Stock Market High

Market Update

The stock market correction that market internals have been signaling for the past couple of months is underway. At this point, I don’t see any indication that internals have improved enough to suggest an end to the downturn. Market breadth is still negative, momentum indicators are down, and the VIX is still elevated.

Below is a chart of the S&P 500. I have drawn blue lines at the areas where stocks are likely to find support. Currently prices are sitting above the first level. If stocks were to fall below the third level (2050 on the S&P 500), that would put the longer-term strength of the stock market into question.

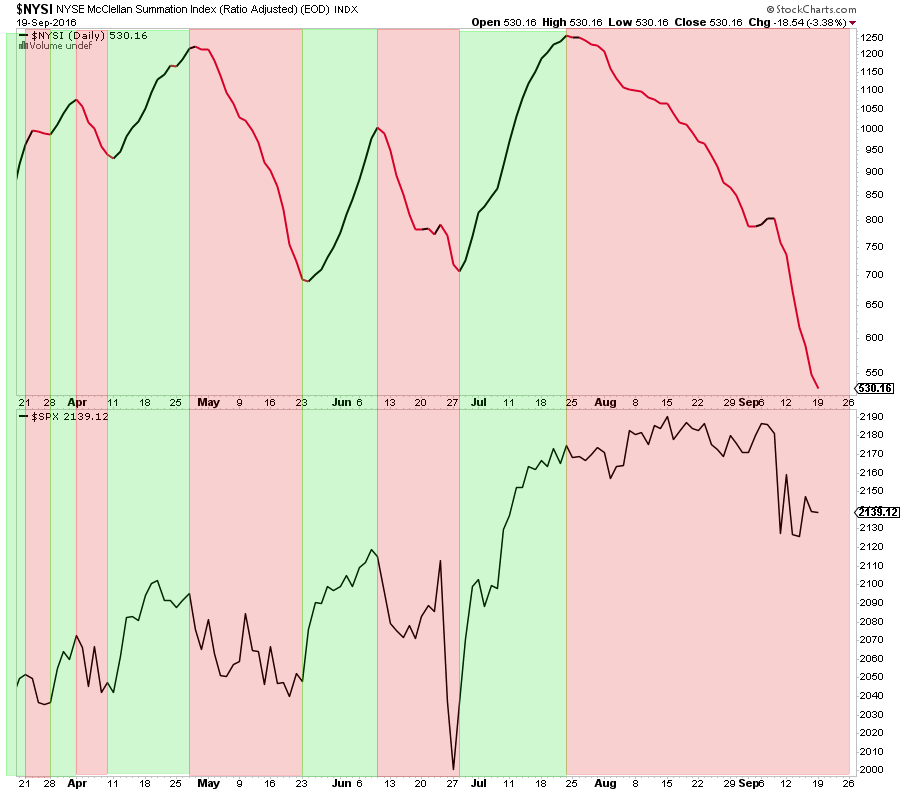

Market breadth is negative. The NYSE Summation Index is still trending down.

Market breadth is negative. The NYSE Summation Index is still trending down.

