While we are likely at the beginning of a long-term (Secular) period of inflation, in the near term we seem to be experiencing deflation as seen in financial markets. I know that this may come as a surprise given that the price of consumer goods is rising and all the media content seems to be highlighting an environment of run-away inflation.

Maybe the inflation trade just got overextended and this is a healthy pullback before we get another strong advance. Only time will tell, but the charts are suggesting deflation right now – not inflation.

During deflationary environments, investors should focus on capital preservation. The best asset class in this environment is typically bonds. On the equity side, risk-off sectors such as utilities, healthcare, and consumer staples tend to outperform.

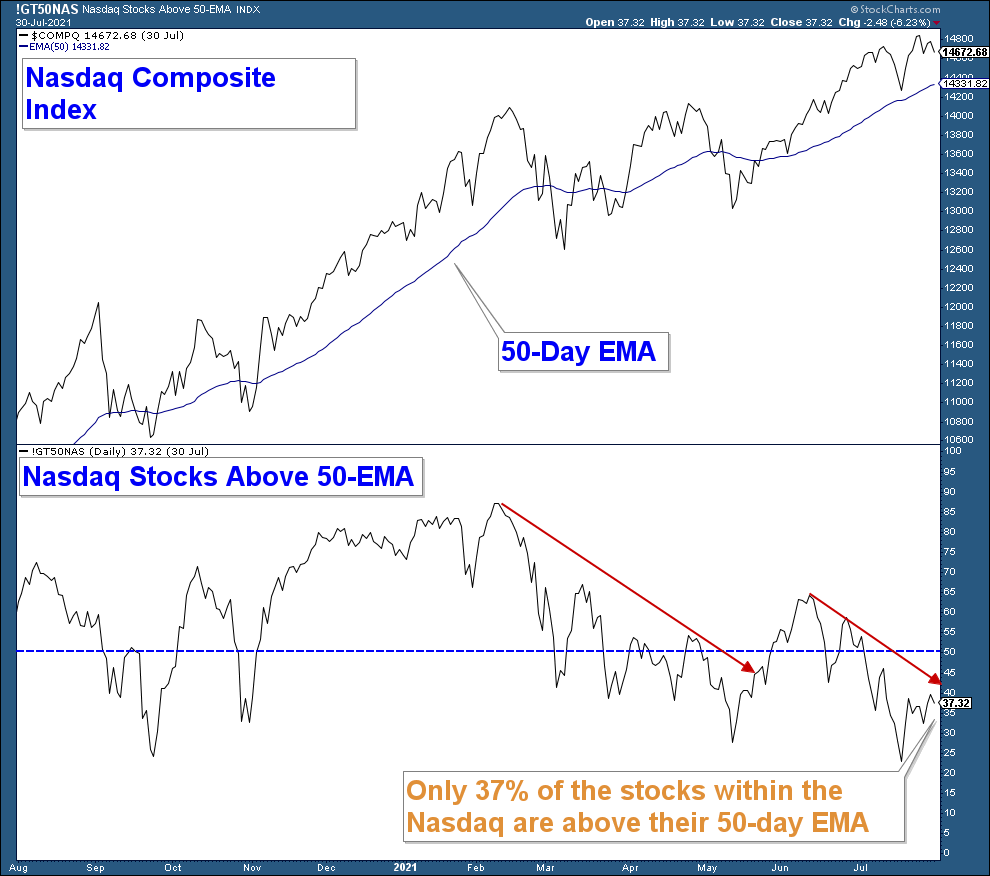

Market Breadth Continues to Deteriorate

As I mentioned in last month’s newsletter, market breadth is poor. While the S&P 500 grinds to marginal new highs, it is on the back of a handful of large-cap stocks that account for an outsized portion of the index’s return.

There are numerous charts that I could show that illustrate the market’s deteriorating breadth. Here is one that drives the point home.

Below is a chart of the Nasdaq Composite Index in the top panel and the number of stocks within that index that are above their respective 50-day exponential moving averages in the lower panel.

Notice how the index is well above its moving average yet there is only 37% of the stocks within that index above their moving averages.

