Support Holds – For Now

Market Update

Stocks ended last week down for the third week in a row. The S&P 500 is trying to hold support, which is an important level for the bulls given the bearish head-and-shoulder pattern that has emerged. If stocks fall below the neckline, it would confirm the topping pattern and odds would favor an additional drop of at least 3% – 5%.

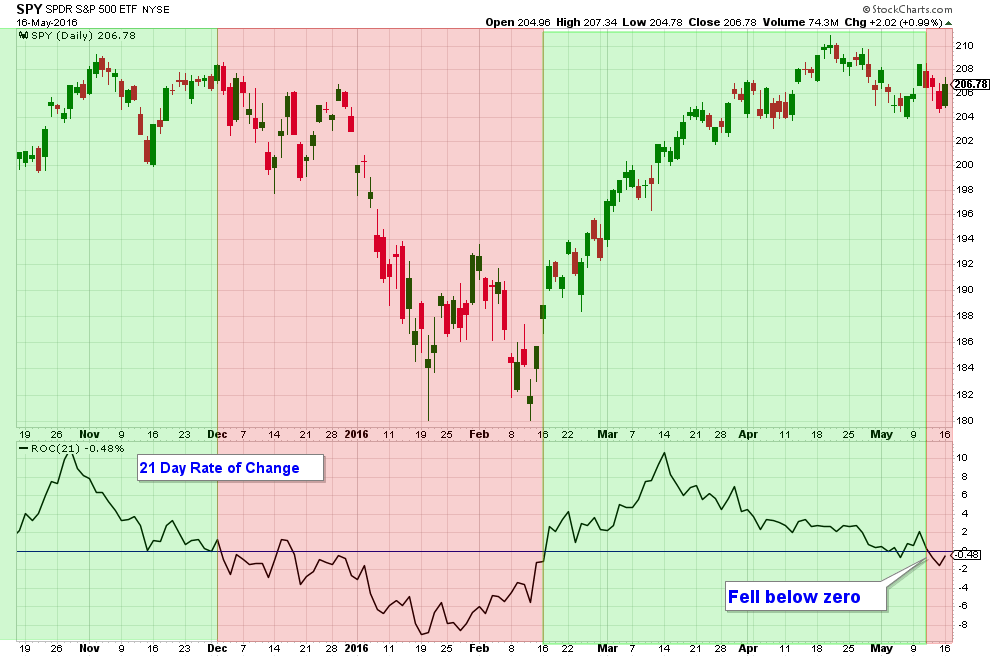

Momentum has shifted to the downside as can be seen by the momentum indicators in the chart below. This is the same chart that I posted last week, but updated through today’s market close.

The 21-day rate of change chart turned bearish (crossed below the horizontal zero line) last week. This suggests that a near term top is in place in the US broad market index, and warns of continuing market weakness.

Market breadth indicators are all still bearish (falling).

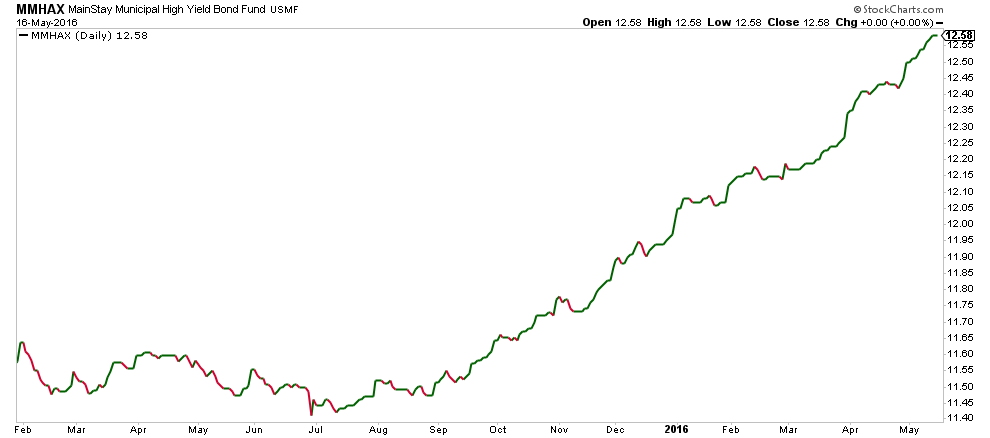

While stocks have been falling the past few weeks, High Yield Municipal Bond funds have continued trending up. Below is one of the High Yield Municipal Bond funds that we own.

The Bottom Line

From a technical standpoint, I monitor a number of different type or category of charts. For the sake of brevity, I only post a couple in my newsletter. Of all the charts that I monitor, most of them are bearish (indicating elevated risk in the stock market). Because of this I view stock market risk to still be elevated.

Client Update

Most Aggressive and Conservative accounts are fully invested in High Yield Municipal Bond and Floating Rate funds. These funds are trending up with very low volatility and have not fallen with the stock market over the past few weeks.

I am waiting for market internals to improve before reallocating client accounts into funds that are more stock market correlated.

On a Personal Note

Today is my 52nd birthday. It is amazing how time flies. While I still feel like the same skinny kid that loved playing sports, riding his skateboard, and unicycle; my bald head and difficulty reading small font remind me that those days are long gone.

I have so much to be grateful for. I have the most amazing, supportive and loving family a person could ask for. Mom and Dad are still healthy.

I have a fiancé (Angie) that I will be marrying next month and a soon to be stepson (Aidan), which is awesome since I always wanted to have kids. I am feeling pretty lucky today!

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.