The stock market is at a short-term inflection point. The advance off the October lows has been indecisive and has lost momentum right under resistance (200-day moving average). This would be a logical area for the market to reverse course and head lower.

On the other hand, a weekly close above the 200-day moving average and last week’s high would be bullish. The next two weeks’ market action will be telling.

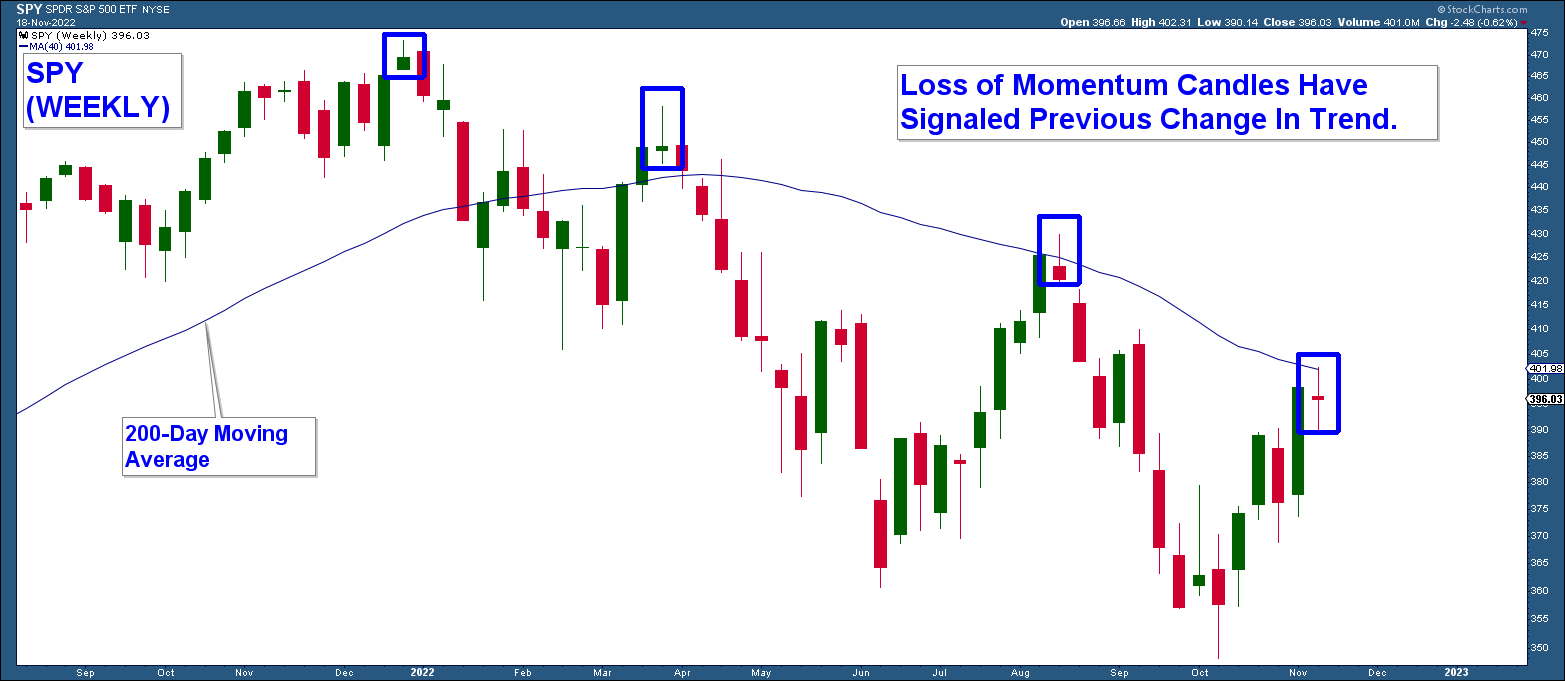

Below is a weekly chart of SPY (S&P 500 ETF). Here are my takeaways:

- The index closed right under its 200-day moving average which is resistance.

- The past week ended with a Doji candle. This candle suggests a loss of momentum when occurring after a move higher.