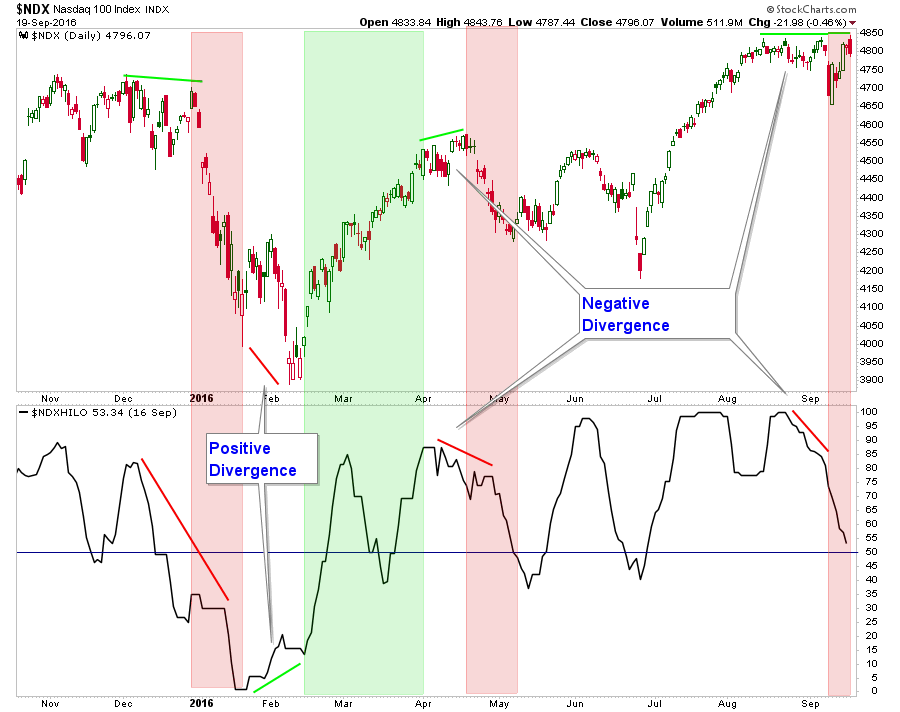

Another breadth indicator that did a good job of forecasting the current pullback is the High-Low Index, shown below. Notice the two recent negative divergences that I highlighted. This is where the High-Low indicator (in the bottom panel) turns down as the index advances or moves sideways, not confirming the strength in the index. In both cases, the index turned down soon after the divergence. I have also made a note where there was a positive divergence earlier this year, and soon after stocks advanced.

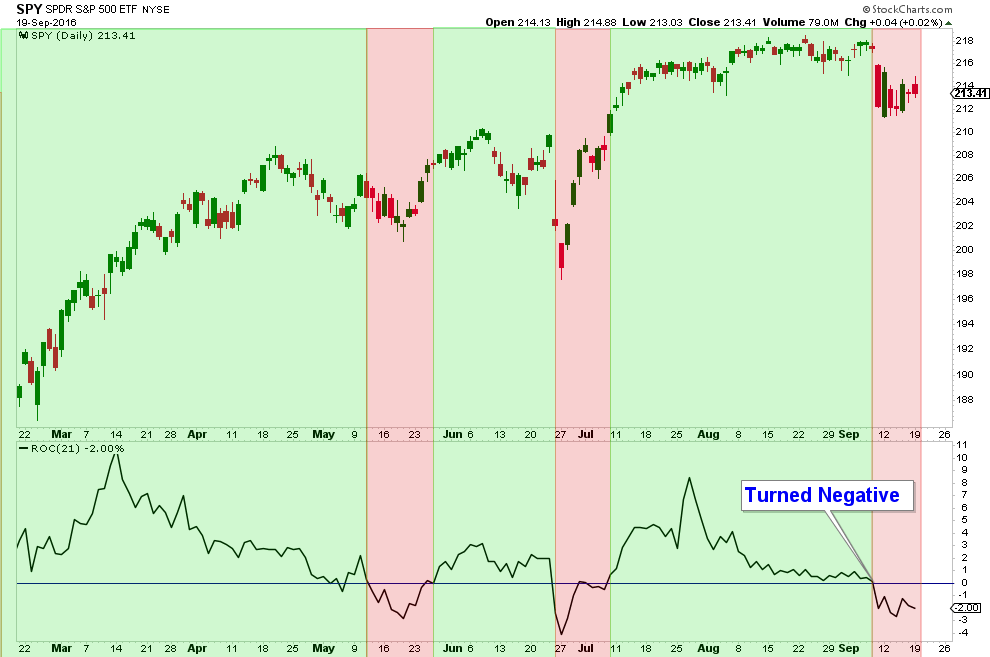

Most stock market momentum indicators have turned negative over the past few weeks. The 21-Day Rate-Of-Change Indicator turned negative about 1.5 weeks ago and is still in negative territory, in addition to trending down.

The VIX, also known as the fear index, jumped up above its 50-day moving average which was a signal that investor fear increased to a level that would suggest further downside stock market risk.

Increasing VIX readings usually coincide with falling stock prices, and extremely high VIX readings can foreshadow reversals. Currently the VIX is at 15.5; above its 50-day moving average suggesting increased market risk, but not high enough to suggest the excessive fear (about the 25 level) that can signal a stock market bottom.

The Bottom Line

Substantial changes were made last week to our stock market bias, relative to the previous couple of months, due to a deterioration in short-term stock market internals. In my opinion, short-term risk is currently high.

Bias: Neutral (Short-term negative, long-term positive for stocks.)

- Long-term stock market price action is positive and will remain so as long as prices remain above the June 2016 lows.

- Market internals suggest a positive environment for stocks over the longer term.

- The short-term market weakness that was signaled by market internals as far back as mid-July has been confirmed. The market is now in the process of correcting.

Client Update

Client accounts are between 80% to 100% invested in lower volatility funds.

We will be looking to add funds that we have identified as providing attractive risk-adjusted return characteristics once short-term internals turn positive.

For the most part, our accounts have trended up with very minor volatility this year.

This retiree became a globe-trotting nomad at 58

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.