Easy money policies by the Fed and excessive fiscal spending have placed the economy and thus markets in a position of weakness. Inflation is raging and the Fed is trying to reign it in as the economy is showing signs of slowing. The net result is that markets are likely to be more volatile and the risk of prolonged market declines elevated. Passive investment strategies that worked well over the past bull market run are likely to underperform going forward.

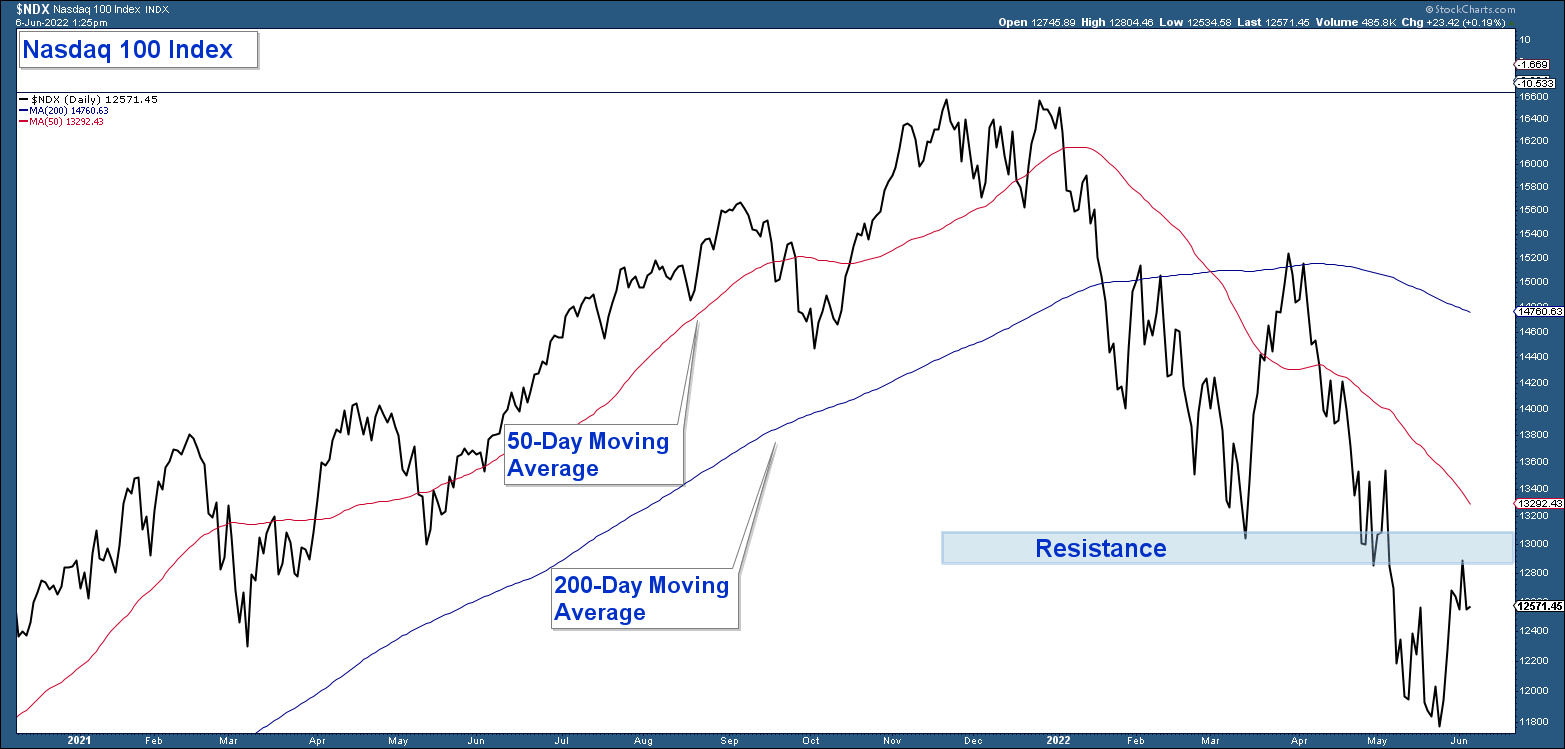

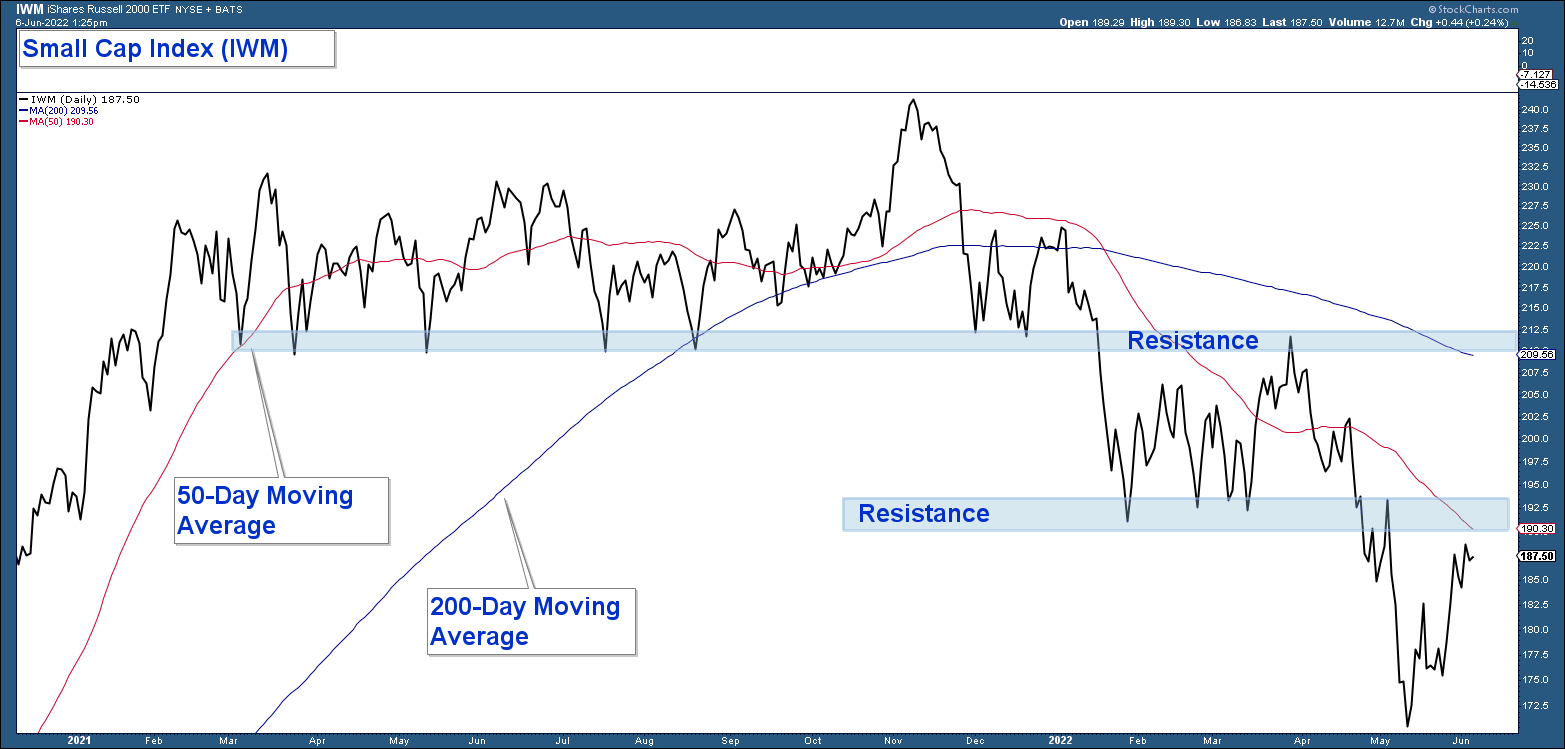

Below are daily charts for the S&P 500, Nasdaq 100, and Russell 2000 Small Cap Index. The pattern of all three are similar in that they are experiencing a short-term advance within a longer-term downtrend.

The question is, of course, does this bounce signal the end of the downtrend? For those investors hoping the market has bottomed because they are fearful of further losses. Don’t get your hopes up.

Here are my takeaways from the charts:

- All three are in downtrends, price is below both their 50 and 200-day moving averages, and those averages are trending down.

- The bounce that began last month has taken all three indexes right up to resistance.

At this point, I don’t see any technical data that suggests this advance is anything other than an oversold bounce. However, if those indexes can advance strongly above resistance and risk-on assets start to outperform, I would have to reevaluate that thesis.

In summary, the market still looks bearish.

Client Account Update

The stock portion of client portfolios is minimally invested in stronger market sectors and industry groups. These positions have been hedged with index short funds for most of this year. I have increased/decreased the degree to which we have shorted the market based on short-term market conditions.

The amount of risk we are taking in client accounts has been minimal all year given poor market technicals.

The further the market falls, the greater the future opportunity for those who can minimize losses during this bearish market environment.

As always, we monitor market conditions daily and look to protect our clients from losses during times of major stock and bond market stress.

If you have any questions, please feel free to send me an email.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.