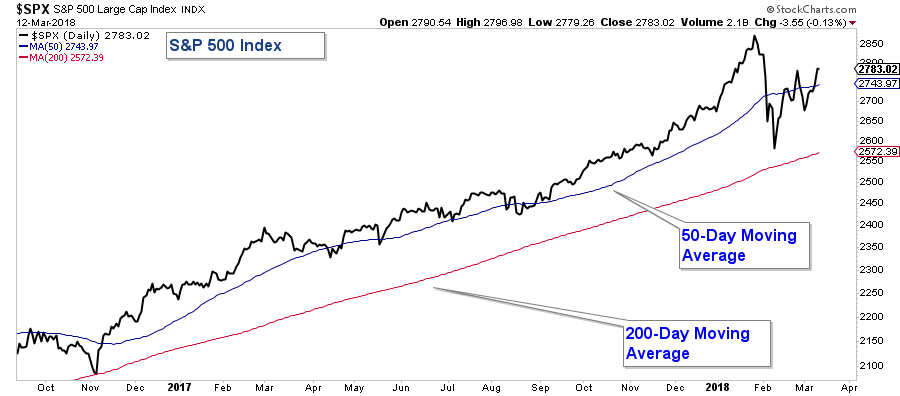

The S&P 500 rebounded last week advancing 3.5%. The move allowed the market to put in a short-term higher-low and price is now back above its 50-day moving average. For the current year, the S&P 500 is up a little over 4%.

On a long-term basis, the S&P 500 is trending up, its 50-day moving average is above its 200-day moving average, and both those averages are trending higher. The weight of the evidence continues to be bullish for the stock market.

The Bottom Line

Bias:

Positive for Stocks and Commodity Prices

Negative for Interest Rate Sensitive Bonds

• Even though the stock market fell 10% earlier this month, we are still in a bull market.

• When the S&P 500 is hitting all-time highs, international markets are advancing strongly, and market breadth is positive – there is no other way to view the market other than positive!

• Interest rate sensitive bonds are falling and could be transitioning into a long-term bear market.

• Long-term, the weight of the evidence continues to be bullish for stocks. At some point, this will change and when it does, I will have no problem flipping to a bearish bias and reallocating client accounts to a more defensive posture. However, market technicals continue to signal that we are in a bull market and thus we should be invested in stocks aggressively.

Client Update

I continue to view stock market risk as low, thus our accounts have high stock market exposure.

I have continued to add to our equity holdings by buying stocks and stock funds that have pulled back and are in long-term up-trends.

We do not hold any interest rate sensitive bond funds.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.