Major Data Points – January 2024

- Bullish market signal – Breadth Thrusts.

- Short-term market indexes are overbought and at resistance.

- Most economists expected a recession in 2023. It didn’t happen.

- The economy is still a risk factor in 2024. A recession, if it occurs, would push stocks much lower.

Stock Market

No market indicator is infallible. Because of this, I use a weight-of-the-evidence approach to formulating my market thesis.

Based on this approach, the market appears to be longer-term bullish; however, major market indexes are overbought and at major resistance. Therefore, we could see near-term market weakness that allows stocks to work off their overbought condition before making another run higher.

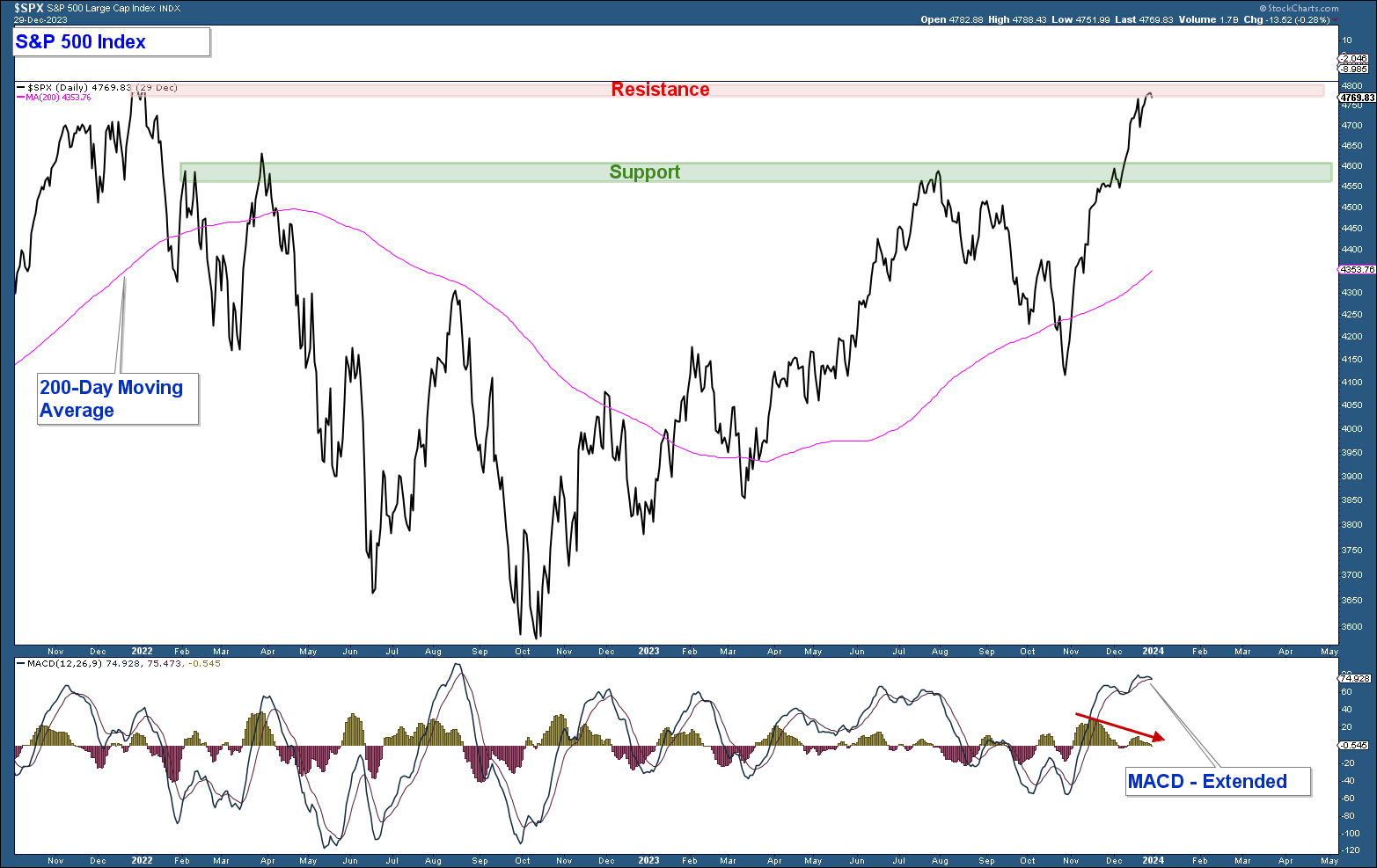

Below is a chart of the S&P 500 Index in the upper panel and its MACD (a momentum indicator) in the lower panel. Here are my takeaways.

