I began to turn bearish the broad stock market June 2019 as noted in our June 24, 2019 Market Update: Stock Market Walking a Tightrope. The stock market is still technically in an uptrend that started in January 2019; however, that doesn’t negate the many red flags I am seeing in the market.

The bottom line is that I currently view broad stock market risk to be at a very elevated level and believe it would not take much to push this market into a protracted decline that could last for months.

Reasons For Our Bearish Market Thesis

• Glaring bearish risk-off environment:

Out-Performing Risk-Off Assets – Treasuries, Consumer Staples, Utilities, Gold and REIT’s

Under-Performing Risk-On Assets – Technology, Lumber, Consumer Discretionary, Transports, Financials, Small-Cap, Energy, Broker-Dealers, and Biotech.

• Long-term negative momentum divergences AND breadth divergences that have been historically seen at previous market tops.

• Global Economic Weakness. Here is an article that does a good job of highlighting domestic economic warning signs: Here’s a list of recession signals that are flashing red

• Bond yields are plummeting.

• Domestic bond yield inversion which has been an extremely accurate predictor of an impending recession, albeit with varying lead times.

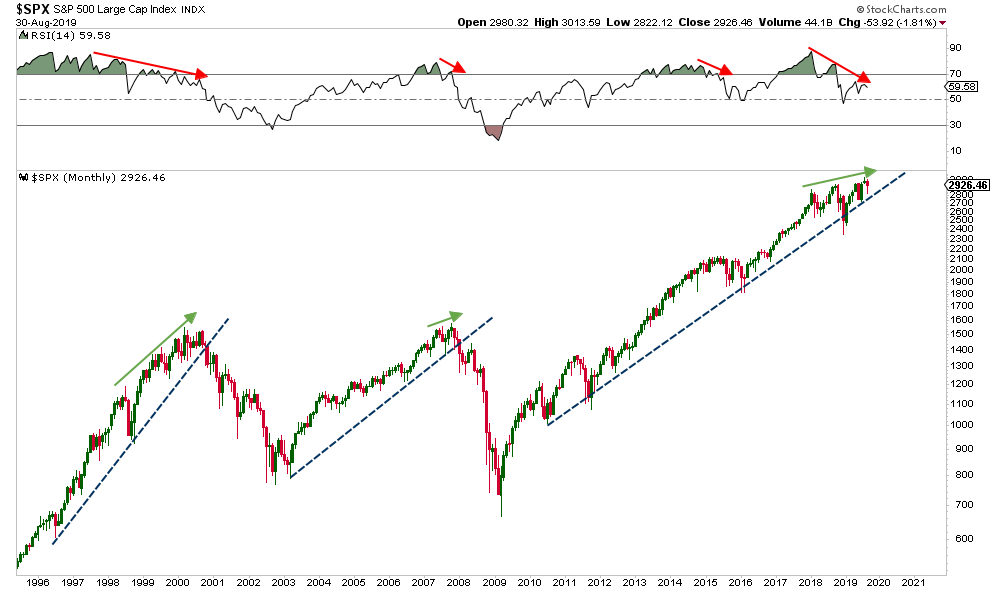

Market Update

Below is a long-term chart of the S&P 500 in the bottom panel and a momentum (RSI 14) indicator in the top panel. Notice how on each of the previously noted market tops the momentum indicator turned down while the index was advancing (negative divergence). Currently, we are seeing the same divergence.

Like I have stated in previous updates, these divergences are major red flags and signal that any breakdown in price could potentially lead to a substantial market correction.