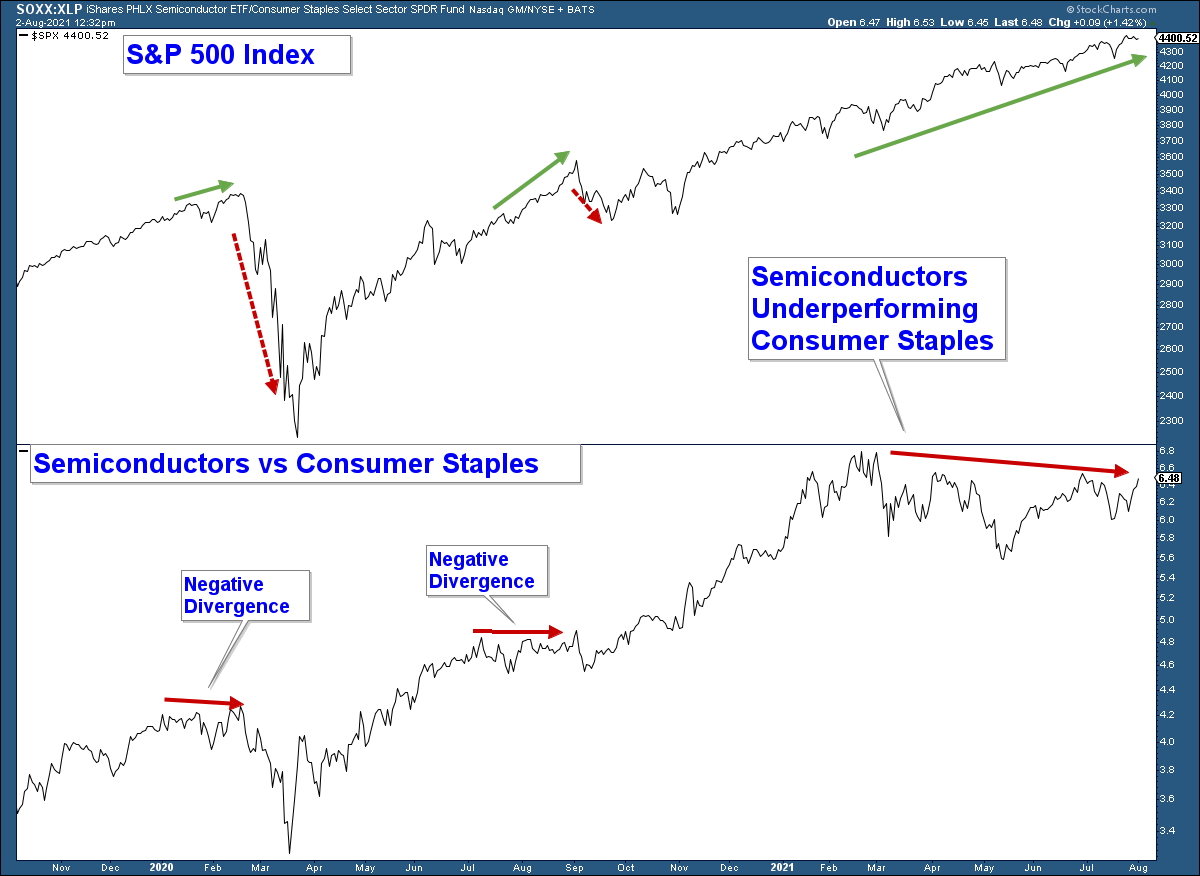

Risk-Off Environment

If we were in a high growth, inflationary environment you would expect to see risk-on assets like Semiconductors, Transportation, and Small-Caps outperforming. But that is not what we have been seeing over the past few months.

Below is a relative strength chart that illustrates the performance of Semiconductor stocks relative to Consumer Staples stocks. When the line is rising Semiconductor stocks are outperforming Consumer Staples.

Consumer Staples have been outperforming Semiconductor Stocks since the beginning of March. For the sake of brevity, I won’t show similar charts of Small Caps and Transportation stocks; but they are underperforming as well.