- The last three advances ended with the same type of candle.

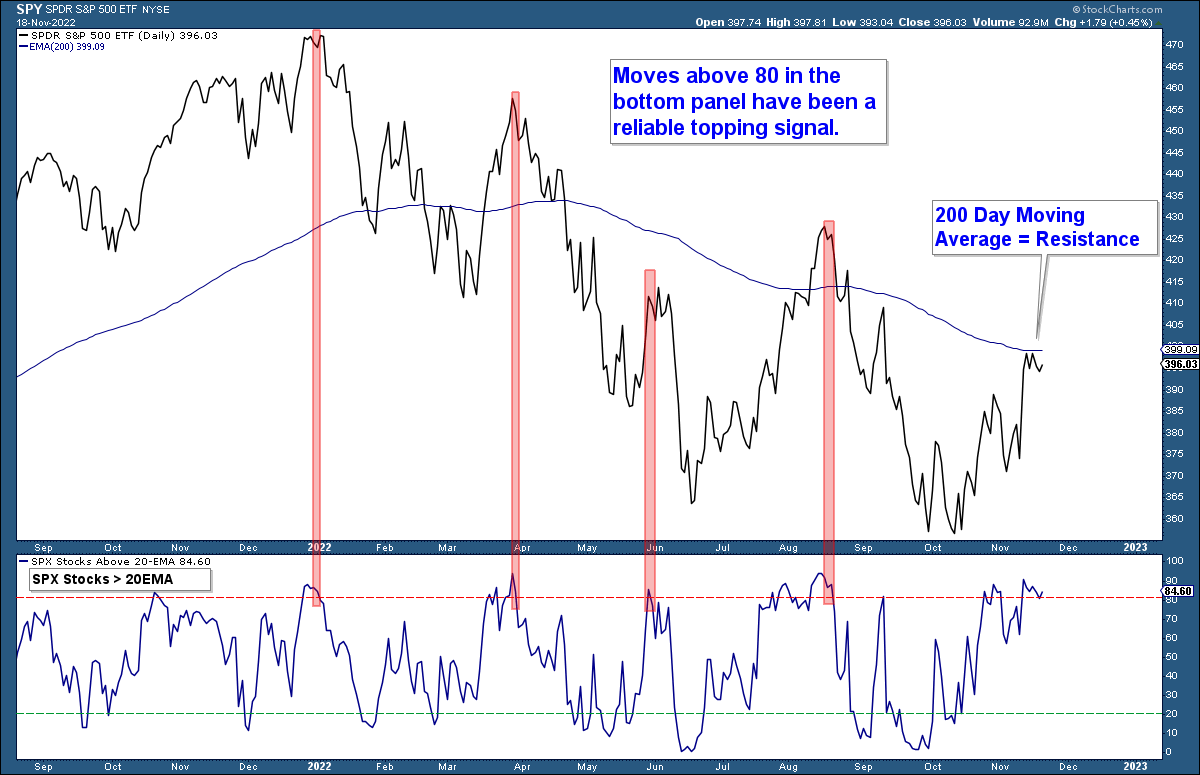

Below is a daily chart of SPY in the upper panel and in the lower panel I chart the percent of stocks within that index that are above their respective 20-day moving averages.

Notice how each time the percent of stocks above this moving average exceeds 80 it has been a reliable indicator of a change in trend. The index is currently above 80.

I view these two charts as early warning signs. They are useful in that they keep me focused on looking for corroborating technical evidence of a change in short-term trend.

If we see a strong move down this week, that weakness could trigger other signals such as momentum indicators rolling over, the VIX rising, etc. Weakness would beget more weakness.

CAN WE HELP YOU?

HERE’S AN EASY WAY TO FIND OUT:

We want clients who are a good mutual fit. To find out, we offer a no-pressure complimentary consultation. If we can help you and you want to work with us, that’s great. But if you don’t, we will give you free asset allocation direction on your retirement accounts, at no charge and with no strings attached.

If you are interested, send us an email to set up your complimentary zoom meeting.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.