The Bottom Line

Bias:

Long-Term Positive and Short-term Positive for Stocks.

-

Long-term, the stock market is in an uptrend.

-

Short-term, the market has posted a higher-low and made an all-time high last week. Stock market price action is Bullish.

-

While the summer months are typically bad for stocks and sentiment is currently negative, the weight of the evidence is Bullish for the stock market.

Client Update

Client accounts are fully invested and mainly allocated in Preferred Income Funds and Equities.

Market Technicals

Positive Long-Term

Positive Short-Term

Long-Term Price Action – Positive

The stock market is above both it’s 50 and 200-Day Moving Average (see chart below). This is indicative of a long-term uptrend.

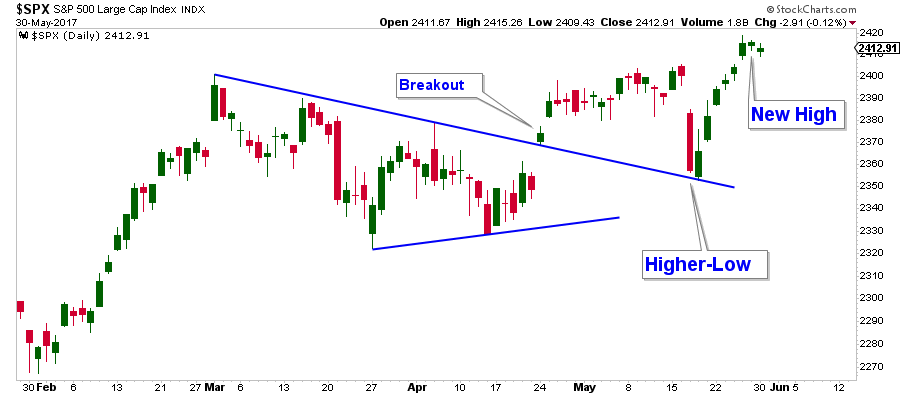

Short-Term Price Action – Positive

The stock market began a period of consolidation that started March 1, 2017. This consolidation formed a wedge pattern that was resolved to the upside, which is Bullish.

Two weeks ago, the market fell strongly; however, did not fall below the previous lows set back in February. This one-day drop was followed by an advance that formed a higher-low, and last week stocks hit a new all-time high. This is Bullish!

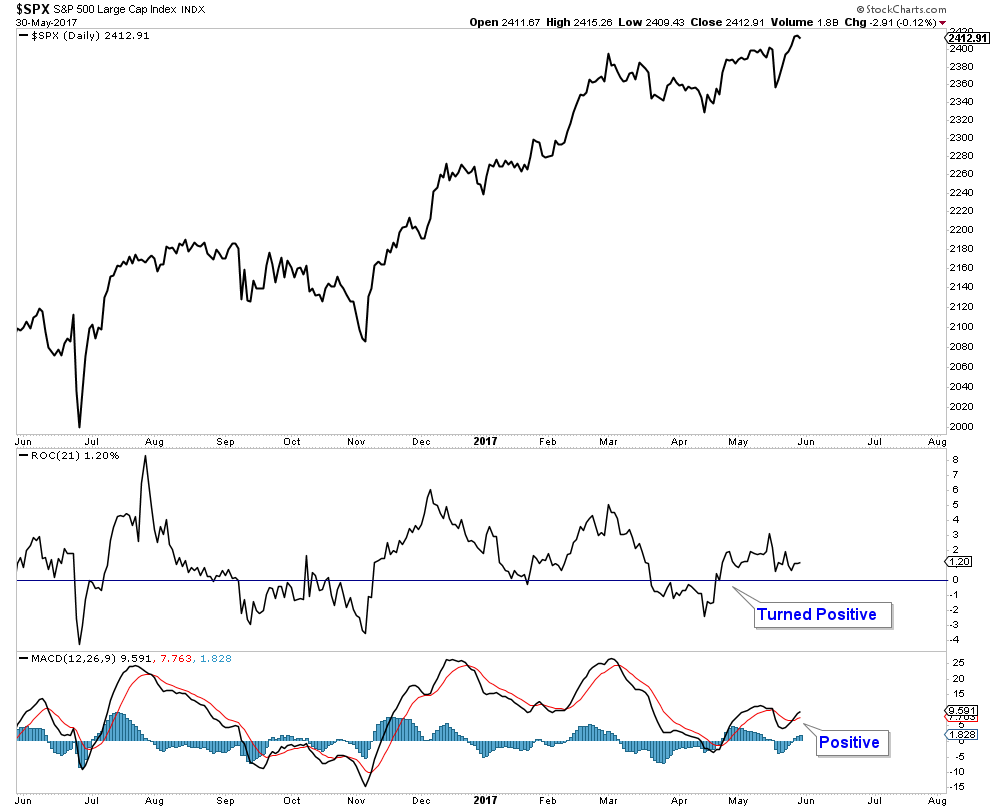

Stock Market Momentum – Positive

Most momentum indicators are positive. Below is a chart of the S&P 500 in the upper panel and two momentum indicators in the lower panels.

When the Rate-of-Change Indicator (second panel) drops below zero it is a signal that short-term momentum has turned negative. Conversely, when it crosses up above zero, it is suggesting that short-term momentum has turned positive. It is above 50 which signals positive momentum.