- The index advanced strongly over the past two months without a pullback. This type of advance, while bullish, is not sustainable. From a price action perspective, the market is due for a pullback. Since the bulk of the longer-term technical data is positive, I would expect any pullback to be a buying opportunity and not a major market top.

- The MACD is at the top of its range and is close to rolling over. Therefore, momentum is waning, and the odds of a consolidation or pullback are elevated.

- The index has reached an important resistance area, the January 2022 high. The combination of momentum waning and the index sitting at major resistance, suggests elevated odds of a short-term pullback.

- If the market does pull back and market technicals remain positive, I expect the index to not drop decisively below support (highlighted in green) or its 200-day moving average.

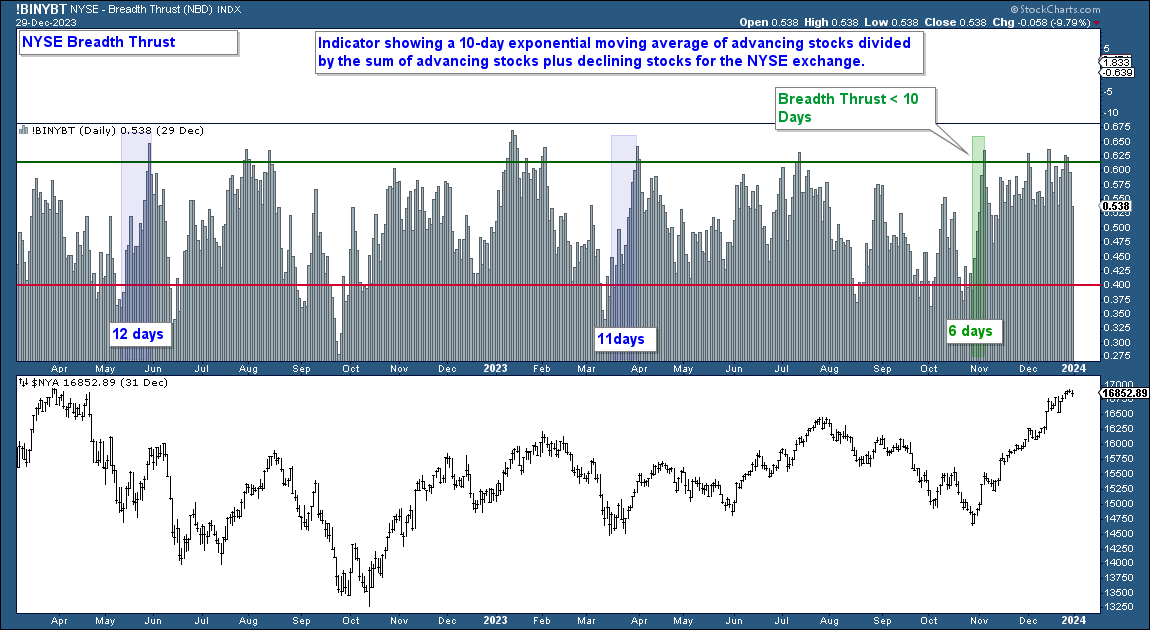

Breadth Thrust – Zweig

The market’s recent (November – December) advance was strong and broad-based and many breadth indicators displayed a long-term bullish signal called a breadth thrust.

