2022 is a wrap. Below are the returns for the calendar year.

2022 Major Equity Index Returns:

Dow Jones Industrials Index -8%

S&P 500 Index -19%

Nasdaq 100 Index -32%

2022 Bond ETF Returns:

iShares 20+ Year Treasury Bond ETF (TLT) -31%

iShares Core U.S. Aggregate Bond EFT(AGG) -13%

iShares High Yield Corp. Bond ETF (HYG) -11%

2022 was a classic grinding bear market. What made it unique is that bonds, which typically perform well in this environment, performed poorly. So, using bonds as a hedge against stock market losses isn’t working.

Market technicals continue to suggest further market losses going into next year. There are signals that are characteristic of a bear market bottom and ensuing market advance (bull market), and we have not seen any of them yet.

Risk-On or Risk-Off

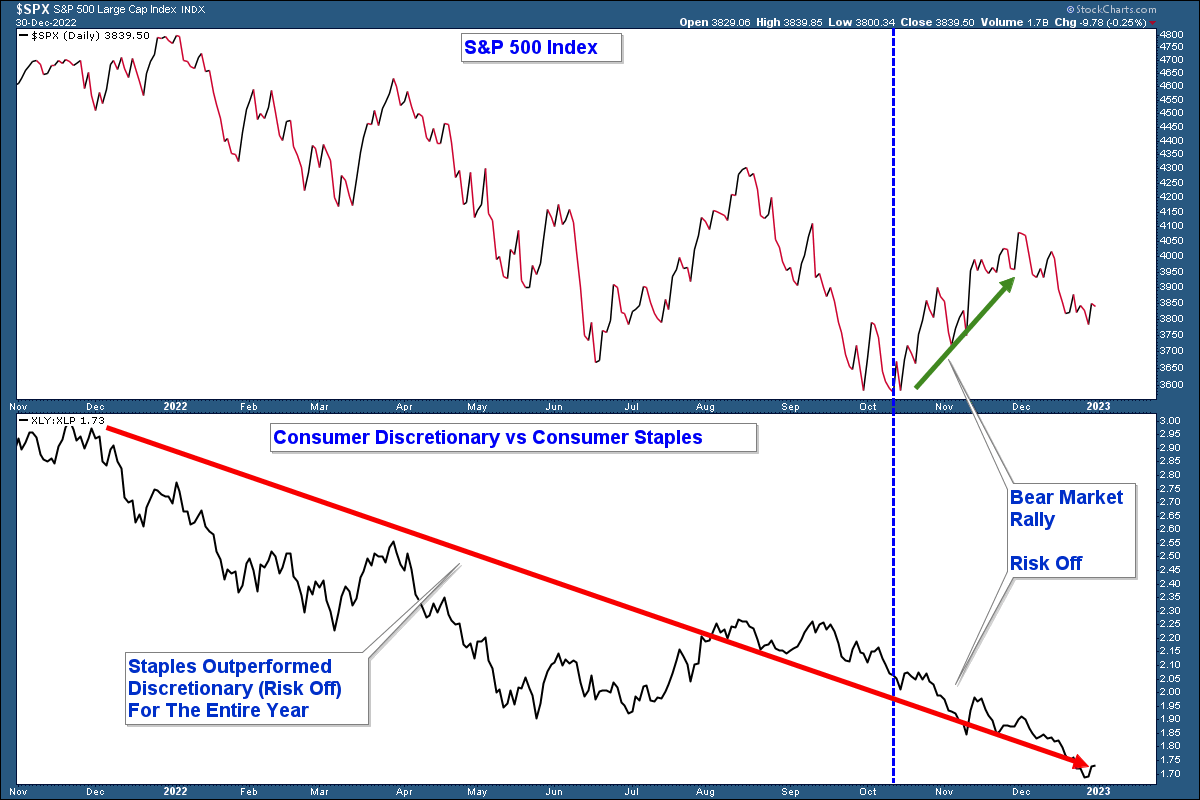

One sign of a bullish market is a risk-on environment. In the chart below is the S&P 500 Index in the top panel and a relative strength chart of Consumer Discretionary (risk-on) verse Consumer Staples (risk-off) in the lower panel.

When the relative strength line is rising it indicates that Consumer Discretionary is outperforming which would signal a risk-on environment and would be a bullish factor for the market.

The line has fallen all year. That weakness has continued through the recent advance off the October lows (blue horizontal line) which suggests that the advance is likely to fail.

