The Bottom Line

Bias:

Positive for Stocks.

• Long-term, stocks are in an uptrend and we are in a bull market.

• When the S&P 500 is hitting all-time highs, international markets are advancing strongly, and market breadth is positive – there is no other way to view the market other than positive!

• Stock market breadth is positive and confirming the strength we are seeing in the stock market. Market internals continue to suggest higher stock market prices.

Client Update

Client accounts are fully invested and mainly invested in equity funds, preferred securities funds, and high yield funds. I have viewed market risk as low for most of this year, thus our accounts have had high stock market exposure and any changes that I made have been minor.

Market Technicals

Stock Market Price Action

Bias: Positive

The S&P 500 advanced this past week and hit another all-time high. In addition, we saw an improvement in market breadth which is confirming current stock market strength.

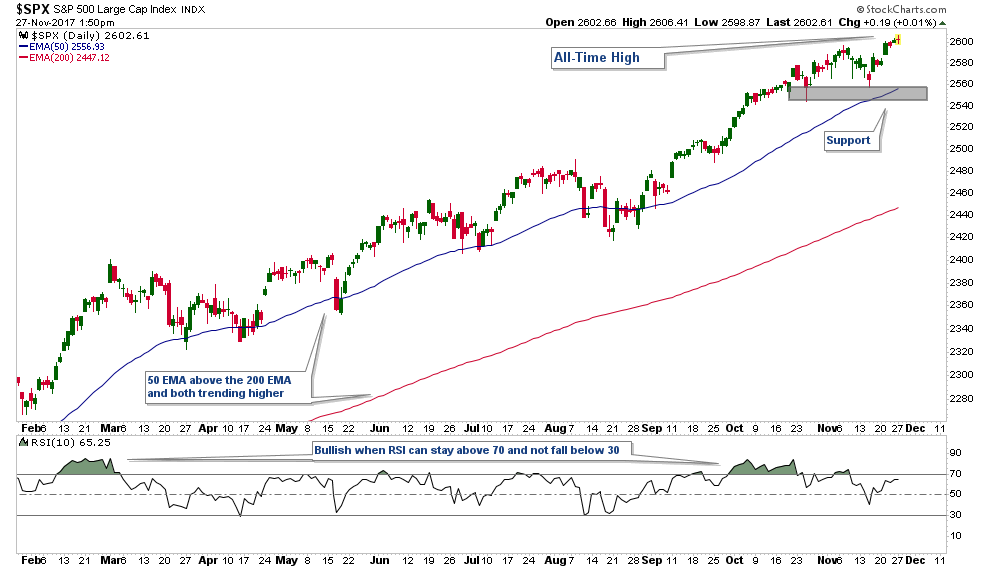

The S&P 500 (chart below) is above both its 50-day moving average and its 200-day moving average. Both those averages are trending higher and any pullback we have seen in the index this year has been extraordinarily minor.

Bottom line is that the trend of the market is up.

Stock Market Breadth

Bias: Positive

Stock market breadth “had” been somewhat weak based upon short-term breadth charts; while longer-term breadth charts were/are displaying strength. This type of short-term weakness in breadth is normal and was just signaling a short-term pullback within a longer-term up-trending market. These short-term breadth charts are once again positive and suggesting higher stock market prices in the near and intermediate term.

Long-term, the weight of the evidence continues to be bullish for stocks. At some point, this will change and when it does, I will have no problem flipping to a bearish bias and reallocating client accounts to a more defensive posture. However, market technicals continue to signal that we are in a bull market and thus we should be invested in stocks aggressively.

Email me to schedule your free, no obligation retirement account allocation review.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.