The Economy

The Fed is raising rates in hopes of taming inflation by reducing demand. Every bear market advance this year is propelled by investors’ expectation that the Fed will pivot. And each advance gets squashed when the Fed reiterates its hawkish stance.

The Fed has now made it clear that there is no pivot until there are clear signs of lower or falling inflation data. They are raising rates aggressively and that will definitely lower demand which lowers economic growth and corporate earnings. But it takes time for that to occur based on the lag effect of those rate increases. My point here is that we are many months away from the Fed reversing course.

When the Fed does eventually start lowering rates, it will be accompanied by a very weak economy (sometimes a recession). And most importantly, I don’t see that pivot being a bullish event. Historically, the stock market doesn’t bottom until the Fed is near the end of its easing cycle and the recession is in its later innings. This all suggests that the ultimate bottom in the stock market is far away.

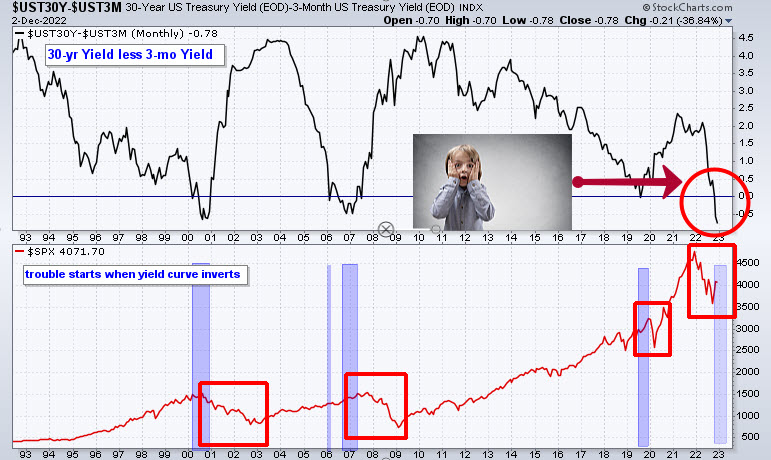

One historically accurate signal in predicting recessions is a yield curve inversion. An inversion means short-term rates are higher than longer-term rates. This does not happen often but when it does the odds of a recession are high.

Below is a chart of the difference between the 30-year yield less the 3-month yield in the top panel. When the line drops below zero (horizontal blue line) the yields are inverted. Look at the far right of the chart. The yield is substantially inverted (red circle).

In the lower panel is the S&P 500 and I have highlighted the last three major inversions. In each case, a recession has followed and the stock market has fallen between 33% – 55%.

Therefore, from an economic perspective, the economy is in the danger zone.

The odds of entering a recession next year are very high. Historically, the most significant drops in the stock market occur during economic recessions. For example, the 2000 and 2007 recessionary bear markets saw the S&P 500 fall 50% – 55%. The S&P 500 is down about 14% year-to-date thus there is a lot of downside risk from here.

One of my favorite Macroeconomic podcasts is Macro Voices. They regularly interview some of the most knowledgeable macro experts. If you are interested in getting a broad-based economic forecast that is insightful, listen to the episode featuring David Rosenberg in the link below.

Market Technicals

Below is a daily chart of the S&P 500 in the upper panel and the MACD (a momentum indicator) in the lower panel.

The 200-day moving average is a very important area of resistance during bear markets. Historically the index advances into this area only to reverse course. And that is exactly where the index sits as of Friday’s close.

Here is what I will be watching over the coming weeks.

- Can the index advance decisively above its 200-day moving average? If so, that would be short-term bullish.

- If the index falls below its uptrend line and its nearest area of support that would be definitively short-term bearish.

- If 2 occurs, it would probably be enough downside price action to cause the MACD to roll over which would be a sell signal for momentum traders. 2 and 3 would be a strong signal that the current rally is over and prices would likely fall in the near-term.

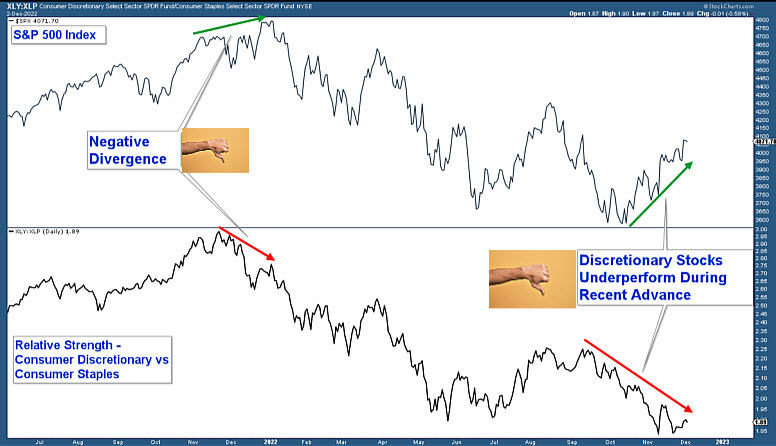

Risk-On or Risk-Off

One characteristic of a weak market is a risk-off environment. During bullish markets, investors typically buy stocks in sectors like consumer discretionary, technology, and communications. And during bearish markets, they prefer the safety of consumer staples, utilities, and healthcare.

Below is the classic relative strength chart for determining which environment we are in. In the lower panel is the relative strength line for consumer staples versus consumer discretionary.

When the line rises it indicates that discretionary stocks are outperforming staples which is a risk-on signal. That is what you want to see if you are long the market.

Look at the recent advance. The index has risen but consumer staples are strongly outperforming consumer discretionary stocks. This indicates a risk-off environment which is a warning that the advance is susceptible to a sell-off.

Client Account Update

One of our firm’s primary goals is to preserve client account capital during bear markets (major stock market corrections). Making money in the market during these times is extraordinarily difficult because most stocks are falling. This year is historically more challenging given bond prices are falling with stocks.

Our strategy centers around adjusting the risk in client accounts based on the risk in the market. The risk this year has been high and thus we have been invested very conservatively all year.

Our returns have oscillated between being slightly up to slightly down this year. Again, this is in line with what we strive to achieve in this type of market. The opportunity lies in having our capital intact when the market finally bottoms. That is when risk in the markets is low and returns are high.

Most investors use a passive strategy that has them fully invested during all market environments. They end up losing substantial portions of their savings during these types of markets. This can have life-altering consequences if you are nearing or in retirement.

Our equity exposure this year has been low and those holdings have been hedged with index short positions. Day-to-day volatility is minor. The strategies that we use in this type of market are different from the strategies we use in bullish environments.

For example, I am frequently altering the amount of total short positions we hold based on our analysis of shorter-term market risk. This can create more total trades than what is typical for our client accounts. And those trades are usually shorter-term trades.

During more favorable market environments we are looking to enter position trades that are longer-term in nature. We will eventually enter this type of market but we are probably months away from that point.

Again, our opportunity lies in taking advantage of the next bull market with our capital intact. Most passive investors are going to get crushed if we enter a recessionary bear market. During bear markets, you win by not losing.

CAN WE HELP YOU?

HERE’S AN EASY WAY TO FIND OUT:

We want clients who are a good mutual fit. To find out, we offer a no-pressure complimentary consultation. If we can help you and you want to work with us, that’s great. But if you don’t, we will give you free asset allocation direction on your retirement accounts, at no charge and with no strings attached.

If you are interested, send us an email to set up your complimentary zoom meeting.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.