September was a down month for the stock market and market risk has turned decidedly higher. For a number of months, we have seen the S&P 500 grind higher while waning market breadth continued to warn of internal market weakness.

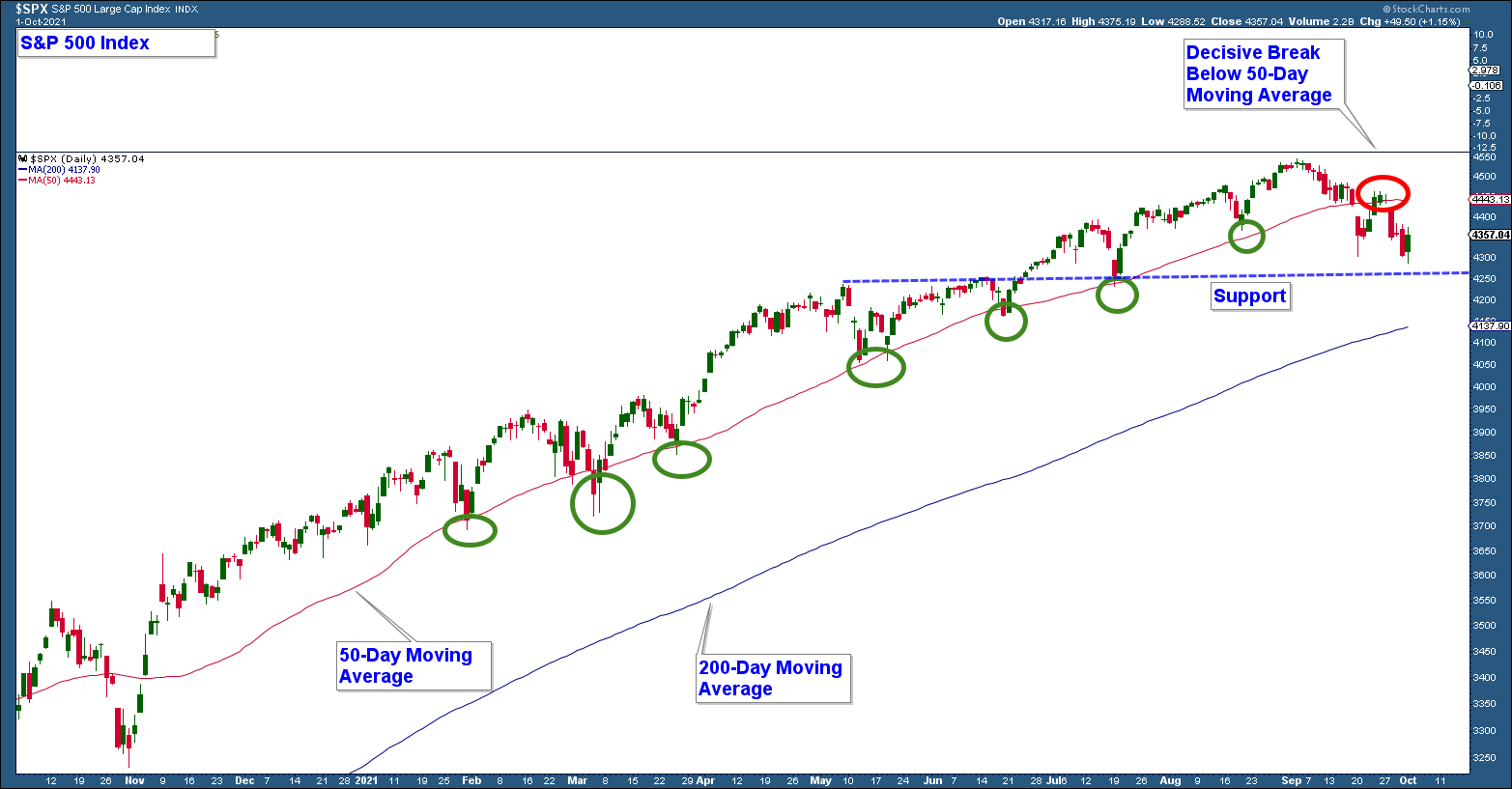

Over the past month, the market finally broke down. Below is a chart of the S&P 500 which has trended higher using its 50-day moving average as support for any minor pullback. That dynamic broke down last month when the index fell decidedly below this moving average and now the average is acting as resistance.

The levels that I will be watching as possible areas of support are at about 4260 (notated with the blue horizontal line) and the 200-day moving average. If the index falls below its 200-day moving average (about 5% below Friday’s close) it would be extremely bearish for the market.

