The Bottom Line

Bias:

Positive for Stocks.

• Long-term, stocks are in an uptrend and we are in a bull market.

• When the S&P 500 is hitting all-time highs, international markets are advancing strongly, and market breadth is positive – there is no other way to view the market other than positive!

• Short-term stock market breadth has weakened, so odds are somewhat elevated that we could see some stock market weakness over the next few weeks.

• Market technicals are starting to suggest that we are in the early stages of a rising yield environment. I highlighted how this scenario would adversely affect interest rate sensitive bonds in my newsletters: Bonds – A Ticking Time Bomb (Part 1) and Bonds – A Ticking Time Bomb (Part 2).

Client Update

Client accounts are fully invested.

Market Technicals

Stock Market Price Action

Bias: Positive

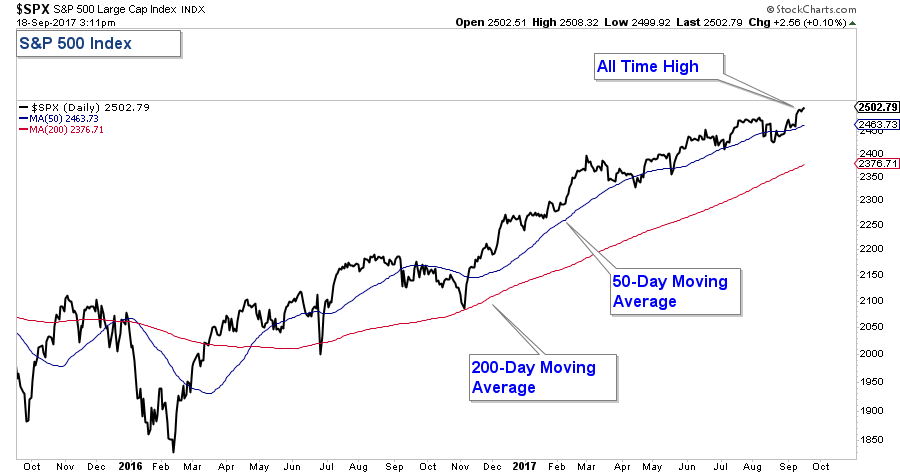

The S&P 500 advanced just under one-quarter of a percent last week and hit another all-time high on Friday. Buying pressure has been so strong that any pullback that we have seen in stocks over the past year has been extraordinarily minor. The stock market is obviously extended on a short-term basis, however, any pullback in stocks should be viewed as a buying opportunity. The trend continues to be up.

Stock Market Breadth

Bias: Long-Term Positive However Showing Signs of Short-Term Weakness

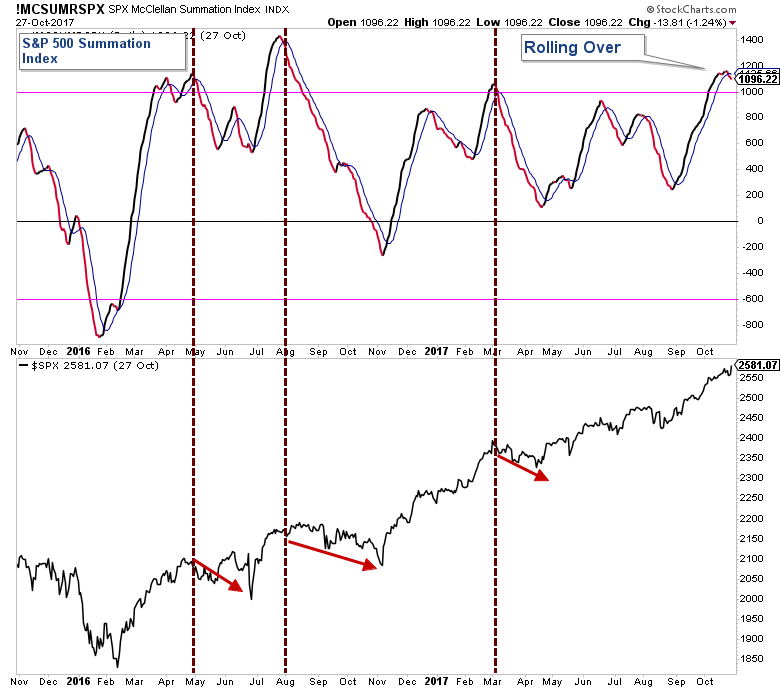

My favorite market breadth indicator is the Summation Index. When it declines from an elevated level it is signaling that odds are elevated that the market could pullback in the short-term. In the chart below, notice how when the Summation Index (upper panel) rolls over from above the 1000 level, the S&P 500 (lower panel) has corrected to some degree. The Summation Index just rolled over this past week.

There are other breadth indicators that are also displaying weakness; however, for the sake of brevity, I am not showing them today.

It is important to note that even though short-term breadth is weakening, we are in a strong bull market. Each pullback in stocks over the past year has been very minor. So I am not looking for a major correction in stocks. Any pullback in the market should be considered a buying opportunity.

Intermarket Analysis

Bias:

Positive for Stocks, Bond Yields, and the Dollar

Negative for Bond Prices, and Gold.

