Stock Market

Our newsletter typically goes out on the first Monday of the month, but I am sending this one out early because of recent market developments that I wanted to share.

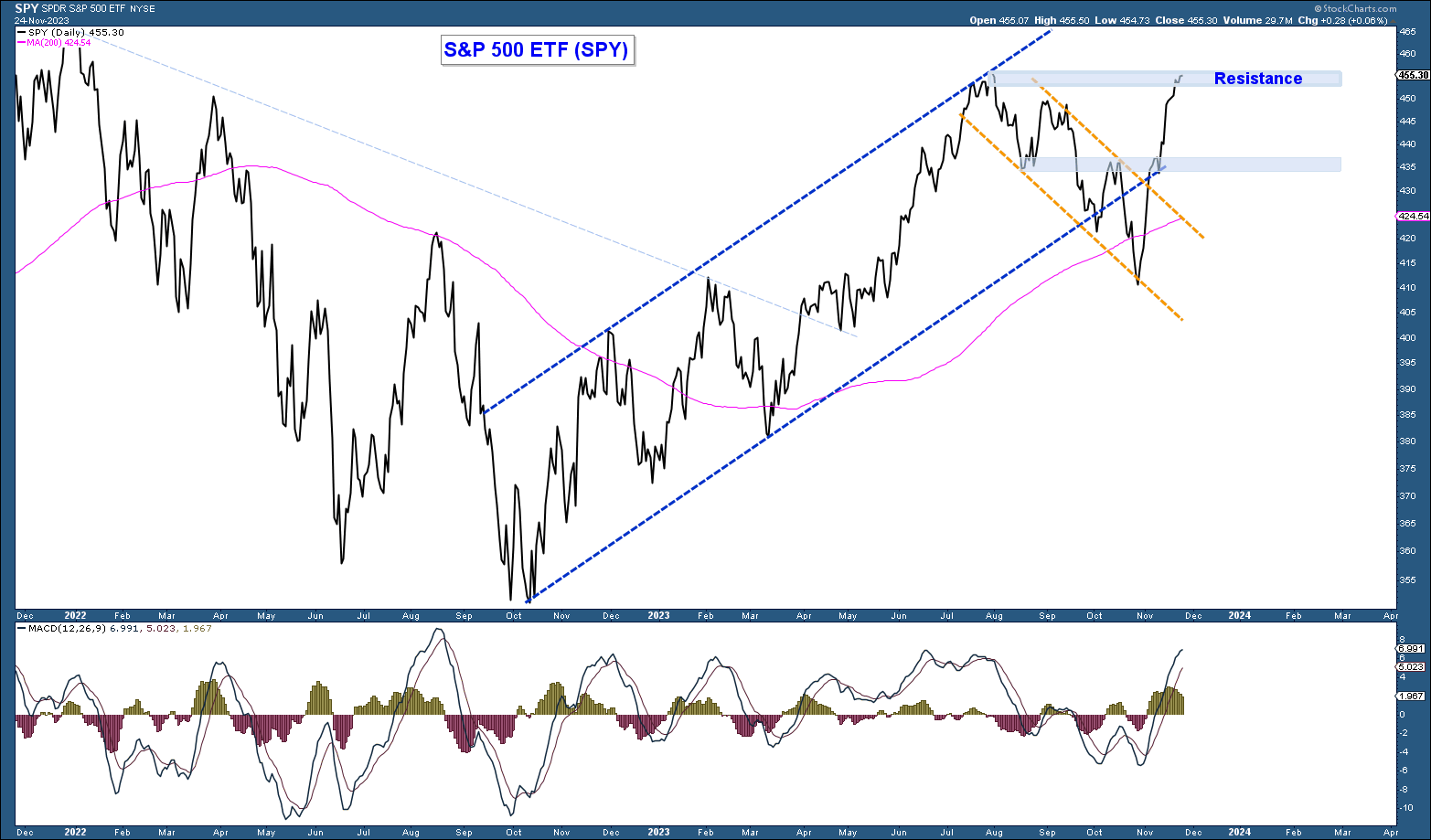

After reaching overbought levels and pulling back from August through October (declining orange channel in the chart below), the market has decisively broken out to the upside. The strength of the move suggests that the path of least resistance over the coming weeks and months is higher.

That being said, the market is short-term overbought, and the S&P 500 Index is sitting right at major resistance. Thus, the market may pull back/consolidate before making another run higher.

Any short-term market weakness should be viewed as a buying opportunity given longer-term market technicals have turned positive.

