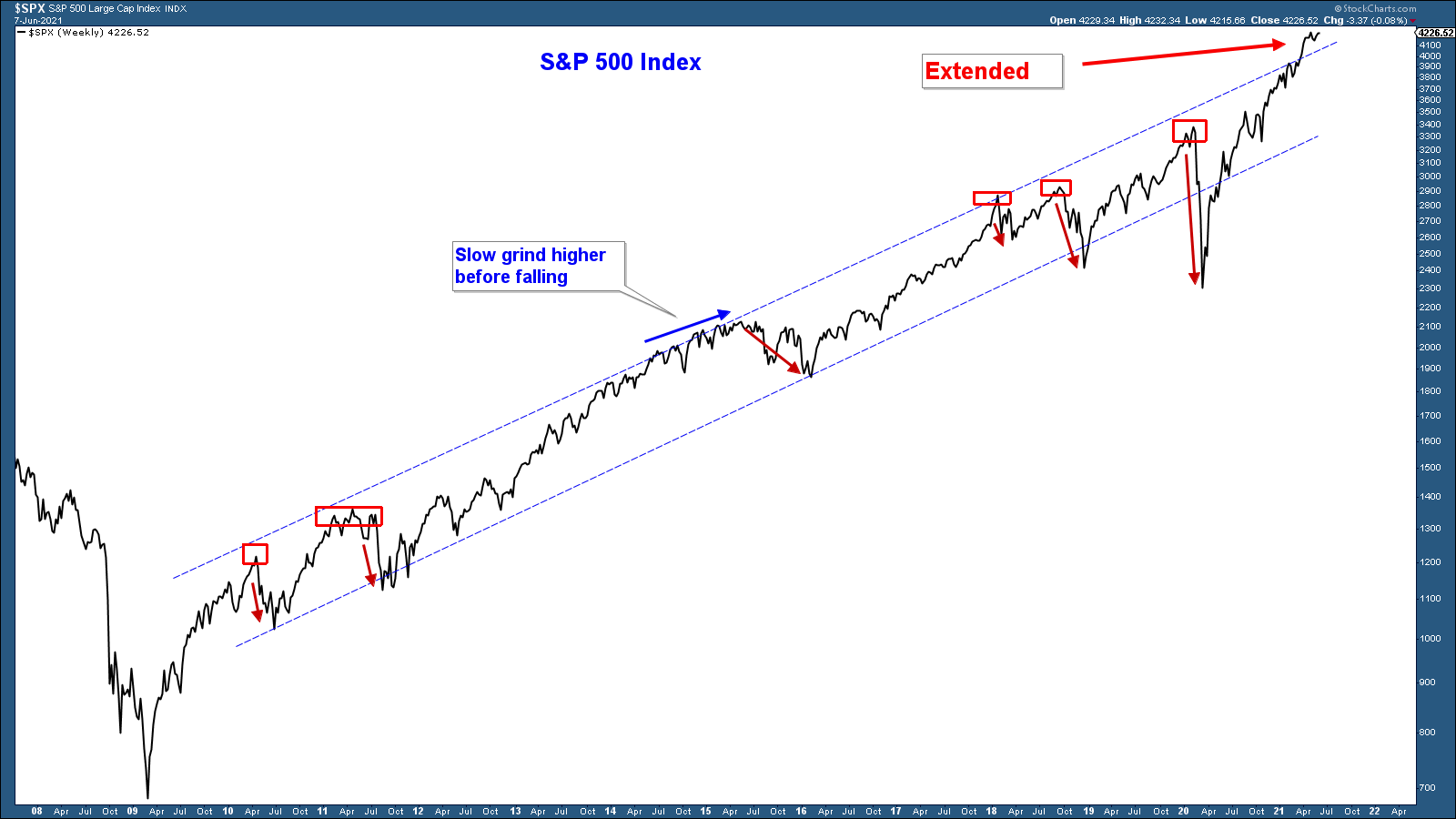

A Long-Term View of the Market

Technically, not much has changed over the past month. In our May Market Update, I wrote about how long-term the market is extended and short-term it’s consolidating. That is still the case.