Market Breadth Continues to Deteriorate

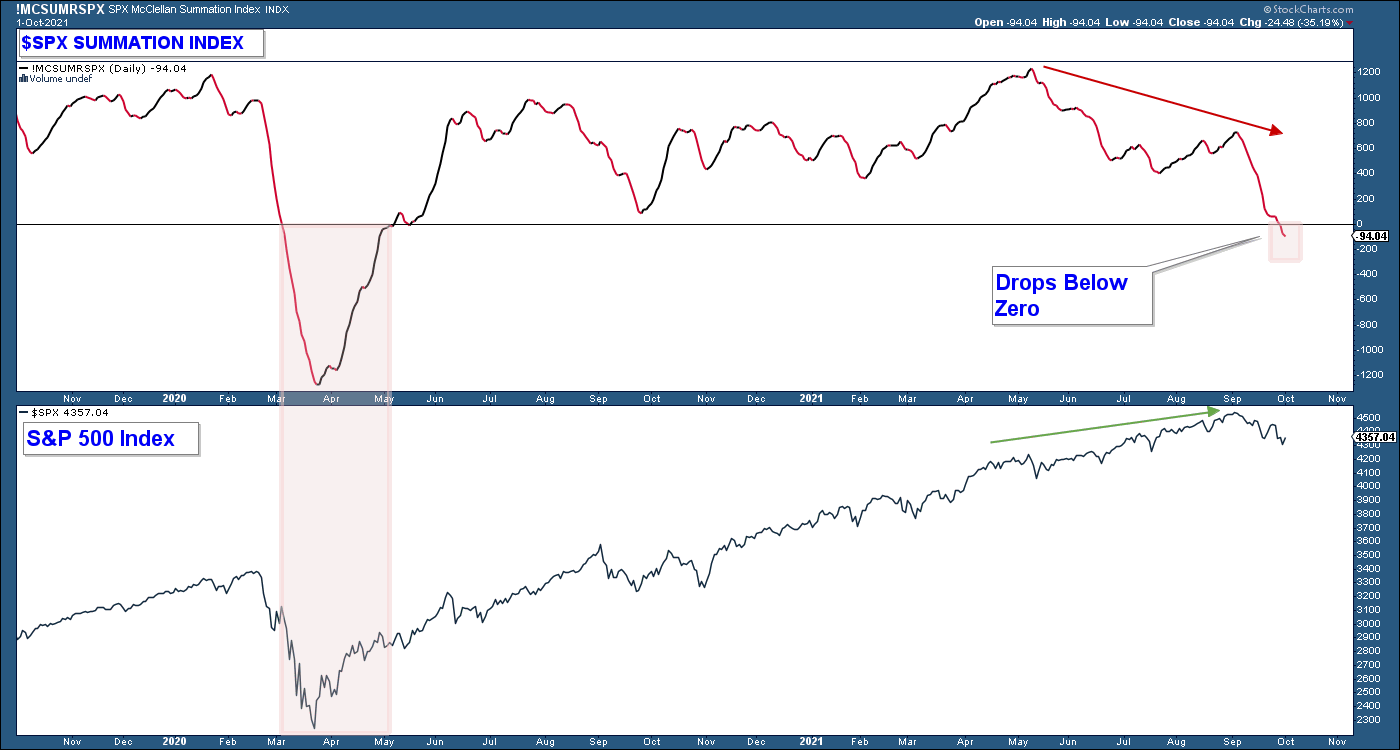

Market breadth continues to deteriorate. Major market indexes (that are capitalization-weighted) continue to grind higher, however, the number of stocks that are participating in that advance has been on the decline for months.

Below is a chart of the S&P 500 Summation Index (a market breadth indicator) in the upper panel. Notice how over the past five months the S&P 500 Index has risen as the Summation Index has fallen.

Recent market weakness has pushed the summation into negative territory. I view stock market risk as being severely elevated any time the index falls below zero.