The Moving Average Convergence Divergence – MACD (lower panel) has crossed up above its signal line suggesting positive stock market momentum.

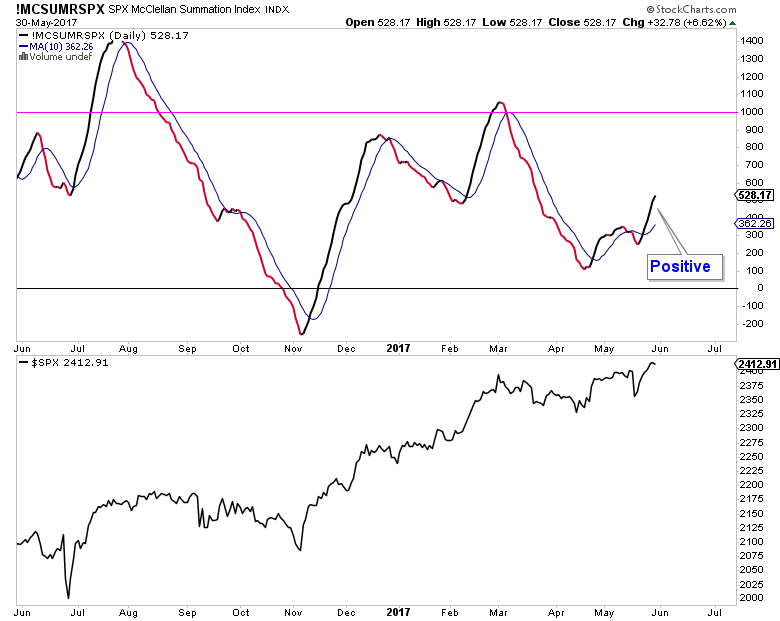

Stock Market Breadth – Positive

Below is a chart of the S&P 500 Summation Index along with the S&P 500 in the panel below it. The Summation Index is above its 10-day moving average and trending higher.

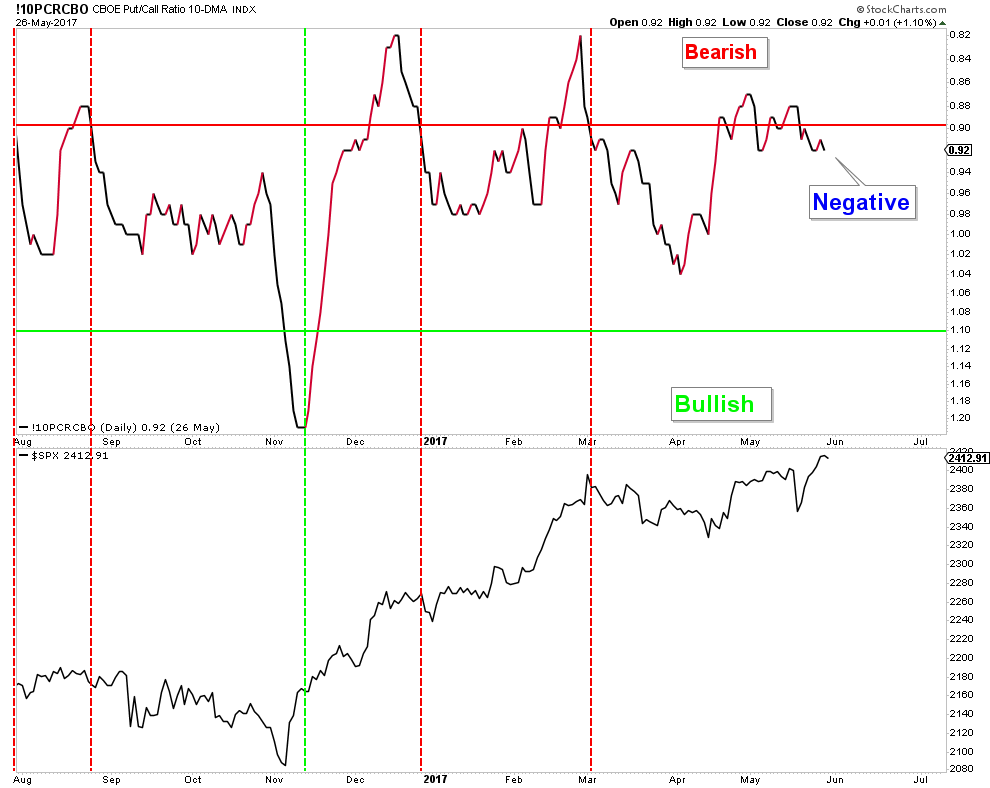

Market Sentiment – Negative

Below is a chart of the 10-Day Moving Average Put/Call Ratio. I have inverted it so that the peaks and valleys match up with the S&P 500 in the lower panel.

This ratio is an indicator that shows put volume relative to call volume. Put options are used to hedge against market weakness or bet on a decline. Call options are used to hedge against market strength or bet on a market advance. Sentiment is deemed excessively bearish when the Put/Call Ratio is trading at relatively high levels, and excessively bullish when at relatively low levels.

Currently, there are a lot more Call options being bought which is Bearish from a sentiment perspective.

10 Things You’ll Love About Retirement

If you have any questions, please feel free to contact me.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.