Intermarket Analysis is a branch of technical analysis that examines the correlations between asset classes to get a better understanding of the future direction of the stock market.

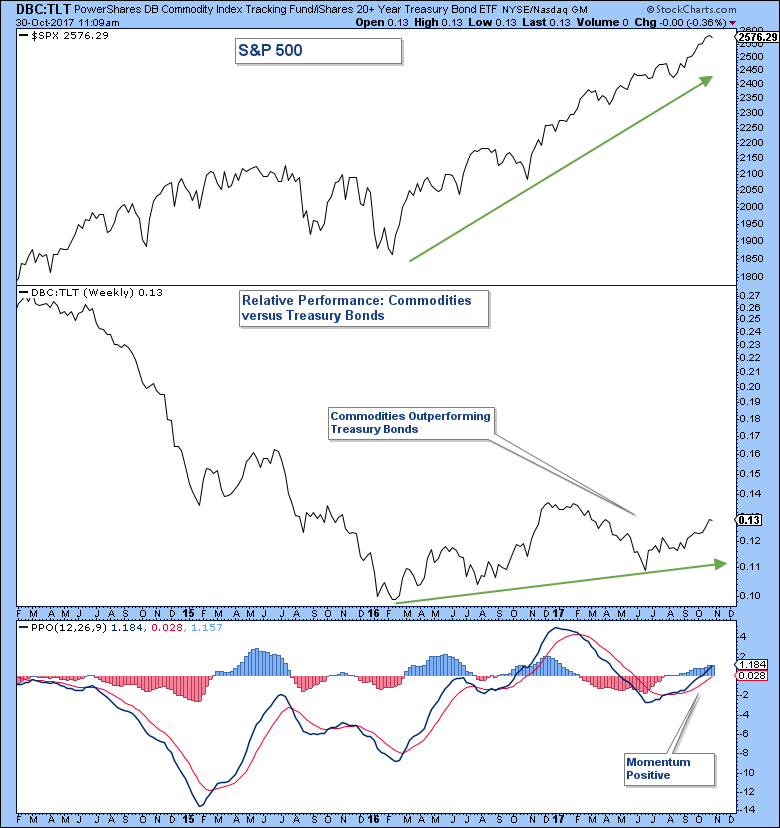

One way to do this is to look at the relative performance of different asset classes, which I have done in the three charts that follow.

In the chart below, I have charted the relative performance of Commodities (DBC) versus Treasury Bonds (TLT) in the lower panel. A chart of the S&P 500 is in the upper panel. As you will notice when the market bottomed at the beginning of 2016, Commodities began to outperform Treasury Bonds as can be seen in the rising relative performance line. This out-performance of Commodity prices over Treasury prices supports my working thesis of currently being in an economic growth environment which is positive for stocks and bond yields, and negative for interest rate sensitive bond prices (Bonds – A Ticking Time Bomb Part 1 and Bonds – A Ticking Time Bomb Part 2).

