The current correction in equity markets began in Q1 – Q2 of last year despite major market indexes not breaking down until the beginning of this year. This correction can be seen in the progressive deterioration in market breadth that I have shown in numerous past updates.

Now that major market indexes are breaking down, what are market technicals suggesting about near and long-term market strength or weakness?

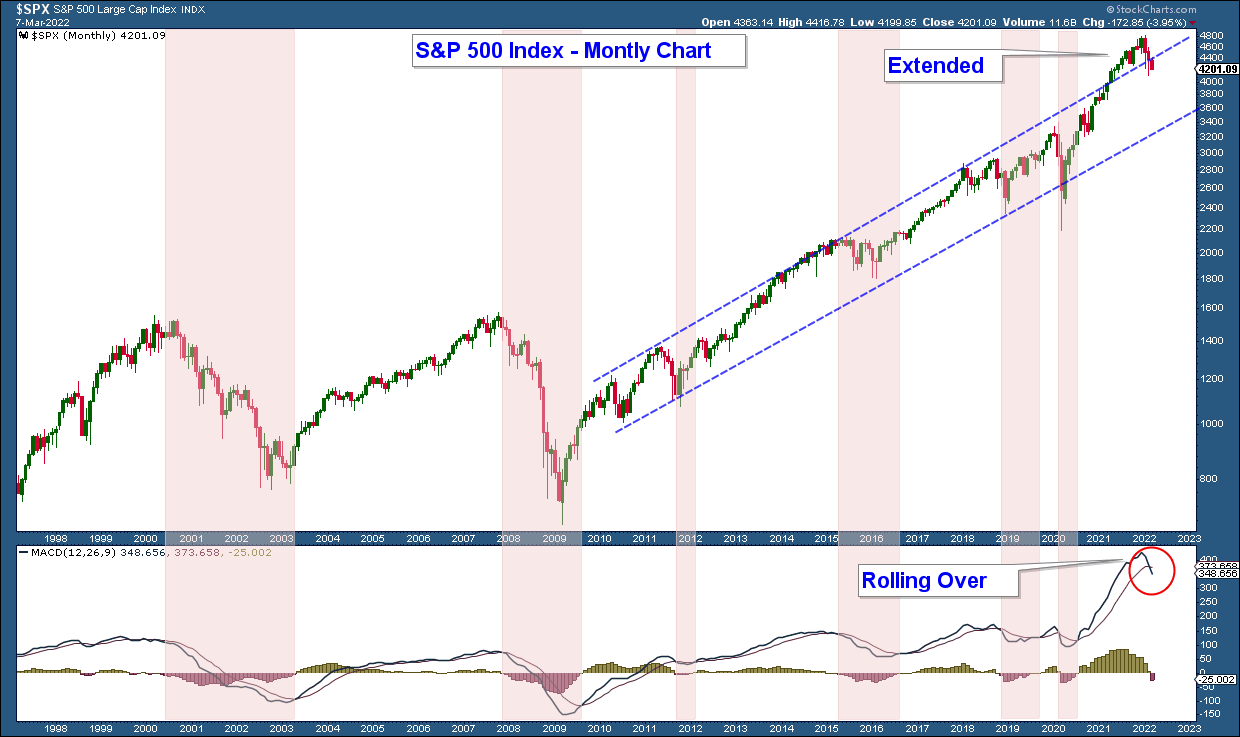

Let’s first look at the S&P 500 from a long-term perspective. Below is a monthly chart of the index along with a MACD (momentum) indicator in the bottom panel.

The first thing to notice is that price is extended to the upside as noted by the rise above the upper end of the price channel. Second, the MACD is rolling over and is below its moving average. Keep in mind that this is a monthly chart and thus the move below the moving average can’t be counted until the end of the month.

I have highlighted, in light red, past occurrences where the MACD was decisively below its moving average. As you will notice, it is normally associated with periods of major weakness in the index.