Below is a long-term chart of the S&P 500. Notice how the index has advanced within a channel. Historically, each time the index has reached the top end of the channel it has either quickly corrected or slowly advanced higher before eventually pulling back to the bottle of the channel.

A Short-Term View of the Market

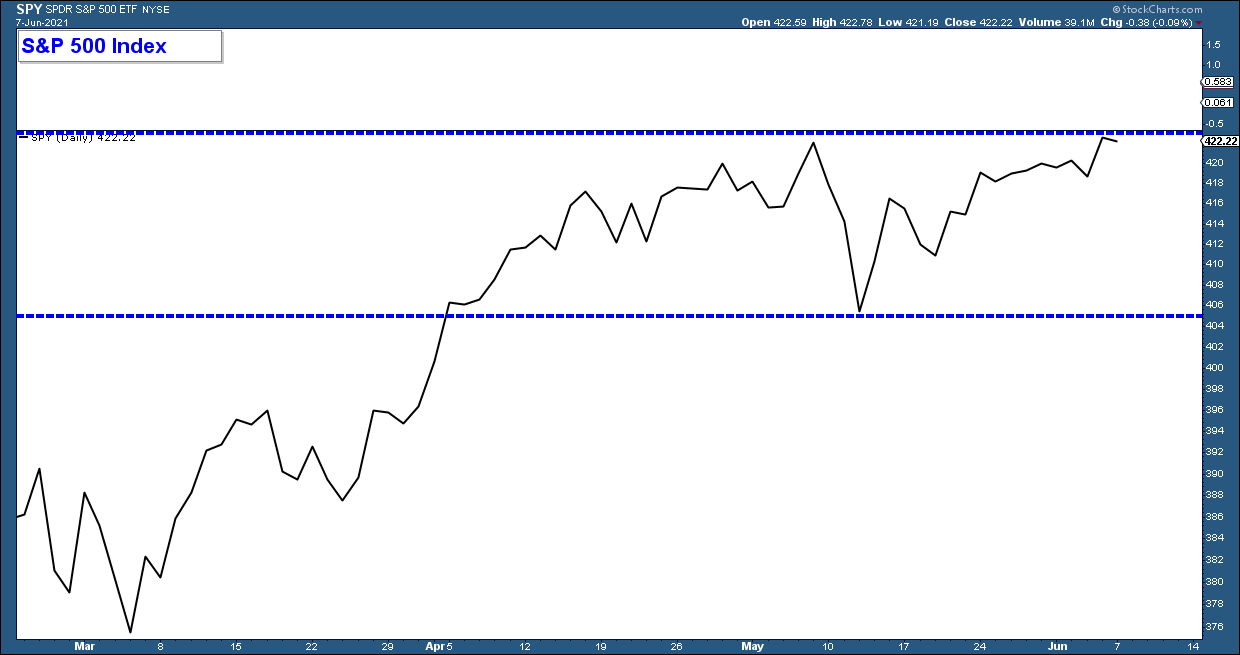

Below is a short-term chart of the S&P 500 index. It has been consolidating since the beginning of April.

