Market Summary

I am not seeing anything in market technicals that suggests elevated stock market risk. That could change and does not mean that the market couldn’t pullback to some degree in the coming days/weeks. However, the odds of a major move down or bear market is unlikely.

The economy is struggling with the effects of an economic recession/shut-down. However, the Fed is supporting the stock market through a very aggressive bond purchasing program.

There are certain sectors and industry groups (such as technology, software, semiconductors, and healthcare) that are outperforming which is making it a stock pickers market. While other areas of the market are decidedly lagging like financials, utilities, and real estate.

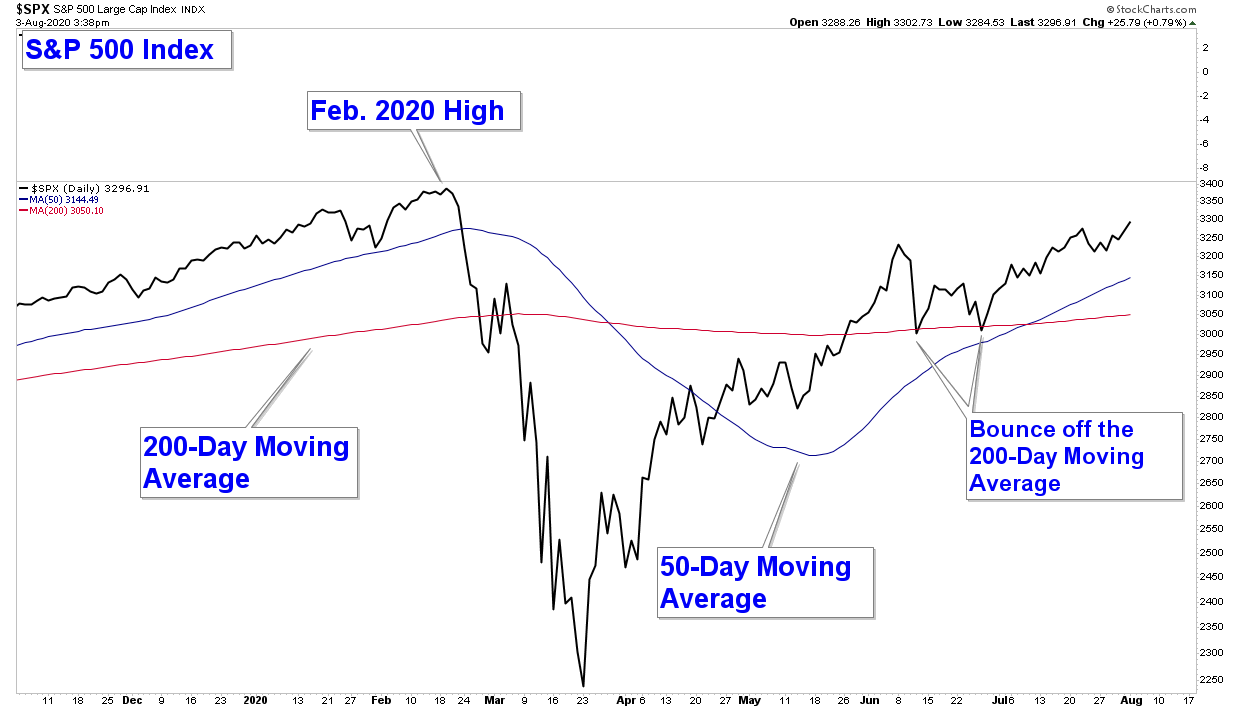

Below is a chart of the S&P 500, our market proxy. The index is in an uptrend as defined by a series of higher-highs and higher-lows. Also, it is above both its 200 and 50-day moving averages.

The Nasdaq 100 Index (not charted) advanced to new all-time highs back in June and continues to outperform the market. So, while the February highs in the S&P 500 is technically resistance, the odds favor a break above these levels given that market technicals are positive, and the Nasdaq 100 and other sectors/industry groups have already advanced to new all-time highs.