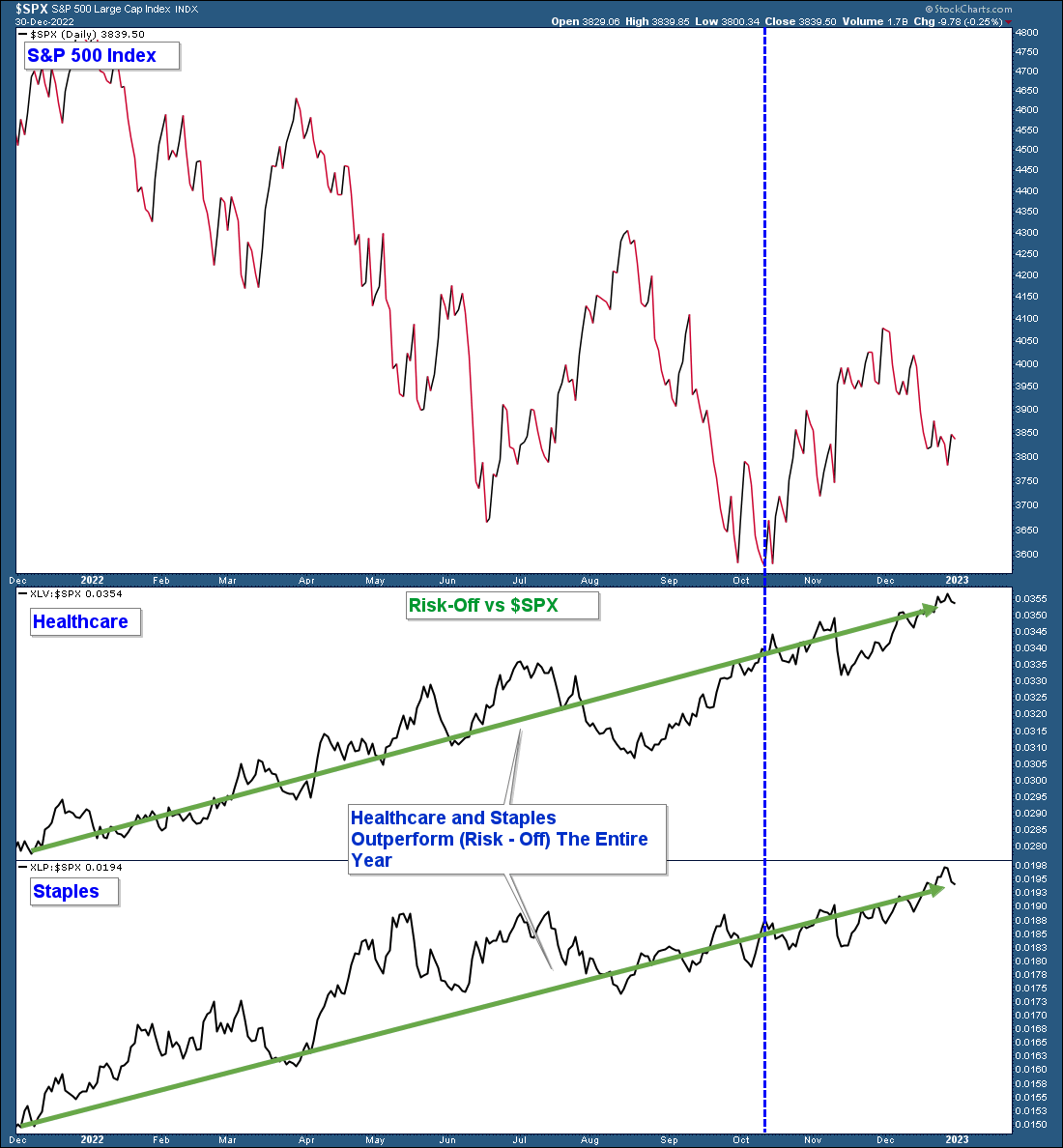

What is performing well relative to the S&P 500 Index? Healthcare and Staples, which are both risk-off sectors. This is further confirmation of a weak market environment.

