The Bottom Line

Bias:

Positive for Stocks.

• Long-term, stocks are in an uptrend and we are in a bull market.

• When the S&P 500 is hitting all-time highs, international markets are advancing strongly, and market breadth is positive – there is no other way to view the market other than positive!

• Short-term stock market breadth has weakened, so odds are somewhat elevated that we could see some stock market weakness over the near term.

Client Update

Client accounts are fully invested.

Market Technicals

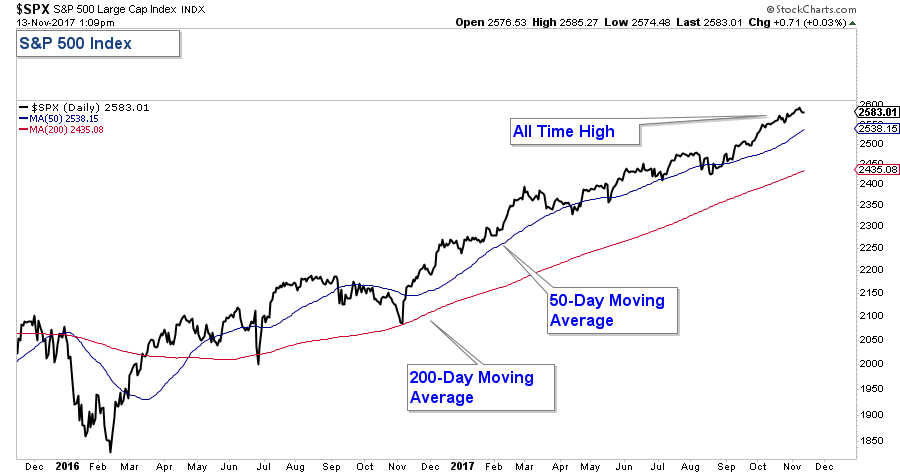

Stock Market Price Action

Bias: Positive

The S&P 500 lost .21% for the week, which is nominal. The trend of the stock market is still up, and the market continues to grind higher.

Buying pressure has been so strong that any pullback that we have seen in stocks over the past year has been extraordinarily minor. The stock market is obviously extended on a short-term basis, however, any pullback in stocks should be viewed as a buying opportunity. The trend continues to be up.

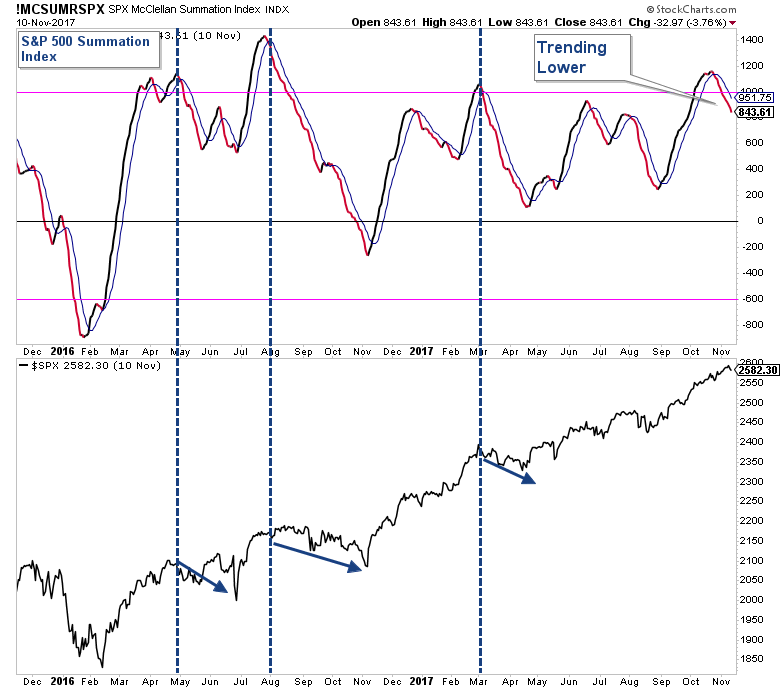

Stock Market Breadth

Bias: Long-Term Positive However Showing Signs of Short-Term Negative

In my newsletter two weeks ago, I pointed out that short-term market breadth had deteriorated somewhat and thus odds were elevated that we could see some market weakness over the near term. Short-term market breadth indicators are still negative as can be seen in the Summation Index below which turned down a couple of weeks ago and is still trending lower.

I don’t view this continued deterioration in market breadth as suggesting that we are going to get a major stock market correction because the weight of the technical evidence is still positive. Therefore, any pullback in stocks that we see in the coming days/weeks will probably be relatively minor and should be viewed as a buying opportunity.

There are other breadth indicators that are also displaying weakness; however, for the sake of brevity, I am not showing them today.

Short-term stock market breadth has continued to weaken, so odds are somewhat elevated that we could see some stock market weakness over the near term.

Long-term, the weight of the evidence continues to be bullish for stocks. At some point, this will change and when it does, I will have no problem flipping to a bearish bias and reallocating client accounts to a more defensive posture. However, market technicals continue to signal that we are in a bull market and thus we should be invested in stocks aggressively.

Email me to schedule your free, no obligation retirement account allocation review.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.