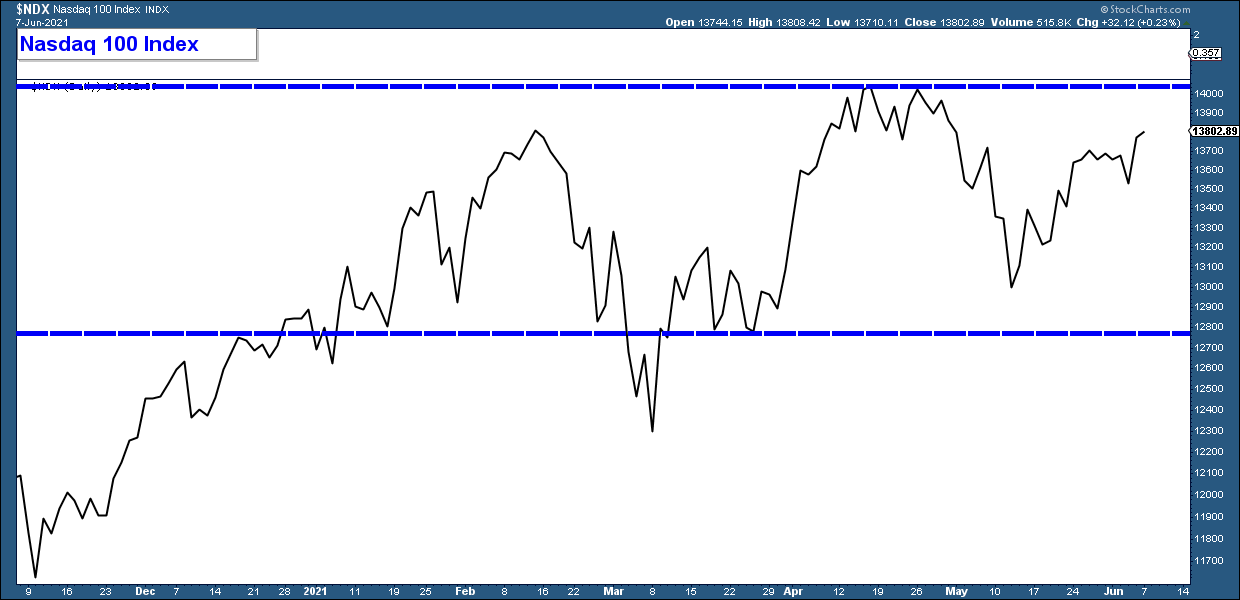

The Nasdaq 100 Index has been oscillating sideways since February.

Same thing with Small Caps. They have gone nowhere since early February.

Where Does The Stock Market Go From Here?

Higher? Lower? Or, Continue to Consolidate?

Can the market advance strongly above this area of consolidation? The S&P 500 is at the top of its consolidation pattern and near all-time highs. Given this, you might think that would be the most likely scenario.

The problem is that the weight of the technical evidence seems to suggest that the market may not be strong enough to sustain an advance.

Remember last year when the market fell 33% in four weeks? Just before that drop, we were seeing the same long-term extended conditions that we are witnessing currently. Check out our February 2020 Market Update that was published about a week before the big drop.