During bearish market environments, stocks become substantially oversold, and their advances are comparatively weak. This pattern defines bearish market environments where the long-term trend is down.

When the broader stock market makes a strong move lower (within a bearish market environment) and subsequently advances strongly within a short period, it is called a breadth thrust. This strong move higher runs counter to the previous weaker counter trend moves higher and signals the start of a new bull market.

Numerous breadth indicators can measure this phenomenon. The most popular is the Breadth Thrust Indicator (see chart below) which is commonly known as the Zweig Breadth Indicator. This indicator is based on the percentage of advancing stocks on the NYSE.

When the Breadth Thrust Indicator drops below .40 (red line), then above .615 (green line) within 10 days it signals a breadth thrust. This commonly watched indicator fired off a signal at the beginning of November 2023 (highlighted in green). Two previous moves (highlighted in blue) advanced from below the red line and then rose above the green line; however, they did not occur within 10 trading days and thus were not valid signals.

“The Breadth Thrust Indicator is sometimes known as the Zweig Breadth Indicator, after its creator. According to Zweig, there have only been 14 Breadth Thrusts since 1945. The average gain following each of these thrusts was 24.6% in an average time-frame of 11 months. Zweig furthermore highlights the fact that the majority of bull markets begin with a Breadth Thrust.”

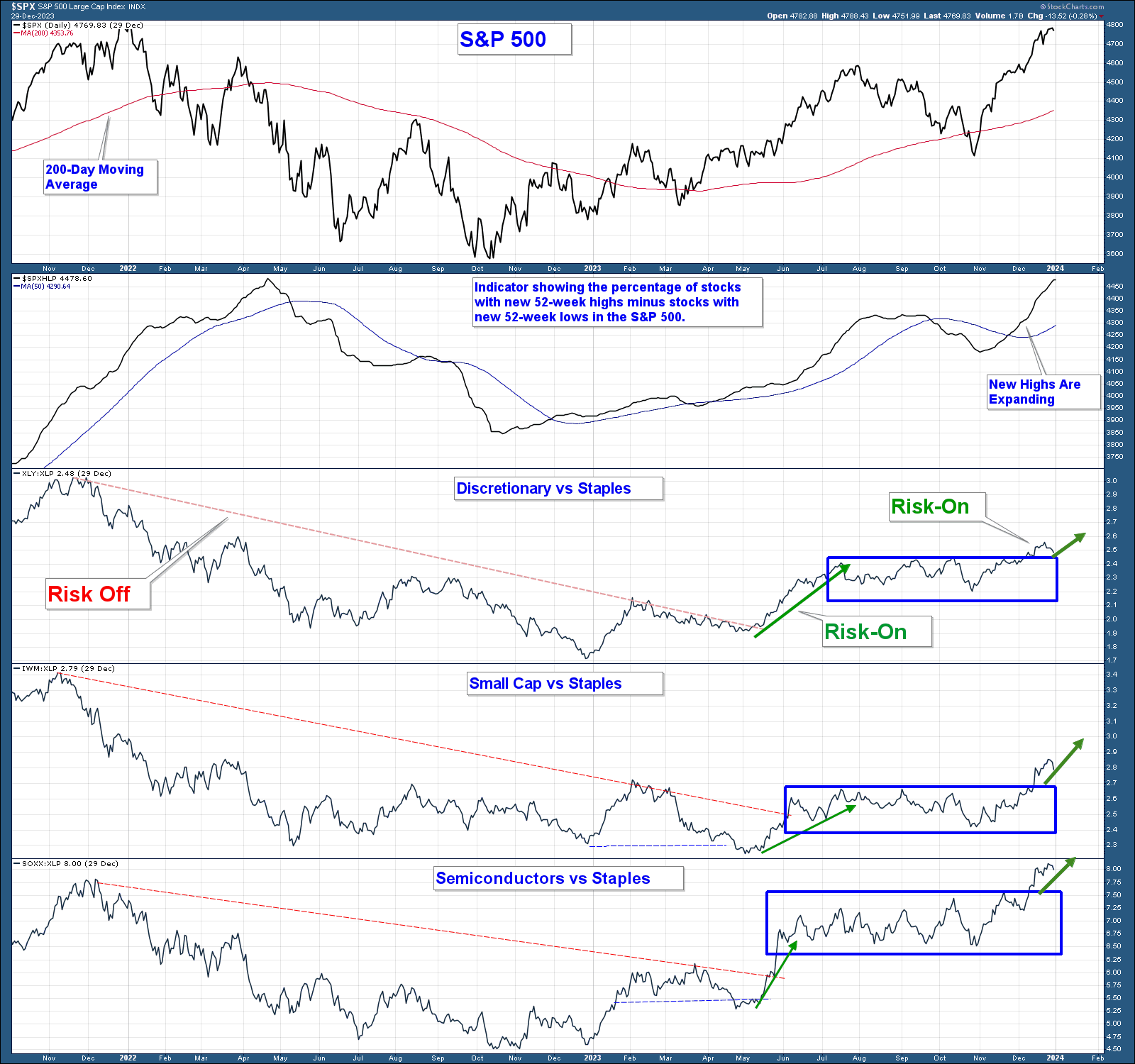

Risk-On/Off & Market Breadth

Below is the same chart that I showed in last month’s newsletter.

In the top panel is a chart of the S&P 500 Index. In the second panel is a market breadth indicator that measures the percentage of stocks hitting new 52-week highs minus those hitting 52-week lows. In the bottom three panels are relative strength charts that help us to determine if the market is in a bullish, risk-on market environment. Here are my takeaways from the chart.

- In the second panel (S&P 500 New Highs-New Lows Percent), when the line rises, the number of stocks hitting new highs is expanding and that is a bullish market breadth signal. When the line is above its moving average, as it is now, market breadth is positive.