Market Breadth

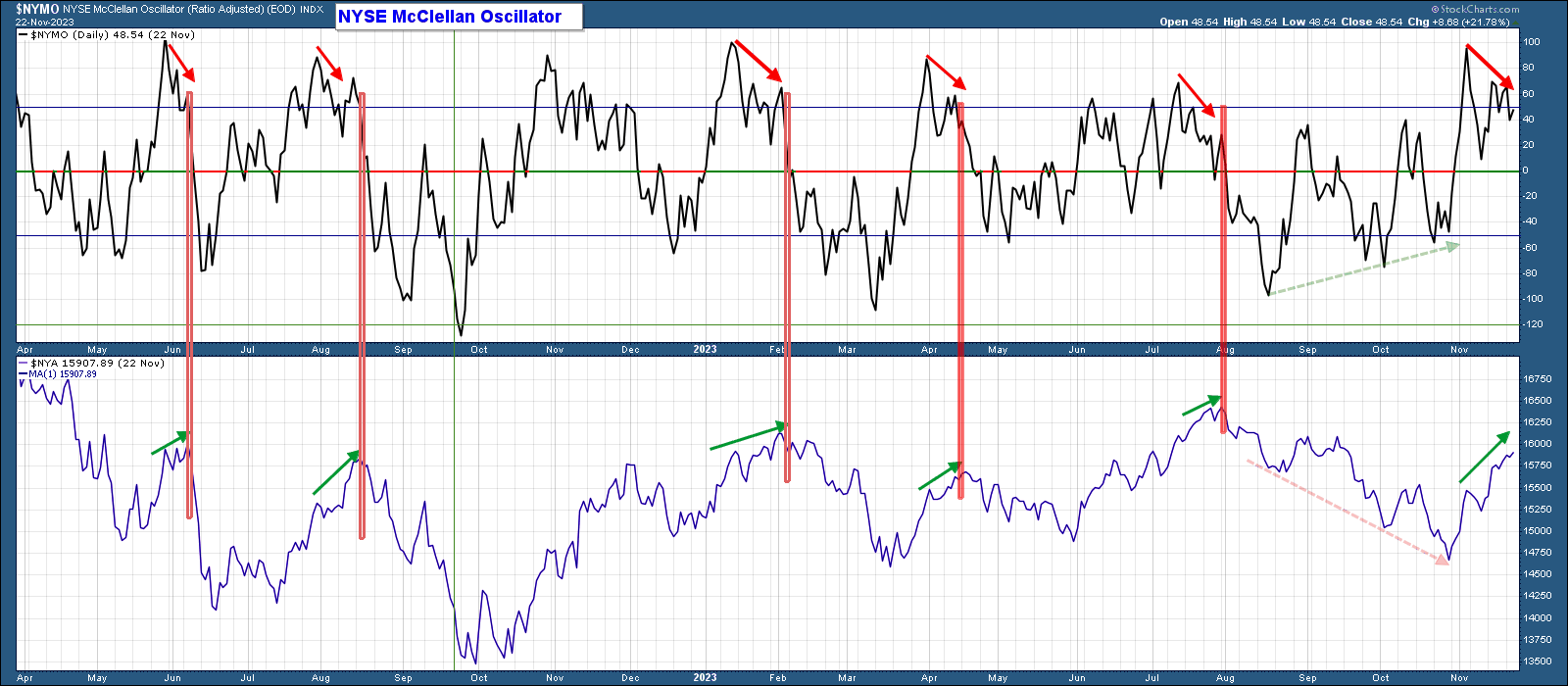

A chart that suggests we may see near-term market weakness before a run higher is the NYSE McClellan Oscillator (chart below). The McClellan Oscillator is a breadth indicator that has recently been helpful with forecasting short-term market moves.

Notice how it has been common for the oscillator to display a negative divergence at key short-term market tops. This divergence is notated in red and occurs when the Oscillator falls as the index (bottom panel) advances.

Bond Yields

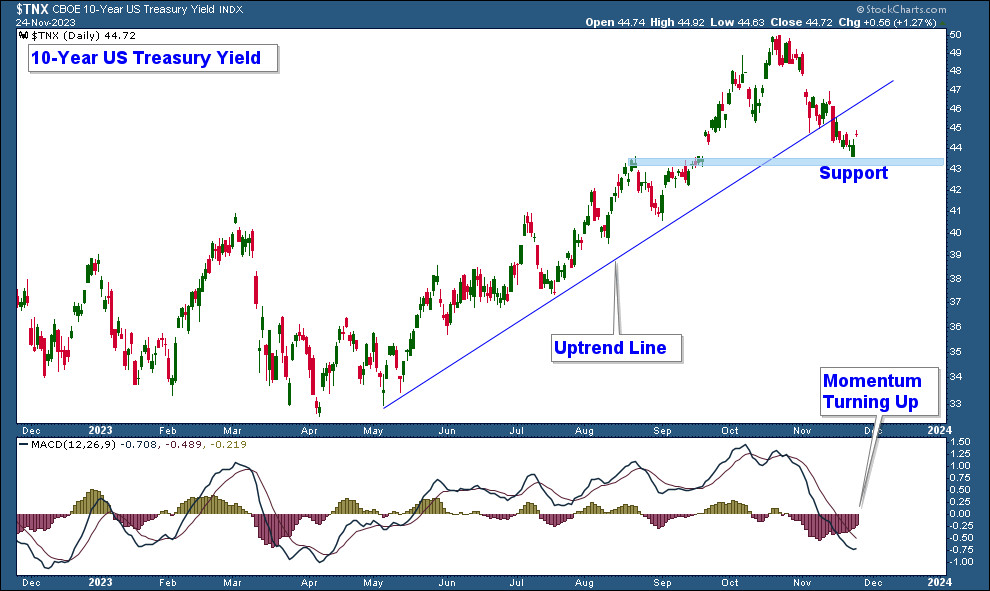

The drop in bond yields off their late October peak coincides with the advance in stock prices that occurred at the same time. Below is a chart of the 10-year US Treasury Yield in the top panel and the MACD (momentum indicator) in the lower panel.

Rising bond yields have been a headwind for stocks, and the recent decline is seen as a sign that inflationary forces may be abating. The yield on 10-year US Treasuries is sitting right on support after falling decisively below an uptrending trendline. This trendline break is bullish for the broader equity market and a move below support would be an additional bullish signal.

Client Account Update

As the market advanced over the past four weeks, I progressively increased our equity exposure after being allocated defensively during the prior three-month market correction.

Provided longer-term market technicals remain positive, I will continue to increase equity exposure to strategically get client accounts to a fully invested allocation.

CAN WE HELP YOU?

HERE’S AN EASY WAY TO FIND OUT:

We want clients who are a good mutual fit. To find out, we offer a no-pressure complimentary consultation. If we can help you and you want to work with us, that’s great. But if you don’t, we will give you free asset allocation direction on your retirement accounts, at no charge and with no strings attached.

If you are interested, send us an email to set up your complimentary zoom meeting.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.