Capitulation Common at Bear Market Bottoms

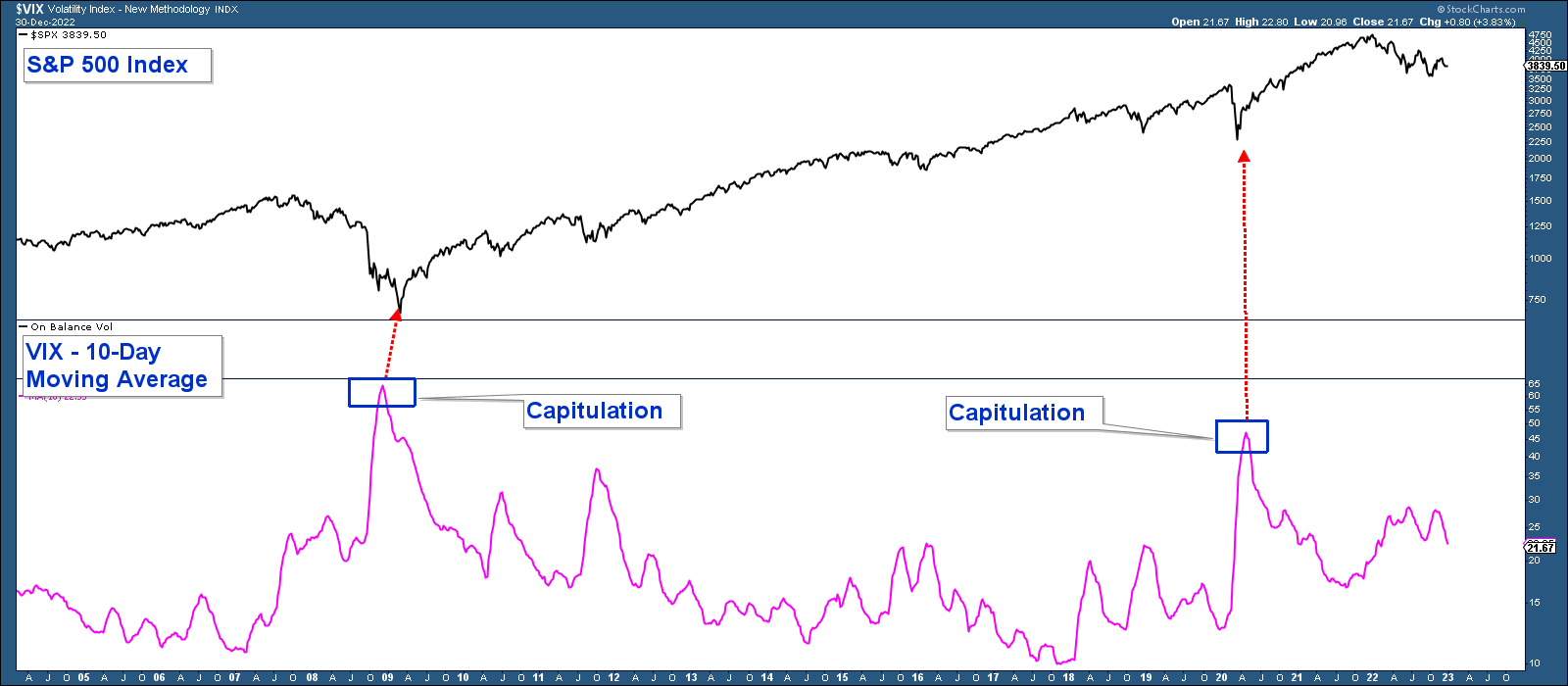

In our July 2022 Market Update, I wrote about how bear markets typically end when investors capitulate which is most commonly gauged using the VIX.

Typically, the VIX will rise to elevated levels at market bottoms which is a reflection of investors rushing to sell in mass. This is referred to as capitulation, and we are not there yet.

Below is a chart of the S&P 500 in the upper panel and the 10-day moving average of the VIX in the lower panel. Notice how the VIX topped out this year at about 28 which is nowhere close to the elevated levels seen at the last two bear market bottoms (47 in 2020 and 64 in 2009).

Economic Conditions Projected to Deteriorate In 2023

In our December 2022 Update, I wrote about how economic conditions were going to worsen next year (recession likely) and how that would negatively impact the stock market. Here is an expert from that update but with this year’s S&P 500 return updated.

“The odds of entering a recession next year are very high. Historically, the most significant drops in the stock market occur during economic recessions. For example, the 2000 and 2007 recessionary bear markets saw the S&P 500 fall 50% – 55%. The S&P 500 is down about 19% year-to-date thus there is a lot of downside risk from here.”

Client Account Update

Our client accounts ended 2022 approximately flat for the year. I feel like we did a good job of analyzing market conditions and determining market turning points. But, making money without taking a lot of risk in a bear market is challenging. The name of the game in a bear market is protecting your capital so you can take advantage of lower prices whenever the market bottoms.

We continue to use a long/short strategy to attempt to capture gains but without taking much risk. Currently, we are invested as follows:

- Long a select group of individual stocks that are in outperforming sectors and performing well.

- Long Gold and Silver.

- Short Treasury Bonds

- Short Major Equity Market Indexes.

CAN WE HELP YOU?

HERE’S AN EASY WAY TO FIND OUT:

We want clients who are a good mutual fit. To find out, we offer a no-pressure complimentary consultation. If we can help you and you want to work with us, that’s great. But if you don’t, we will give you free asset allocation direction on your retirement accounts, at no charge and with no strings attached.

If you are interested, send us an email to set up your complimentary zoom meeting.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.