The fact that the market is at an extremely elevated level and long-term momentum is rolling over suggests that the current weakness in the market could be the beginning of a longer-term decline

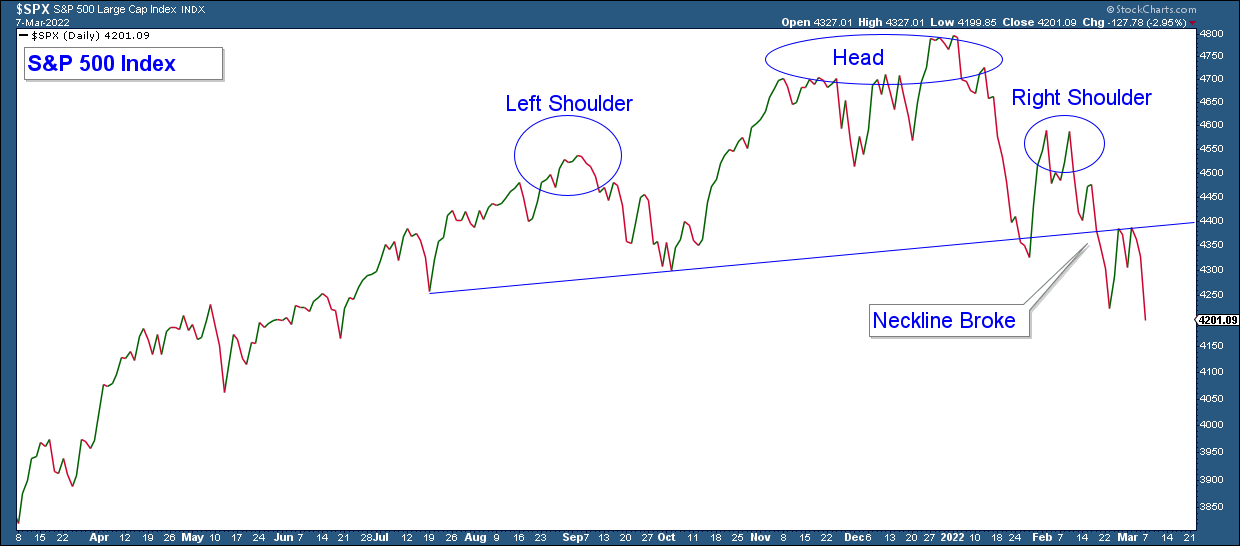

Now let’s look at a daily chart of the S&P 500 index. One thing that stands out is the head-and-shoulders topping pattern which signals a top when price drops below the neckline, which has recently occurred.