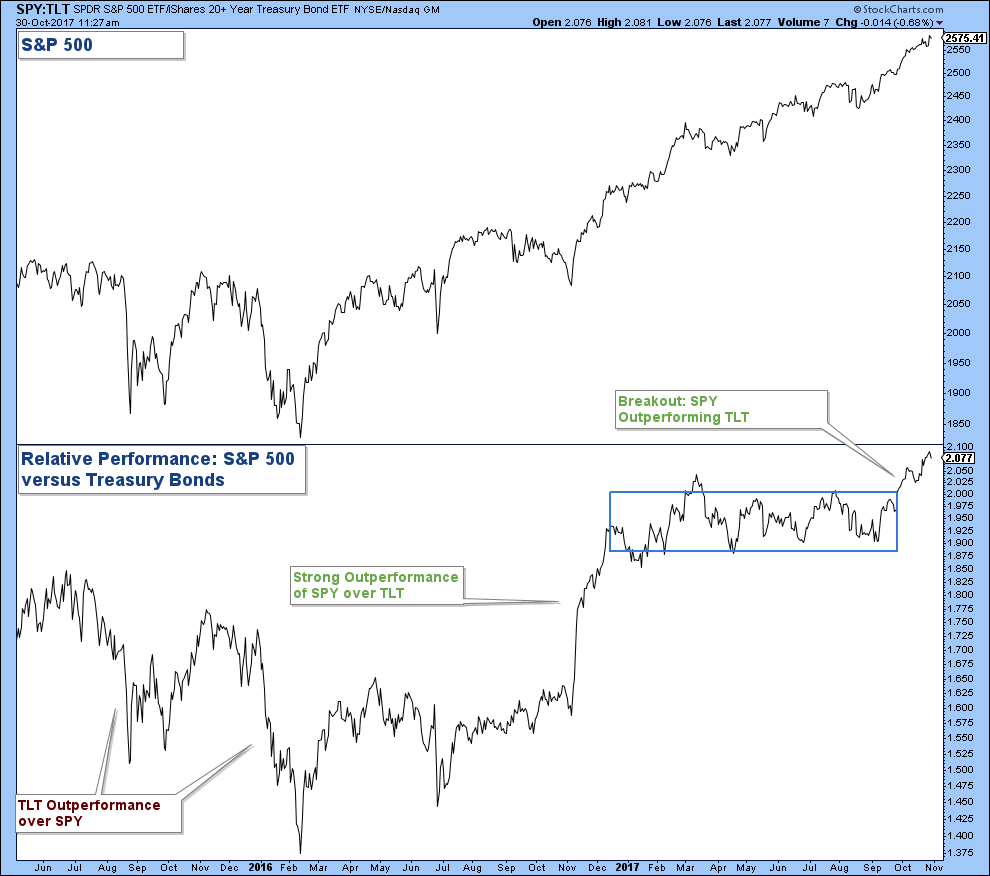

Below is a chart of the relative performance of the S&P 500 (SPY) versus Treasury Bonds (TLT) in the lower panel. A chart of the S&P 500 is in the upper panel.

Notice how relative performance of SPY was falling when the stock market corrected in the second half of 2015. Since the market bottomed at the beginning of 2016, SPY has been out-performing TLT. At the end of 2016, the relative strength of SPY shot higher as noted in the chart, then digested those gains by moving mostly sideways until they broke out again to the upside earlier this month.

This continued out-performance of stocks over treasury bonds is further confirmation of broad stock market strength.

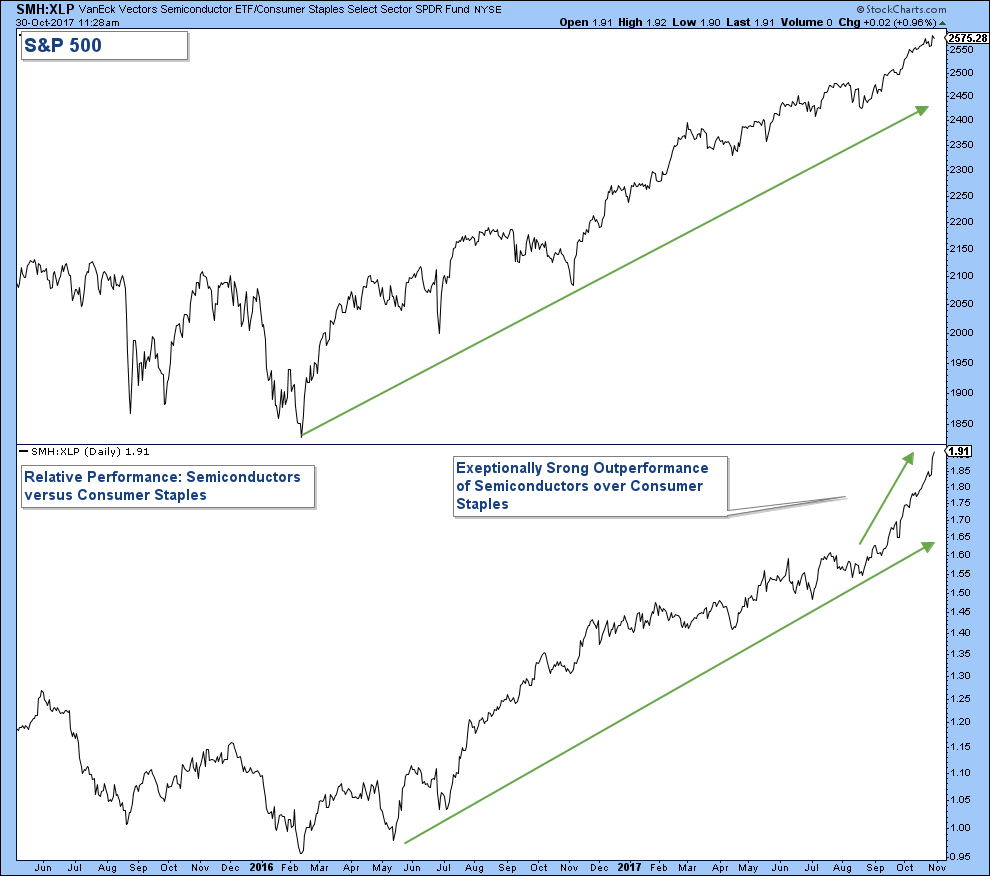

I like the chart below because it compares the market leading, risk-on Semiconductor Index to the risk-off, defensive Consumer Staples sector. When investors are aggressively taking risk, which is something you want to see as confirmation of market strength, investors will buy risky assets over defensive assets.

In the lower panel, you can see that the line is rising strongly because Semiconductor stocks are substantially out-performing Consumer Staple stocks. This is further evidence of broad stock market strength and supports our working thesis of being in a strong bull market for stocks.

Short-term stock market breadth has weakened, so odds are somewhat elevated that we could see some stock market weakness over the next few weeks.

Long-term, the weight of the evidence continues to be bullish for stocks. At some point, this will change and when it does, I will have no problem flipping to a bearish bias and reallocating client accounts to a more defensive posture. However, market technicals continue to signal that we are in a bull market and thus we should be invested in stocks aggressively.

Email me to schedule your free, no obligation retirement account allocation review.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.