Stock Market

In my January 2, 2024 Newsletter, Breadth Thrust, I wrote about how the market experienced a breadth thrust that historically has proceeded strong longer-term returns for stocks.

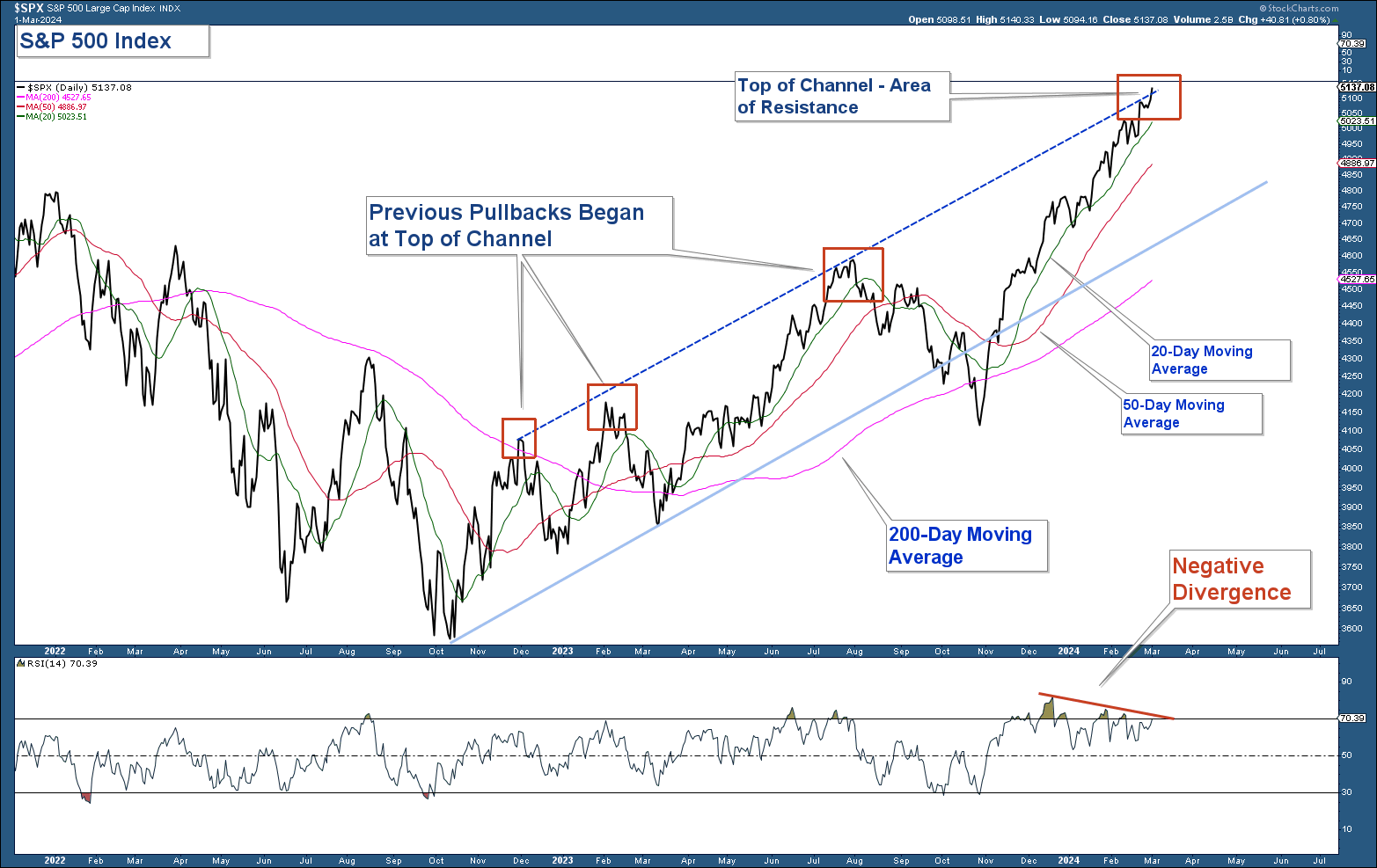

In my February 4, 2024 Newsletter, Strong Price Action, I wrote: “The index is nearing the top of the channel which is an area where the index has pulled back in the past. Any weakness that might occur in the coming weeks is assumed to be minor and not a change in the longer-term market uptrend.”