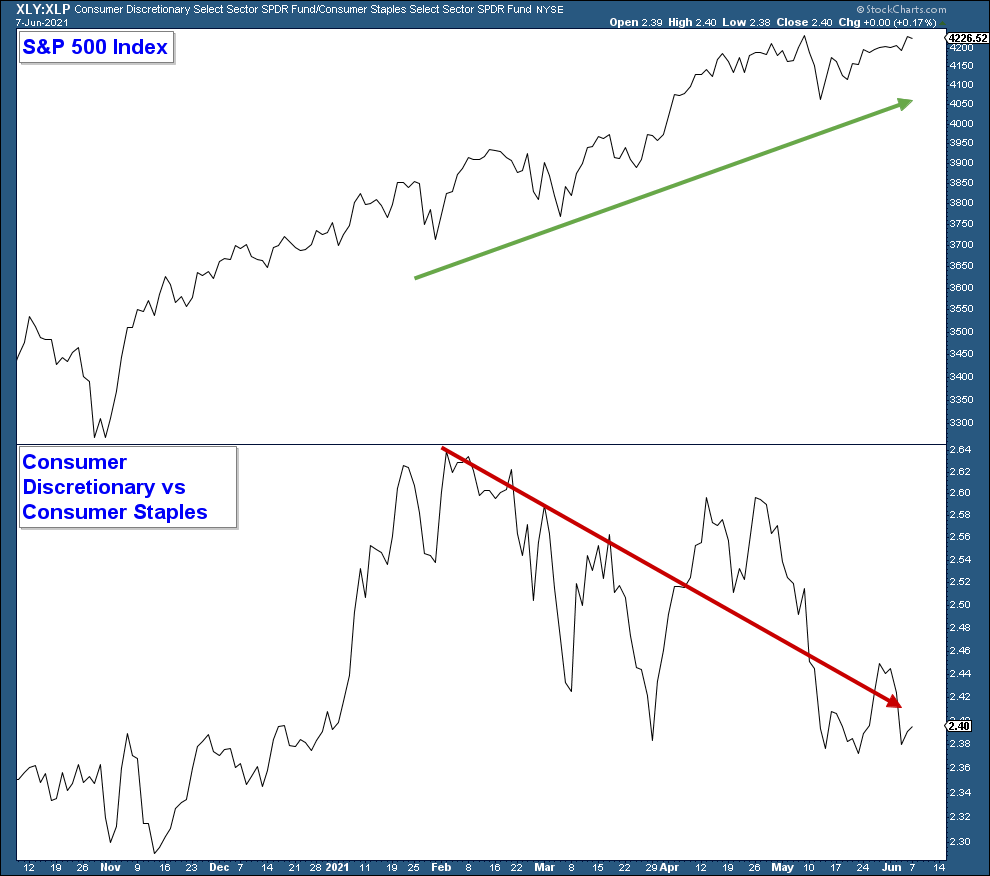

During strong market advances, you typically see risk-on assets outperforming. Here is a chart of Consumer Discretionary (risk-on) relative to Consumer Staples (risk-off) in the lower panel. When Consumer Staples are outperforming the line falls which is what has been occurring since February.

