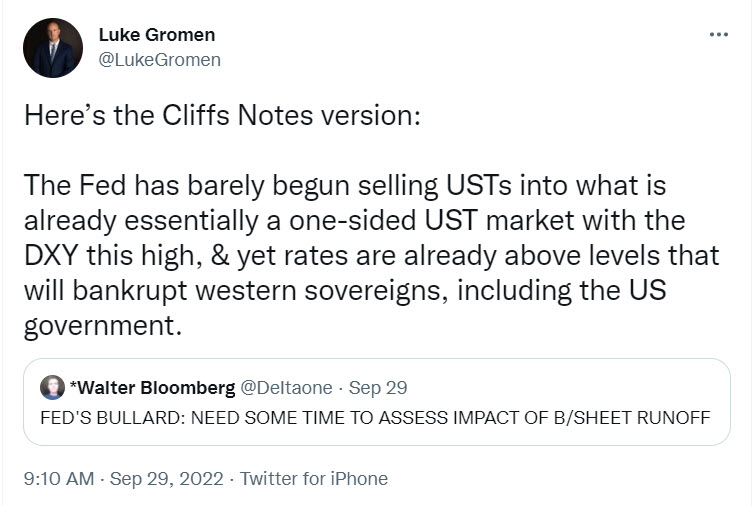

Luke Gromen, the founder of macroeconomic firm Forrest for the Trees, has been predicting that once this situation comes to a head (within the next 5 weeks) the Fed is going to be forced to pivot and go from being a net seller to a buyer of treasuries to shore up the US Treasury market.

Here is a summary from a recent Twitter post.

Here is a Q and A session where he explains his thesis.

Fed pivot timing update; GBP thoughts; What “breaks” this time? – YouTube

I have no way of knowing how this will all pan out. However, what I do know is market risk is high and that an opportunity awaits those that have the ability to minimize losses.

The key is to continue to monitor market technicals. So, let’s get started and look at some charts.

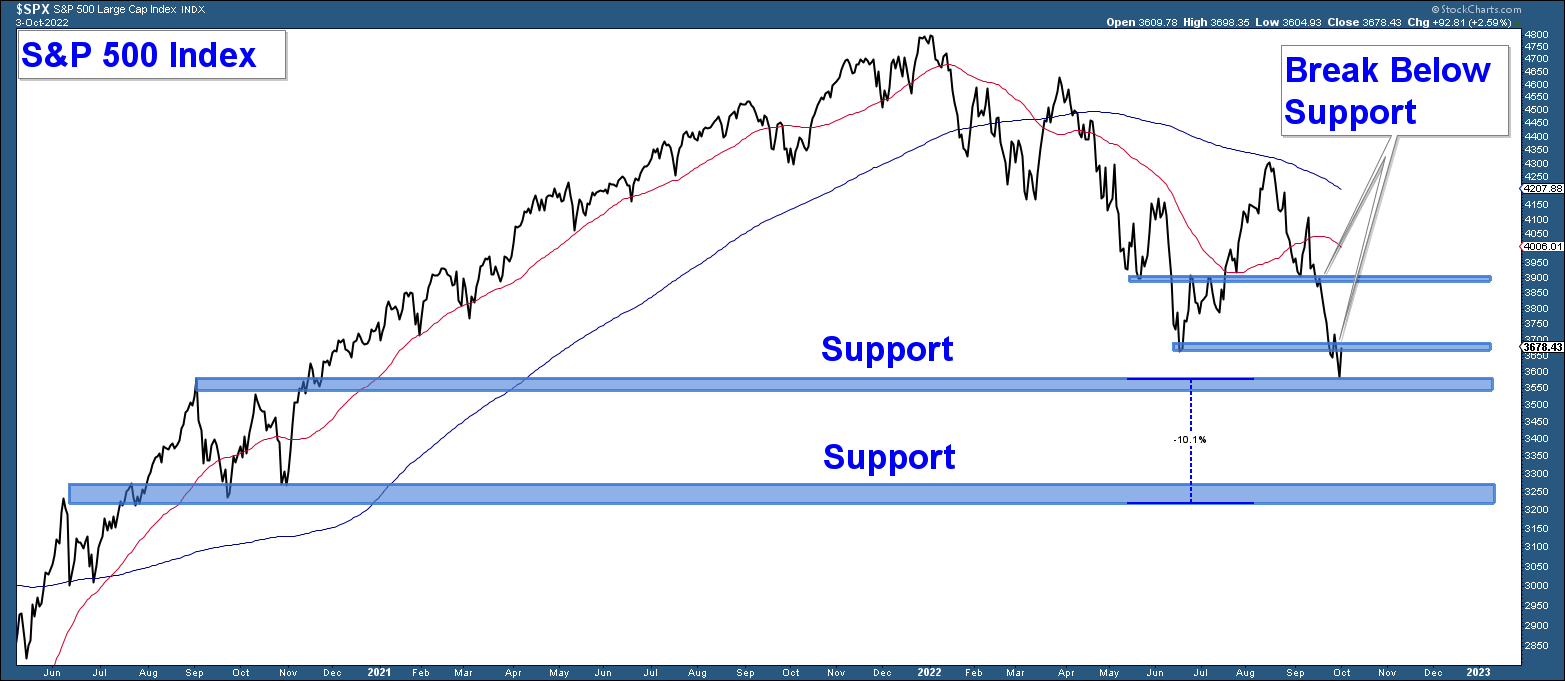

Below is a chart of the S&P 500 Index. The blue lines are areas of past or present support.