When I wrote last month’s newsletter the S&P 500 was nearing the upper end of its uptrending channel, but was not there yet. Over the past month, major market indexes continued to run higher and the S&P 500 is now at the top of its uptrending channel (see chart below). This is an area in which I would expect some market weakness in the near term. Not a change in trend, just some type of short-term pullback.

Notice how the S&P 500 has advanced within the annotated uptrending channel. Here are my takeaways from the chart.

- The past three times the index has approached the upper end of the channel it has resulted in a short-term pullback (see first three red squares).

- The index advanced strongly off the October 27 low. That advance occurred without any major consolidation or pullback and is now sitting at an area where I would expect some type of short-term weakness.

- Momentum is negatively diverging from price. Meaning that the index has recently advanced but the momentum indicator in the lower panel (RSI) is falling. This type of divergence often precedes impending market weakness.

In summary, the market is long-term strong; however, we could see some weakness in the near term given major indexes are severely overbought.

Sector Rotation Is The Lifeblood Of A Bull Market

Sector rotation is the movement of money invested in stocks from one industry to another as investors and traders anticipate the next stage of the economic cycle. This type of market action is indicative of a bullish market environment.

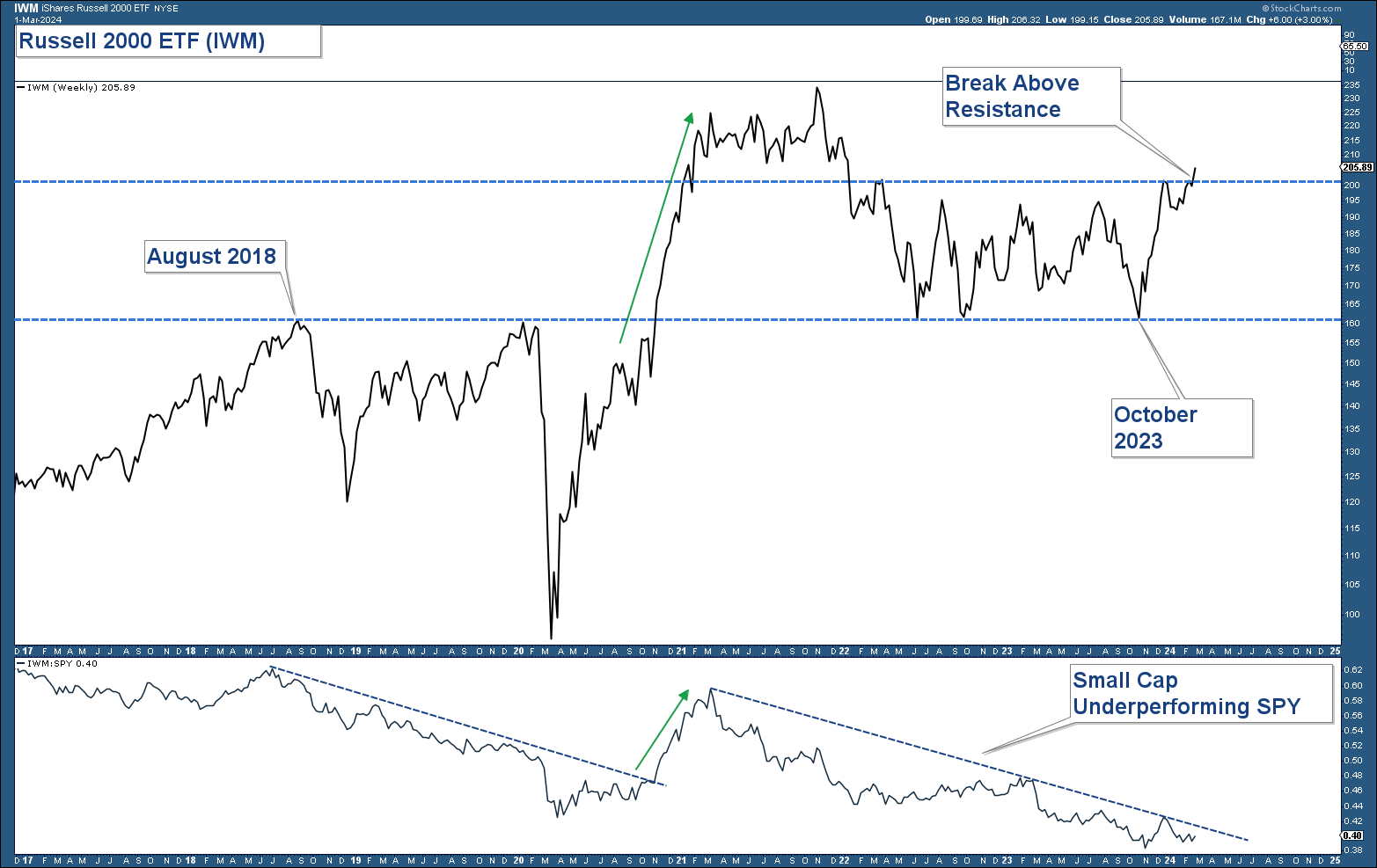

Small-cap stocks have underperformed for years. Below is a chart of the Russell 2000 ETF (IWM). You can see that the IWM was at the same price in October 2023 as it was in August 2018.

For the past two years, IWM has traded sideways between support and resistance (horizontal blue lines). Notice how the price has just peaked above resistance last week. If this index can stay above this area of resistance, which has now become support, it will be a strong signal that the broader stock market is longer-term bullish.