Commodities and Gold are Outperforming Stocks

Bearish Signal

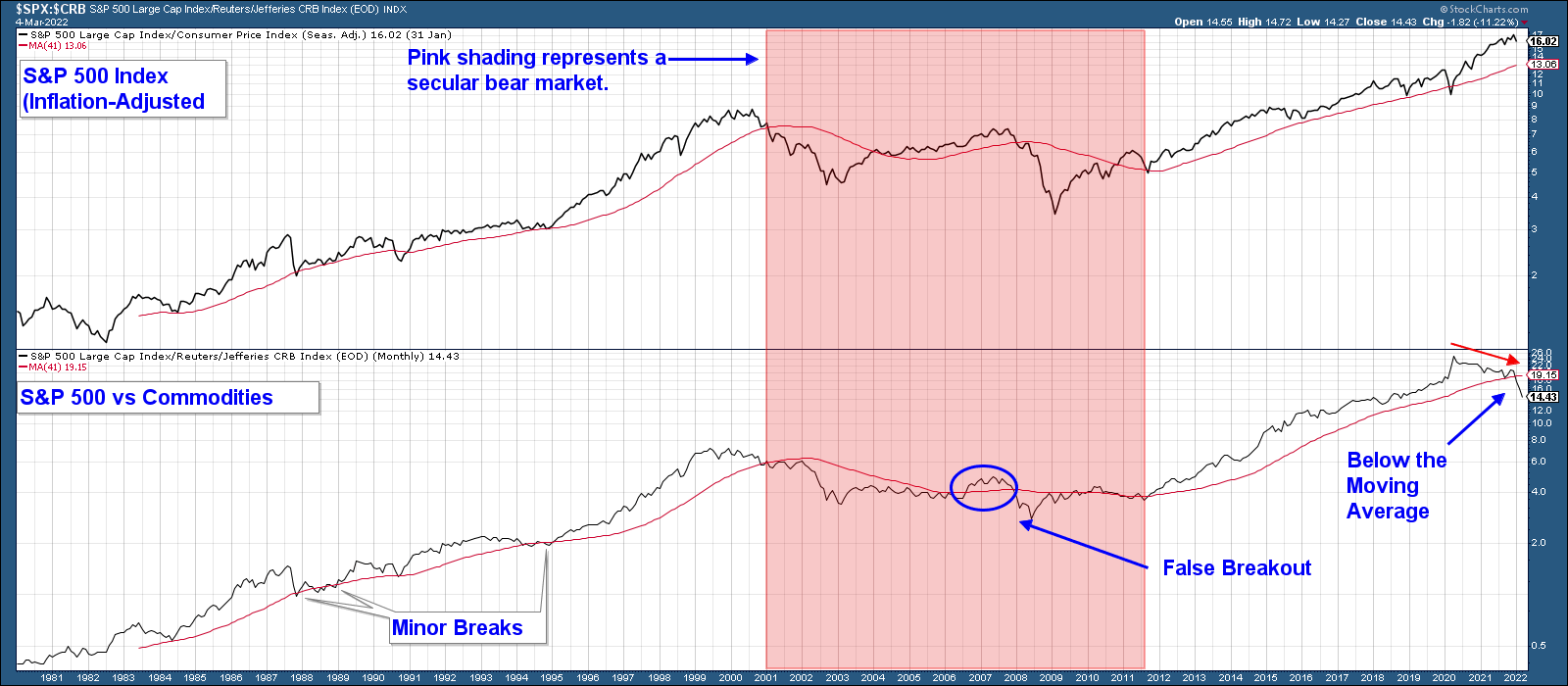

Below is a relative strength chart of the S&P 500 versus the Commodity Index. When the line is rising, stocks are outperforming and when it falls, commodities are outperforming.

Here are a few things to notice:

- Outperformance by either of these indexes seems to persist for long periods of time.

- Commodities historically outperform during cyclical and secular bear markets. The red highlighted area notates the last long-term period of commodity outperformance. This period coincides with a secular period of stock market weakness.

- Stocks began to slowly underperform commodities in early 2020.

- The relative strength line has fallen decisively below its moving average this month. Keep in mind this is a monthly chart therefore we can’t count the moving average violation until the end of the month.

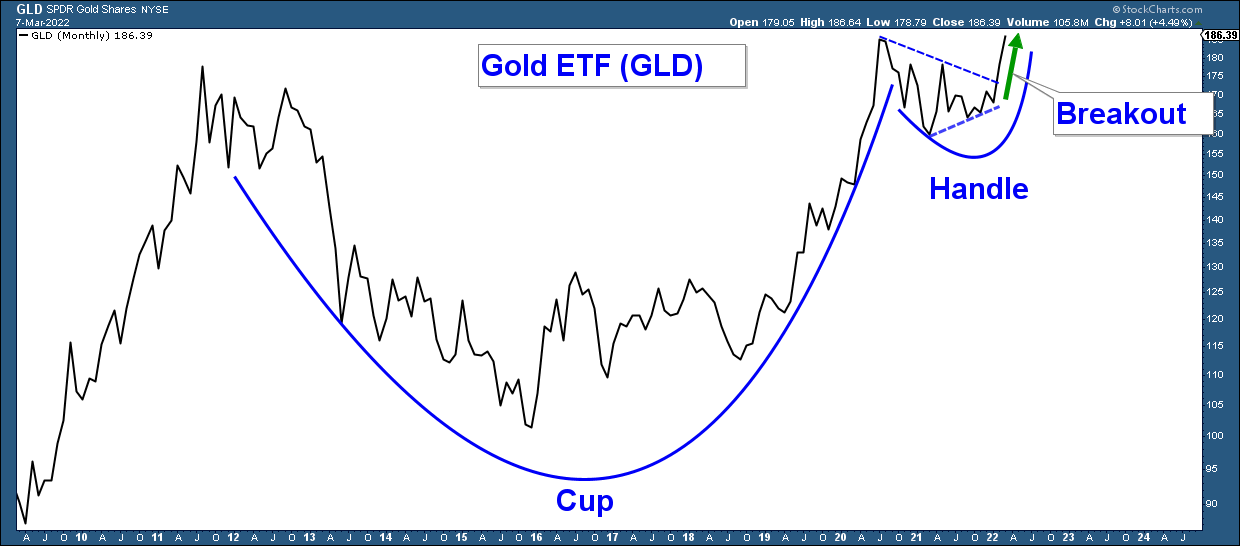

Below is a monthly chart of gold and it has formed a bullish cup and handle basing pattern. Given the pattern begins in 2011 and is just now breaking out to new all-time highs, suggests that gold’s advance could just be beginning.