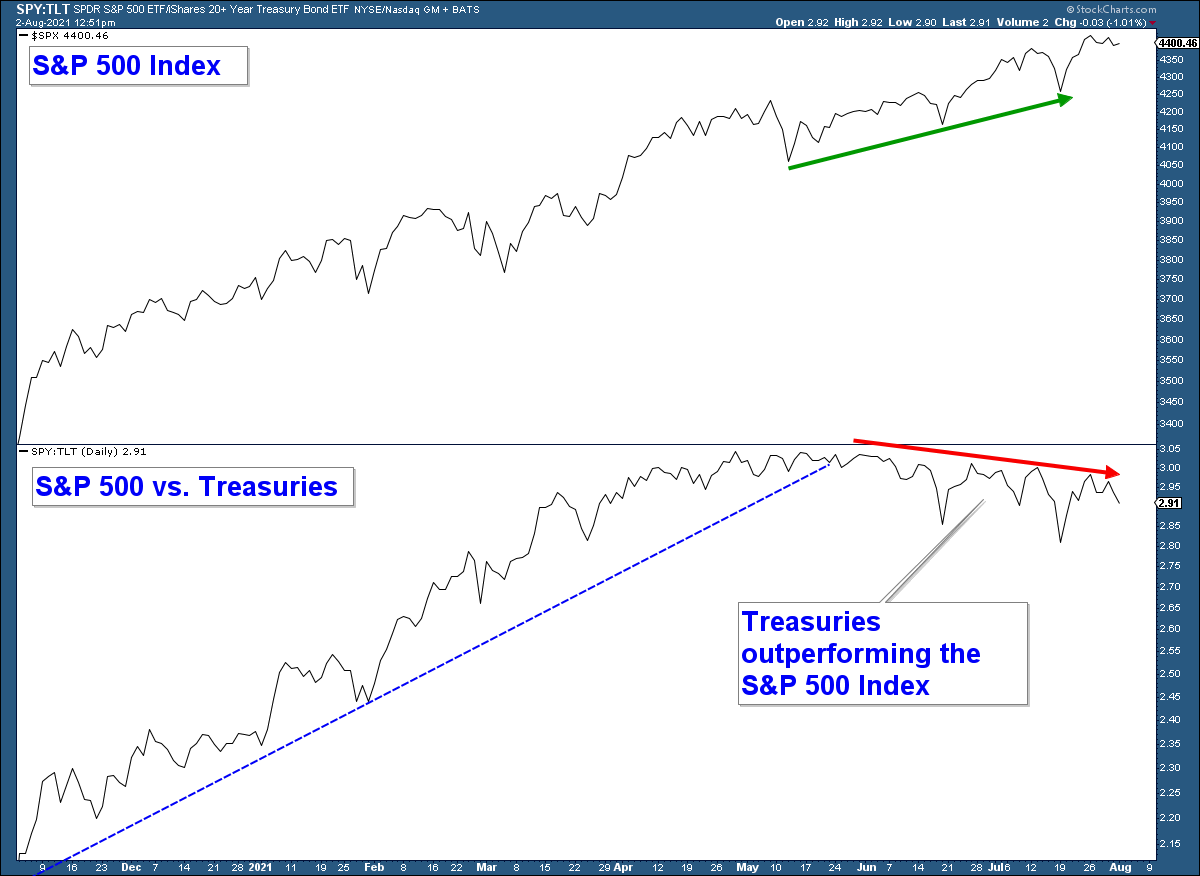

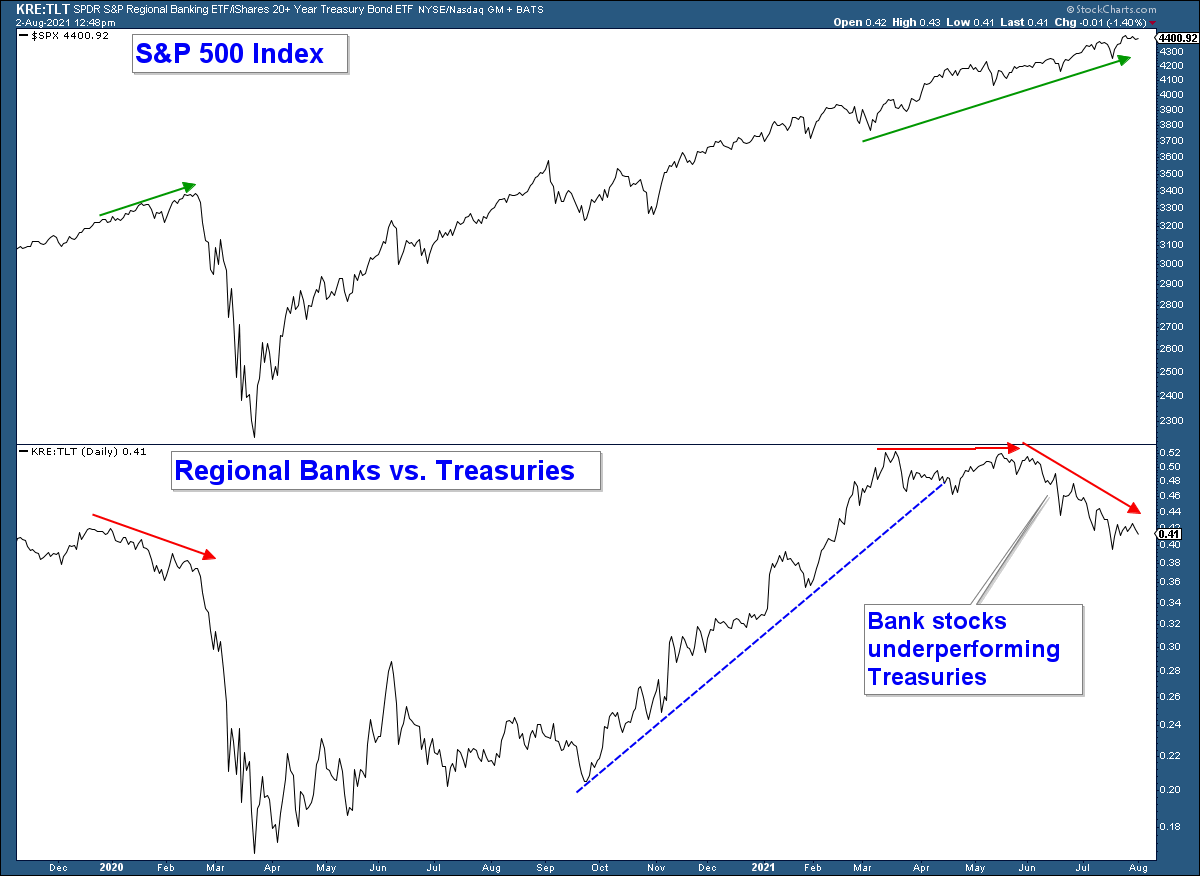

How is the S&P 500 Index performing relative to Treasuries? Not good. For the past three months, Treasury Bonds have been outperforming the S&P 500.

Treasury Bonds are outperforming stocks. Investors are not being rewarded for taking risk.