New Sector/Industry Group Strength

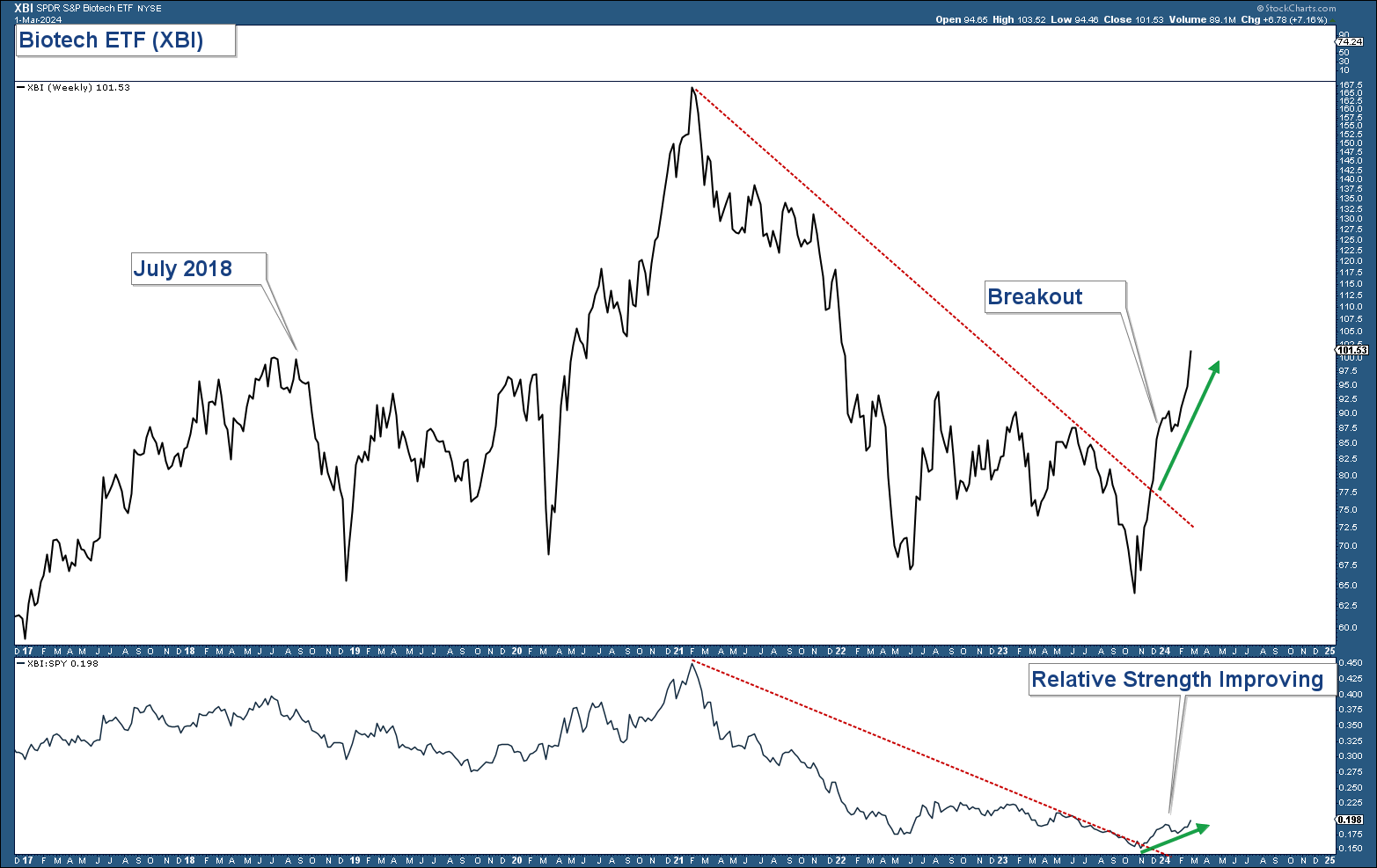

Biotechnology stocks have recently broken out of a downtrend and are starting to show some relative strength. Biotech stocks are a risk-on industry group and if they continue to display strength it would be a bullish sign for the broader market and also provide us with a group of stocks to invest in that are not overbought and thus have more room to run in the near-term.

Below is a chart of the Biotechnology Index ETF (XBI). Notice how the index is just now breaking out of a downtrend. Also, the relative strength line in the bottom panel has broken out and is starting to rise (meaning that XBI is starting to outperform SPY (S&P 500 ETF).

