The Pendulum Has Shifted

Market Update

For the past month I have been stating that market internals were negative and prices have drifted lower, up until last week. Last week’s strong advance has shifted most stock market technical indicators back to the bullish (favoring stock market strength) camp. Market Breadth, Momentum, Money Flow, and Volatility (VIX) are now all positive.

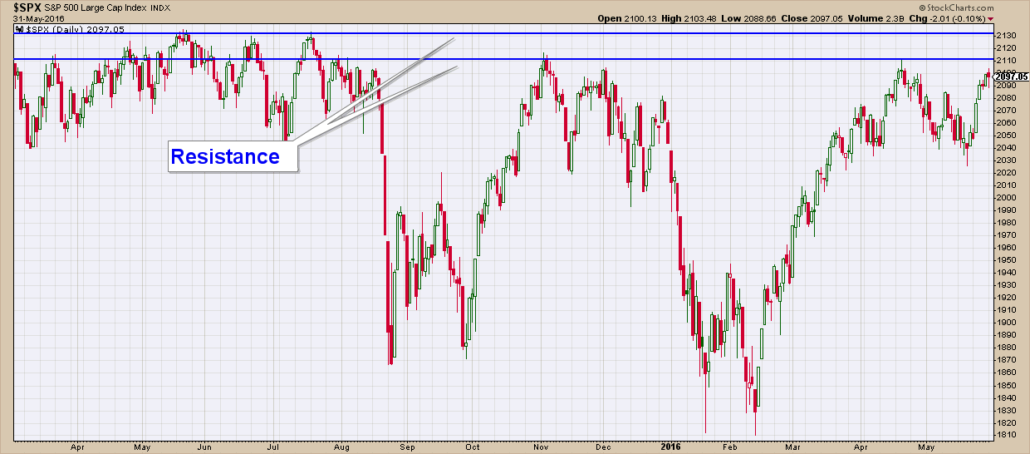

While market internals are positive, most major stock market indexes are under substantial resistance (see S&P 500 chart below). For the past year, stocks have not been able to breach this level. It would take a strong rise above these highs to confirm that a new sustainable broad market advance is underway.

The pendulum looks to have shifted this past week to the bulls. The question now is can they muster enough momentum to break through a level of resistance that has stood for over a year.

Stock market breadth turned up this past week. All four breadth indicators are now positive.

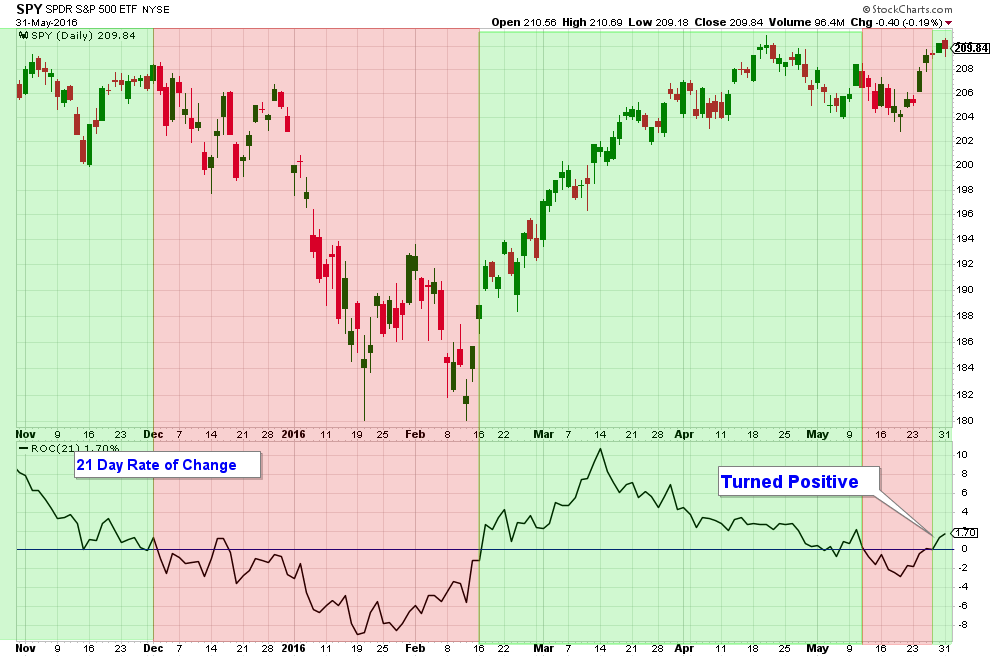

Stock market momentum also turned positive last week. Below is a chart of SPY (an S&P 500 ETF) with a Rate-Of-Change (momentum indicator) indicator in the lower panel. As you will notice, the Rate-Of-Change line turned up and advanced above the zero line. This suggests positive near term stock market momentum.

The Bottom Line

The odds now favor stocks going up in the near term. I would suggest that there is still a good amount of risk in the market given that stocks are still in the same range they have been in for over a year. Because of this, risk management is still very important.

Client Update

I have started to make some small changes in our client accounts, given the positive shift in market internals. I don’t plan on selling all of our current holdings since they are providing such good risk-adjusted returns. However, I have sold one holding to provide us with some cash to invest in additional funds that could benefit from an up-trending stock market. Most Aggressive and Conservative accounts are still invested in High Yield Municipal Bond and Floating Rate funds. I have added a Preferred Stock fund and will be looking to add more funds provided market internals remain positive.

On a Personal Note

As some of you may know, I am a huge dog lover. Angie and Aidan always snicker when we pass a dog on the street because they know that I cannot walk by a dog without saying hi. Below is a link to an interesting article on the best dog breeds for seniors in case you are in the market for a pet.

The Five Best Dogs for Your Golden Years

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.