In last month’s newsletter, I wrote:

“Given that the majority of the technical and economic evidence is bearish, I feel the odds strongly favor more downside for stocks.”

And that is exactly what has happened in that the index has fallen below the first level of support and now sits at the next (June lows).

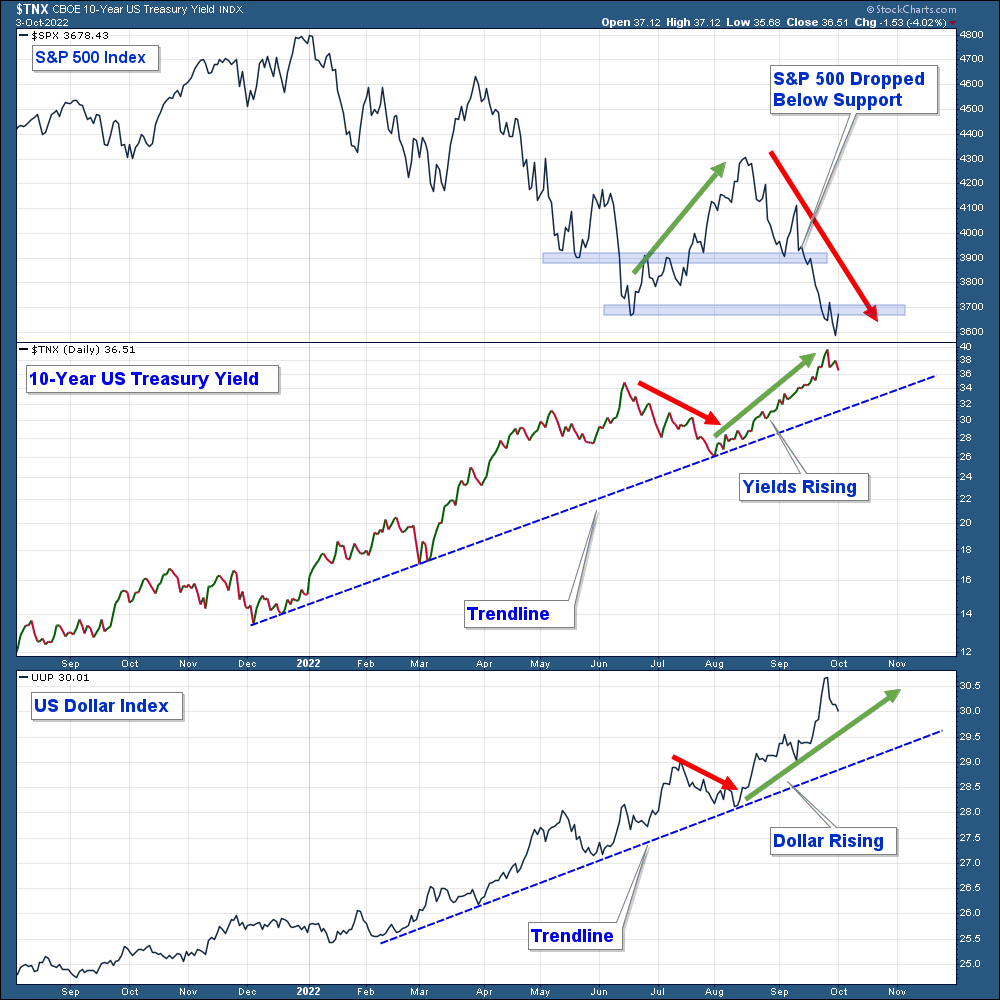

Below is the same chart that I presented in last month’s newsletter. In the top panel is the S&P 500 Index, the 10-Year US Treasury Yield in the middle, and the US Dollar Index in the lowest panel.

The only safe haven in the current bear market is the US Dollar. As long as the Dollar and Yields are rising, stock market conditions are bearish.

If the Fed does pivot in the coming weeks to provide support to the bond market, it would have immediate bullish implications. You would see stocks advance, and the Dollar and Bond Yields fall.

Keep in mind that this would not solve the long-term problems facing the financial markets; however, it would probably provide a tradable advance.

Client Account Update

The amount of risk we are taking in client accounts has been minimal all year given poor market technicals.

Client accounts are allocated very defensively:

- Large Cash Position

- Long Consumer Staple Stocks

- Long US Dollar

- Short Various Market Indexes

- Short Treasury Bonds

The further the market falls, the greater the future opportunity for those who can minimize losses during this bearish market environment.

CAN WE HELP YOU?

HERE’S AN EASY WAY TO FIND OUT:

We want clients who are a good mutual fit. To find out, we offer a no-pressure complimentary consultation. If we can help you and you want to work with us, that’s great. But if you don’t, we will give you free asset allocation direction on your retirement accounts, at no charge and with no strings attached.

If you are interested, send us an email to set up your complimentary zoom meeting.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.