- The three bottom charts are relative strength charts. These charts compare the performance of Consumer Discretionary, Small Cap, and Semiconductor stocks (risk-on indexes) to Consumer Staples a risk-off sector. When the line falls it indicates that the risk-on asset is underperforming and when it rises those risk-on indexes are outperforming. All three have risen above an area of consolidation suggesting a bullish, risk-on environment.

Conclusion: Stock market breadth is positive and risk-on securities are outperforming more conservative risk-off securities which is the result of investors’ willingness to take on risk. Market breadth and sentiment are bullish.

Conclusion

Longer-term market technicals are decidedly bullish. Market Breadth is positive, the market is in a risk-on environment, interest rates are declining, and the recession that most economists predicted for 2023 didn’t occur. At least, not yet.

Short-term the market is overbought and sitting at major resistance. The market is due for a breather which could result in market indexes pulling back or consolidating before making another push higher.

While the majority of the technical data is market-positive, if the economy slips into recession this year, stocks are going to fall hard.

Client Account Update

When the market advanced in November I increased our client equity allocation to take advantage of what I perceived to be a more bullish technical environment.

Most accounts were fully invested going into December. On December 20th I added a short position to account for potential short-term market weakness that could arise from the market being overbought and at major resistance. I will look to reduce/eliminate this hedge as the risk of short-term weakness subsides.

CAN WE HELP YOU?

HERE’S AN EASY WAY TO FIND OUT:

We want clients who are a good mutual fit. To find out, we offer a no-pressure complimentary consultation. If we can help you and you want to work with us, that’s great. But if you don’t, we will give you free asset allocation direction on your retirement accounts, at no charge and with no strings attached.

If you are interested, send us an email to set up your complimentary zoom meeting.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.