S&P 500 Index

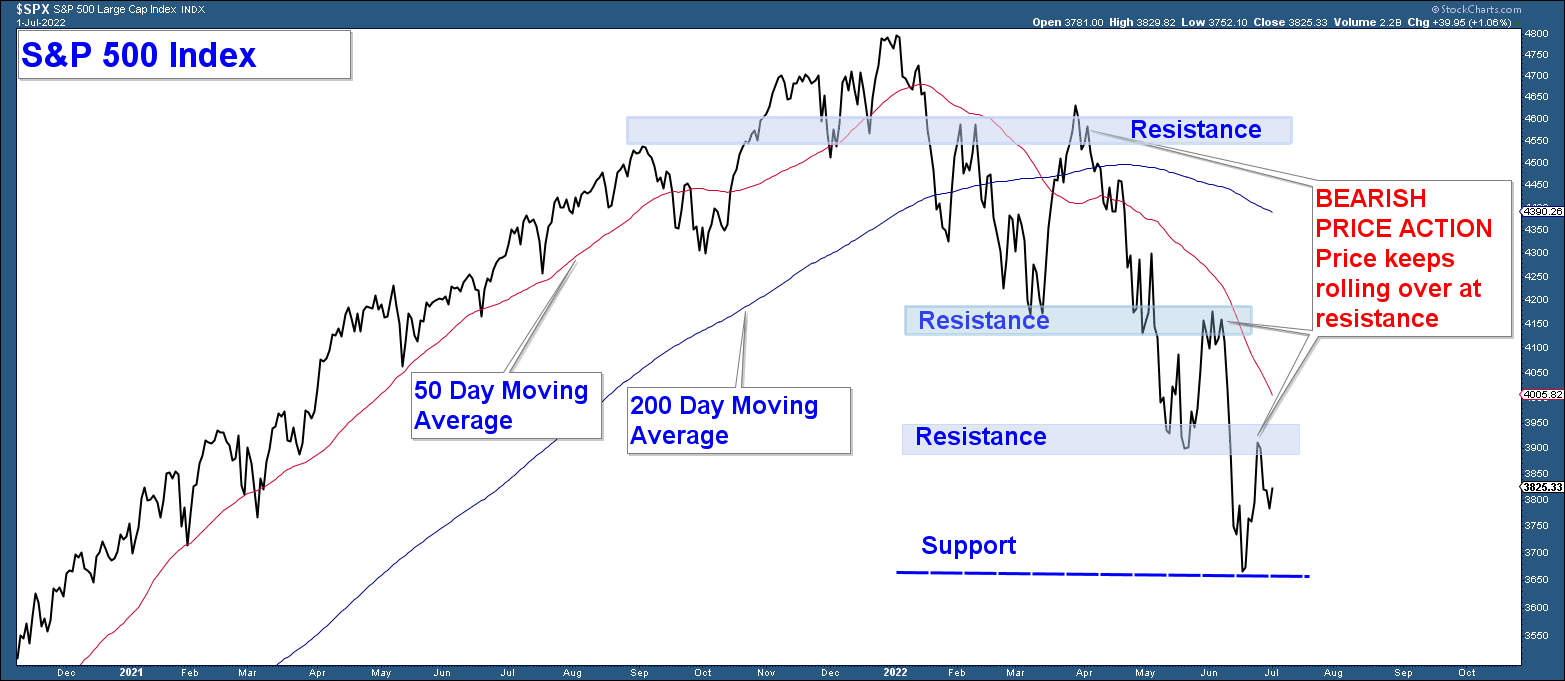

Below is a daily chart of the S&P 500 Index. Here are the critical aspects of the chart:

- The index is in a downtrend defined by a series of lower-highs and lower-lows.

- Price advances keep failing at resistance.

- Price is below its 50 and 200-day moving averages and both those averages are trending down.

Based upon the above-noted chart characteristics the market still looks bearish.

In summary, price action is still bearish.

Technical Market Summary

Market technicals started to become bearish in Q1 – Q2 of last year. Since then, market technicals have continued to deteriorate and major market indexes rolled over at the beginning of this year.

Below I summarize the different technical categories that have helped us to anticipate the market downturn and how they look currently.

Market Breadth – Bearish

In our November 2021 and October 2021 updates, I wrote about the negative divergence that was occurring in the Summation Index (a breadth indicator).

In our December 2021 update, I explained how mid, small, and micro-cap indexes were consolidating as the S&P 500 was advancing.

Market Breadth continues to display weakness. The Summation Index (not charted) is currently below zero which is bearish.

Market Momentum – Bearish

In our March 8, 2022 update, Are We In The Early Stages of a Bear Market, I presented a monthly chart of the S&P 500 showing the MACD (a momentum indicator) had turned decisively down.

Short-term momentum indicators turned up last month which coincided with the June bounce. That bounce has stalled at major resistance and the MACD is starting to show signs of rolling over.

Long-term momentum is negative and short-term momentum is showing signs of rolling over.

Risk-Off – Bearish

The stock market has been in a decidedly risk-off environment since the beginning of the year which is indicative of a bear market environment.

April 11, 2022 Market Update – Risk-on or Risk-off.

Currently, risk-on sectors/industry groups such as Semiconductor, Technology, Discretionary, and Communication stocks are underperforming. While risk-off sectors such as Healthcare, Consumer Staples, and Utilities are outperforming.

The market is still in a risk-off environment.

Market Sentiment – Bearish

Market sentiment has not gotten close to levels that would suggest a major market bottom.

June 16, 2022 Update, Capitulation Common at Market Bottoms.

In this update, I write about how investor capitulation is common at major market bottoms and this sentiment can be charted using the VIX.

Currently, the VIX is still nowhere near the elevated levels that would suggest a major market bottom.

Macro-Economic Considerations

The odds the economy is either in recession or will be entering a recession in the near future is substantially elevated. Historically equities have fallen about 35% during past recessionary market corrections. Given the S&P 500 has dropped only 23% suggests that equities have further to fall.

Client Account Update

The stock portion of client portfolios is minimally invested in stronger market sectors and industry groups. These positions have been hedged with index short funds for most of this year. I have increased/decreased the degree to which we have shorted the market based on short-term market conditions.

The amount of risk we are taking in client accounts has been minimal all year given poor market technicals.

The further the market falls, the greater the future opportunity for those who can minimize losses during this bearish market environment.

Client accounts have positive returns year-to-date.

CAN WE HELP YOU?

HERE’S AN EASY WAY TO FIND OUT:

We want clients who are a good mutual fit. To find out, we offer a no-pressure complimentary consultation. If we can help you and you want to work with us, that’s great. But if you don’t, we will give you free asset allocation direction on your retirement accounts, at no charge and with no strings attached.

If you are interested, send us an email to set up your complimentary zoom meeting.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.