Bond Yields Break Out

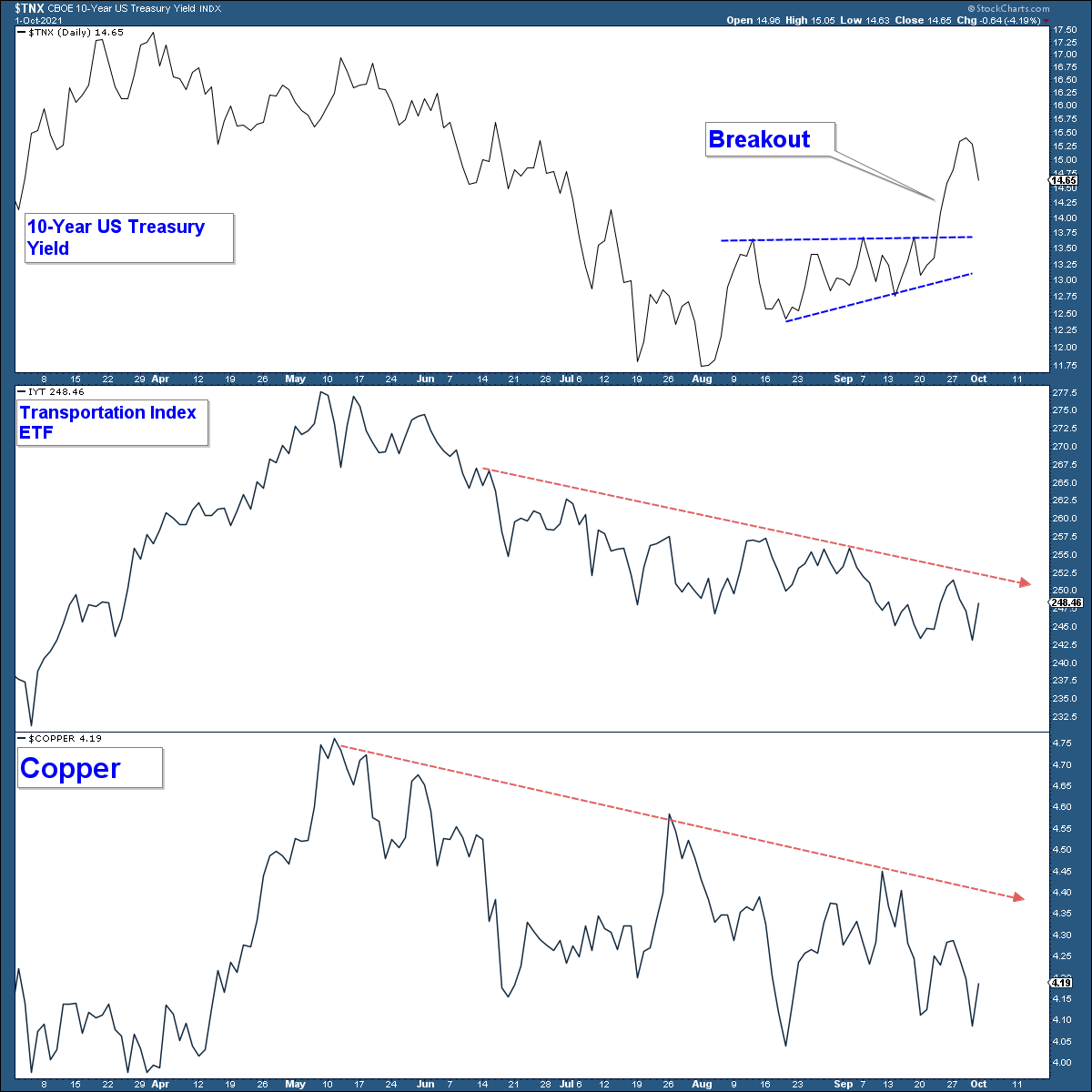

Historically, rising bond yields have been bullish for stocks in that it is a sign of economic growth which offers a strong tailwind for the stock market. On the flip side, falling yields can be a sign of weakness and bearish for stocks.

Note in the chart below how yields topped in May which seems to coincide with the decline in the summation index as well as other breadth indicators.

So, why is the stock market breaking down as rates are rising? Shouldn’t rising yields be a welcome sign for stock investors?

If rising rates were being driven by economic strength I would expect to see transportation stocks and copper (both of which are economically sensitive) to be advancing. Notice in the chart below how they have been falling for months. The recent advance in rates was NOT accompanied by corresponding strength in those areas that typically benefit from economic strength.

I believe investors see the rise in rates as being driven mainly by inflation – not economic strength. This combined with a Fed that has turned hawkish has the market worried.

If this dynamic doesn’t change soon, it could create more downside for stocks.

Client Account Update

It is important to calibrate the risk you take in your investment accounts based on the underlying risk in the market.

Client accounts are allocated in bond funds, cash, and a minor amount in equities. If market internals improve, I will look to increase equity exposure.

If you have any questions, please feel free to send me an email.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

All charts provided by: StockCharts.com