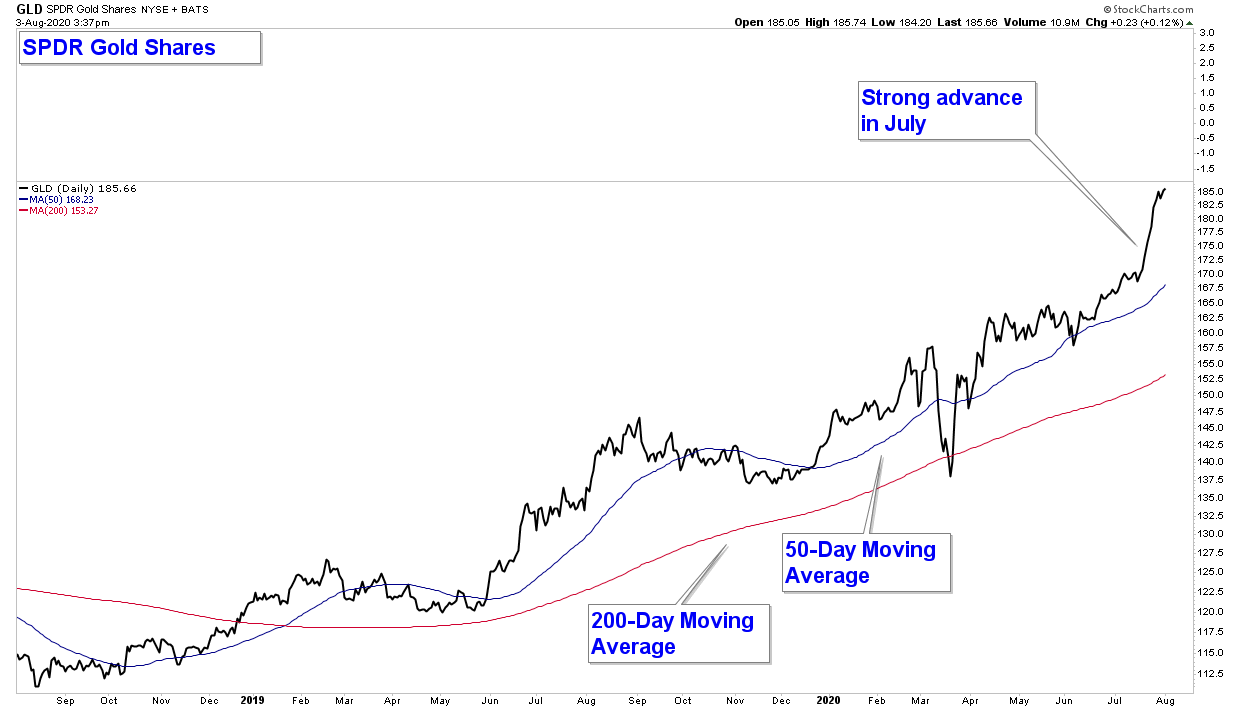

Gold, Gold Miners, and Silver continue to advance. In our May 17, 2020 Update Video, I highlighted how Gold had formed a huge bottoming pattern over the past nine years. If you want to review what we said, you can go to 18:45 in the video to skip to our Gold analysis.

Below is a two-year chart of a Gold ETF (GLD) and as you can see it is in an uptrend and had a strong advance last month.

Bottom Line

As long as market technicals remain positive and broad stock market indexes continue to trend higher, you have to be bullish the market, in our opinion.

Client Account Update

Client accounts are fully invested and leveraged in our aggressive/margin accounts. Our equity positions are mainly allocated in individual stocks with sizable allocations to Gold, Gold Miners, and Silver.

We will continue to monitor market technicals to help manage risk in our client accounts. If conditions deteriorate we will reduce risk to limit market losses.

As always, managing risk is paramount and protecting our clients from major losses during severe market corrections is our focus.

If you have any questions, please feel free to shoot me an email.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

All charts provided by: StockCharts.com