Like commodities, when gold outperforms stocks it is usually a bearish signal for the broader stock market.

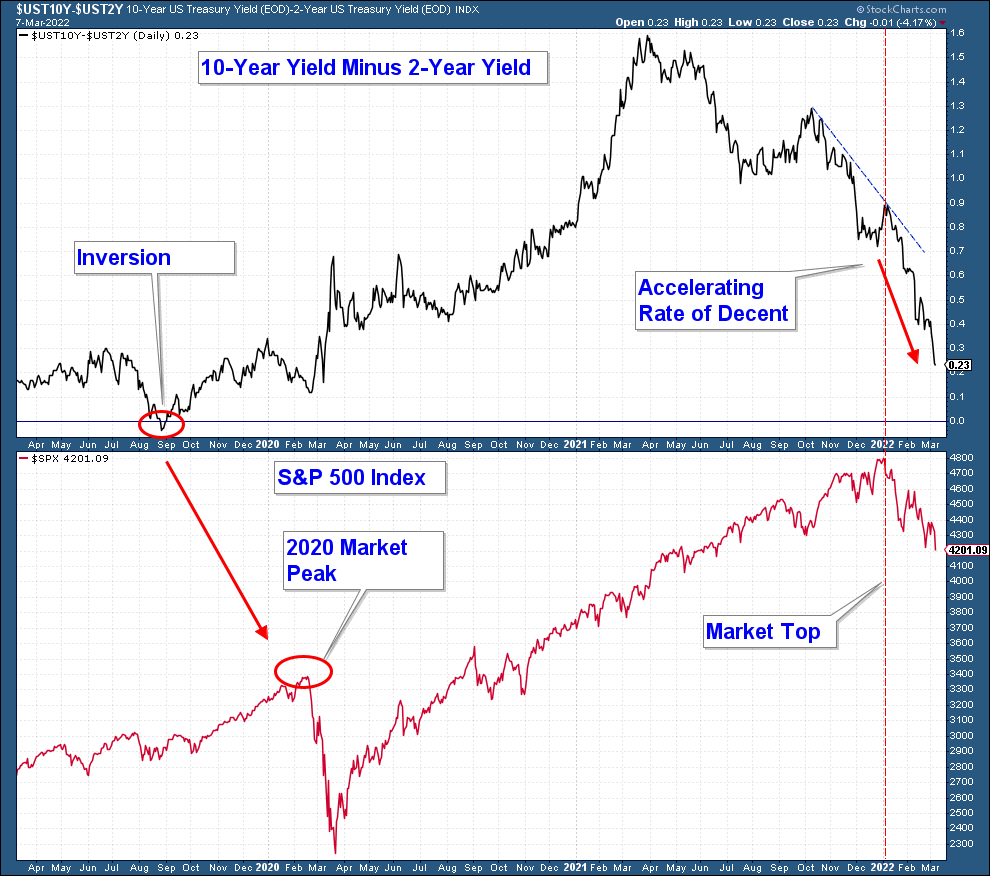

Yield Curve

An inversion of the yield curve has been very accurate at predicting impending recessions; albeit with considerable lead time. While the curve has not inverted yet, the rate that it is flattening is concerning.

In the chart below I have charted the difference between the 10 and 2-year yields. When that line falls the difference between the two yields is contracting and when it falls below zero it means the yields have inverted.

The difference between those yields is now only 23 basis points.

Summary

I don’t know if we are in the early stages of a bear market; however, I do know that market technicals are decidedly bearish, the economy is experiencing slowing growth, and inflation looks strong and persistent. Not to mention the financial impact of Russia’s invasion of Ukraine.

I also think that the Fed put that has held up stocks for so long can’t be counted on anymore. I believe the Fed is now going to favor taming inflation over providing a backstop for stocks.

Client Account Update

Because of elevated market risk, client accounts are allocated extremely defensively.

The stock portion of our portfolio is minimally invested in stronger segments of the market such as commodities, banks, metals & mining, utilities, insurance, country-specific international index funds, and gold. These positions are hedged with index short funds.

The bond portion of our portfolios are minimally invested given poor bond technicals.

As always, we monitor market conditions daily and look to protect our clients from losses during times of major stock and bond market stress.

If you have any questions, please feel free to send me an email.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.