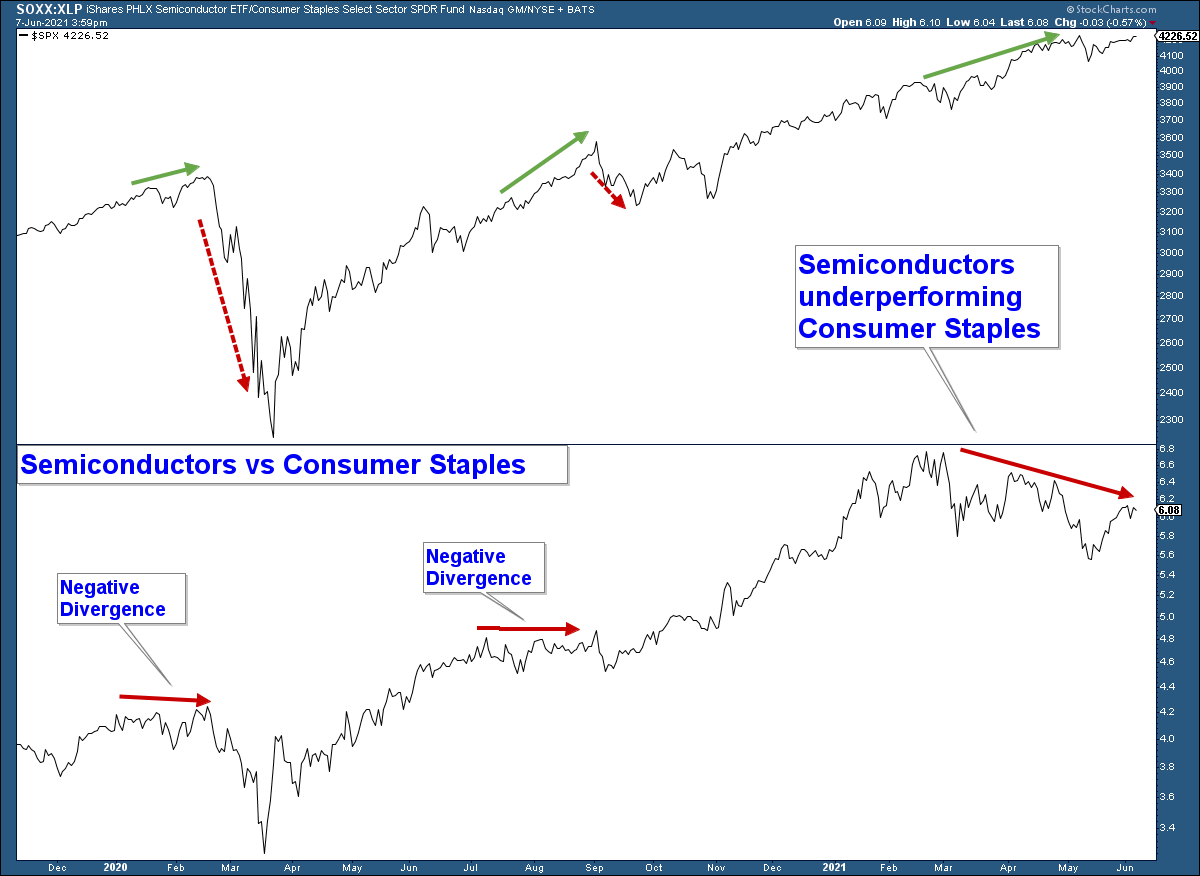

How about Semiconductor stocks? These stocks are a classic risk-on asset so we want to see them outperform to confirm market strength.

Below we chart them relative to Consumer Staples and we see the same thing. Underperformance going back to February.

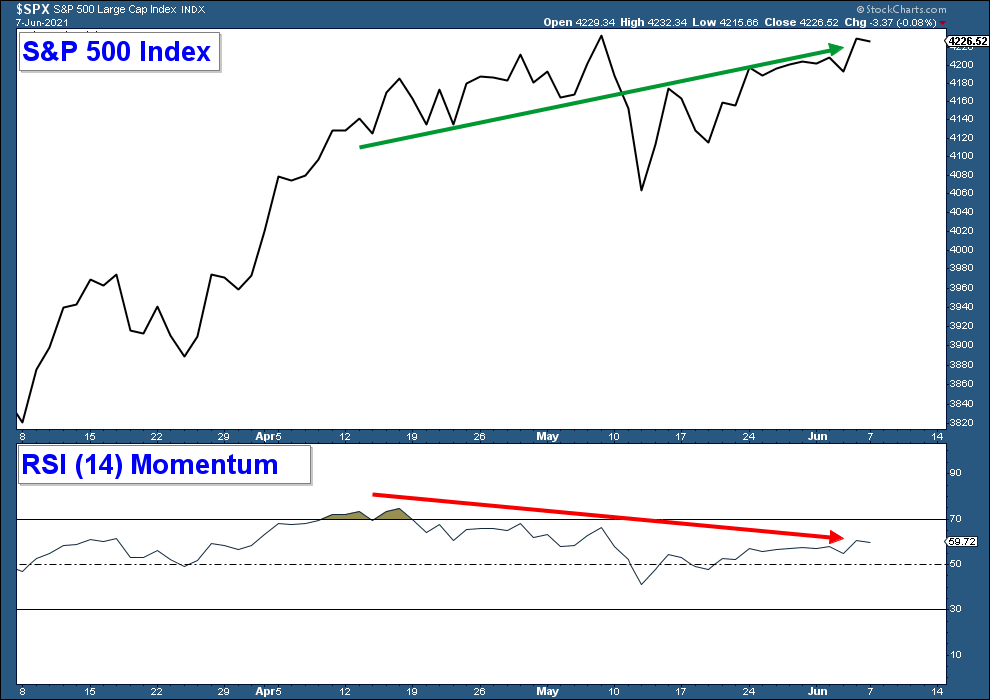

Short-term momentum is diverging negatively with the market which can happen at key market turning points.

See how momentum is falling as the S&P 500 has risen. While momentum indicators are lower on my priority list, they can provide early warning signs of an imminent market move. This time momentum is suggesting near-term market weakness.

The Bottom Line

In summary, the market is in a confirmed long-term uptrend; however, extended with weak internals. This suggests that the risk of continued short-term choppiness or even a pullback in the market is elevated.

Client Account Update

To account for what I perceive as elevated market risk, our client accounts are long select individual equities and hedged with index short positions.

As always, I will continue to monitor market conditions and adjust our client accounts accordingly.

If you have any questions, please feel free to send me an email.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

All charts provided by: StockCharts.com