Deflation Not Inflation

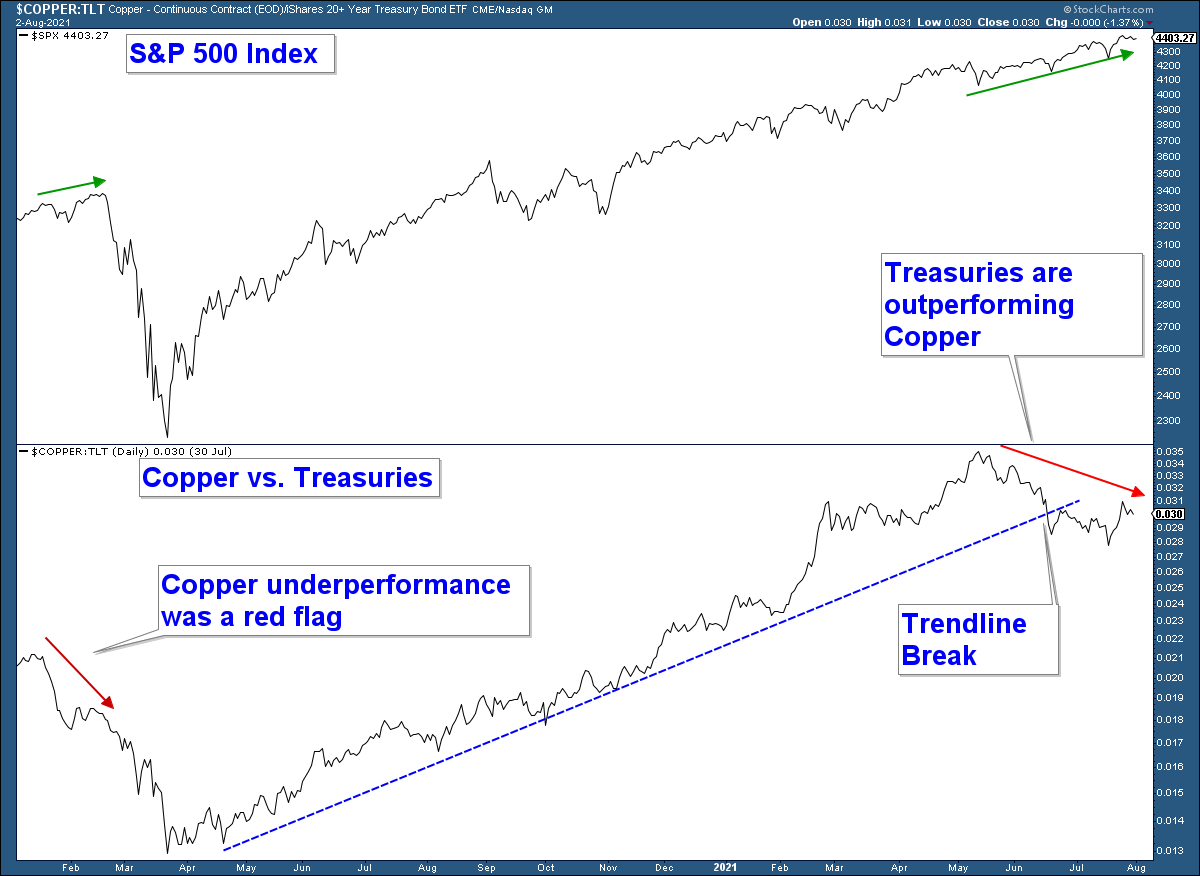

During periods of economic expansion, which is the engine that drives inflation, you usually see yields rise and commodities like Copper rise.

The price of Copper is mainly influenced by the health of the global economy. This is because of the widespread applications of this commodity in the economy. A rising Copper market suggests strong economic health, while a decline suggests the opposite.

Copper had a strong advance that began at last year’s stock market bottom. That strong performance has petered out and Copper has been underperforming Treasuries for the past three months.

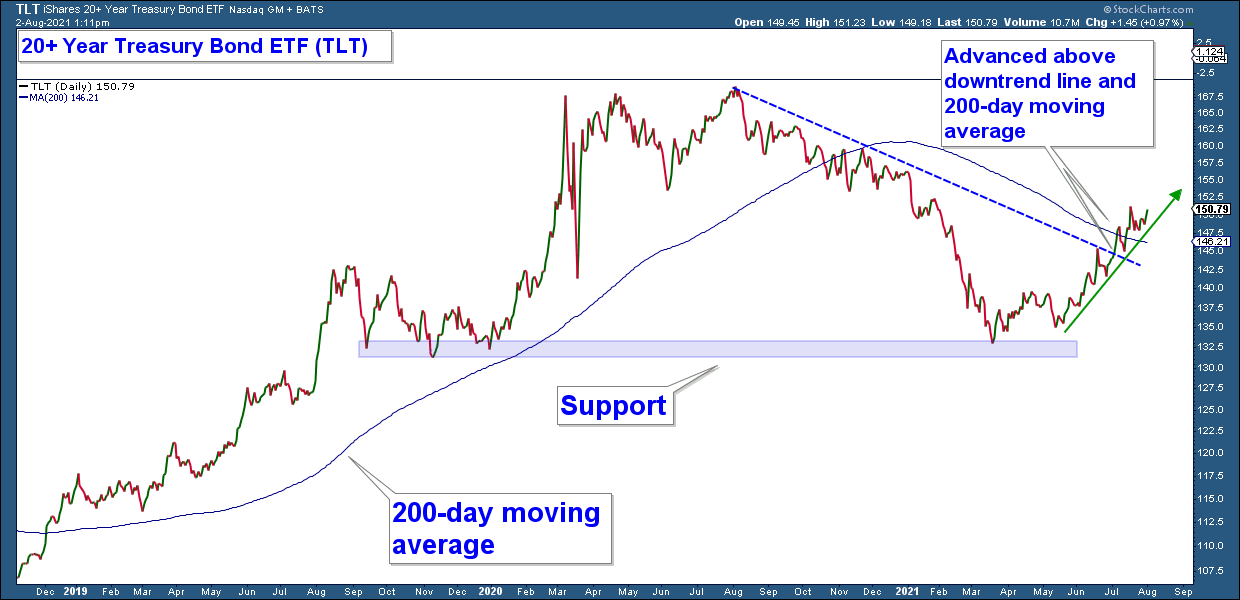

Bank stocks do well in a rising yield environment and Treasury prices perform well in a falling yield environment. Treasuries have been outperforming Bank stocks recently. This is because of falling bond yields.

If we were in an inflationary environment, treasury yields would be rising and treasury prices would be falling. That is not what we are now seeing.

Treasury prices bounced at support in March, advance above a downtrend line, and its 200-day moving average.

Client Account Update

It is important to calibrate the risk you take in your investment accounts based on the underlying risk in the market. We are currently in a deflationary market environment and our client accounts are allocated with this in mind.

Client accounts are nearly fully allocated with an over-allocation to bonds and an under-allocation to equities. Bonds are enjoying the tailwind of near-term falling yields and they sometimes provide a good hedge against falling stock prices. If market internals improve, I will look to increase equity exposure.

If you have any questions, please feel free to send me an email.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

All charts provided by: StockCharts.com