August 23, 2015 Weekly Wrap

Market Update

The S&P 500 fell 5.77% last week and is down 4.27% year-to-date. The market is finally coming to terms with the fact that global growth is contracting and that this will adversely affect our already weak economy. Copper is a commodity that is looked to as a barometer of economic activity. This stems from the metal’s wide applications in most sectors of the economy from homes and factories, to electronics and power generation and transmission. Demand for copper is often a reliable leading indicator of economic health. Rising prices for the metal suggest growth, while falling prices may indicate an imminent economic slowdown.

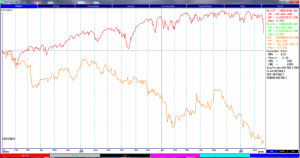

Below is a chart of the Copper Exchange Traded Fund (JJC in orange) and the S&P 500 (red). Like so many other commodities it has fallen dramatically and is down over 35% since December 31, 2013.

I mentioned in last week’s update that I would be watching the handful of stock market leaders that have been propping up this weak market. This past week those leaders fell and, in some cases, violated some important trend lines. This does not bode well for the market going forward.

I mentioned buying a dip for a reversion to the mean swing trade. The volatility indicators that I use for this type of trade are flashing signals that the market is overextended and due for some type of advance; however, these signals historically have not been as reliable during bear markets. I am not saying that we are entering a bear market but the odds that the market is not done falling are high. Any market strength is likely to be met with selling.

Client Update

Currently, we have most client accounts invested primarily in money market funds. Money market funds are safe investments that do not fluctuate in price and are a good place to park our money while we wait for stock and bond market conditions to improve.