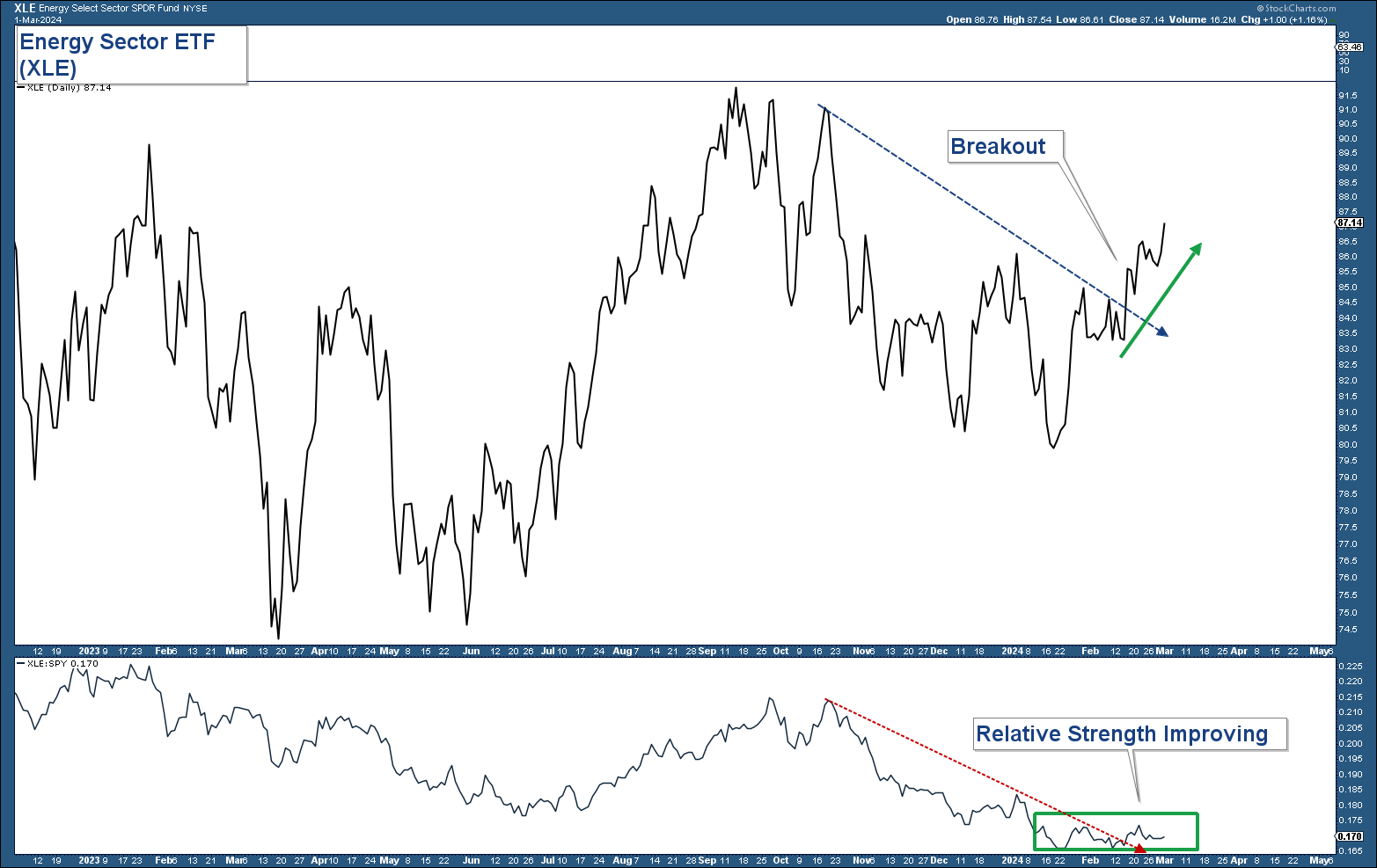

Another sector that has underperformed over the past year; however, is starting to show some early signs of strength is the Energy sector.

In the chart below is the Energy sector ETF (XLE) in the top panel and a relative strength chart (comparing energy relative to the S&P 500) in the lower panel.

Notice how XLE has broken out of a downtrend and advanced above resistance.

Conclusion

Long-term market technicals suggest the stock market is strong. However, short-term the market is overbought and ripe for a pullback.

If we continue to see sector rotation it would be a bullish market environment signal. Therefore, watch for strength in those beaten-down sectors/industry groups such as small caps, biotechnology, and energy stocks.

Client Account Update

Our conservative model is nearly fully invested and our aggressive model is about 60% invested in equities. I will be adding equity positions to our aggressive model provided market technicals remain positive.

CAN WE HELP YOU?

HERE’S AN EASY WAY TO FIND OUT:

We want clients who are a good mutual fit. To find out, we offer a no-pressure complimentary consultation. If we can help you and you want to work with us, that’s great. But if you don’t, we will give you free asset allocation direction on your retirement accounts, at no charge and with no strings attached.

If you are interested, send us an email to set up your complimentary zoom meeting.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.