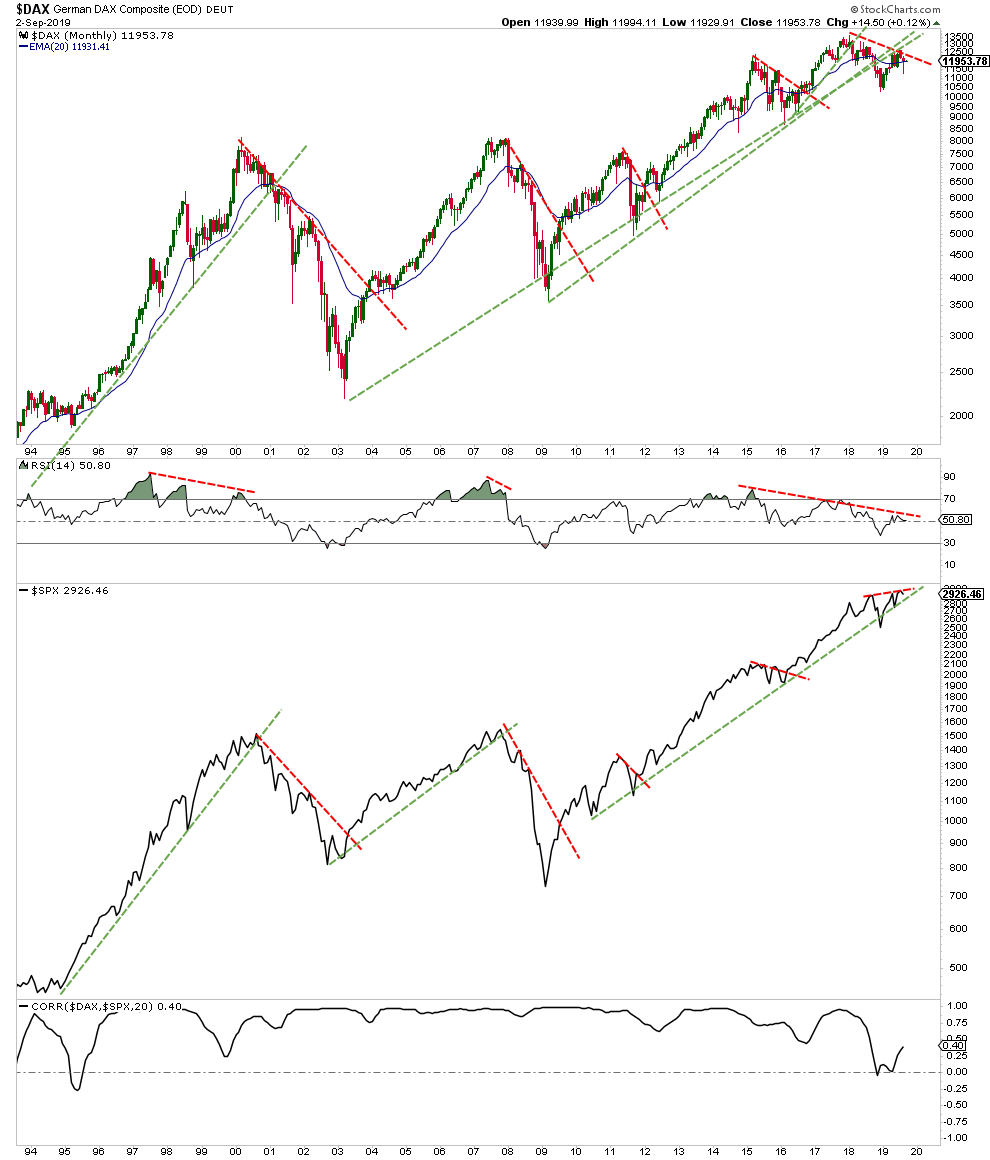

Our market does not go up and down in a vacuum. We live in a global economy and thus markets are highly correlated. Global markets peaked ahead of our market last year and we can look to them for clues as to what we might expect going forward.

Below is a long-term chart of the German DAX in the upper panel, a momentum indicator for the DAX, the S&P 500 index, and a correlation chart at the bottom.

Here is what I have noted and is of concern:

The German DAX peaked in January of 2018 while the S&P 500 peaked in July 2019.

The Correlation line in the bottom panel is consistently above zero. This indicates that the German DAX and the S&P 500 are highly correlated.

The major corrections that occurred in the DAX were typically accompanied by a corresponding correction in the S&P 500.

The momentum indicator (RSI 14) has diverged negatively with the DAX prior to major corrections. This includes the negative divergence that preceded the current market correction.

The German DAX broke below a long-term trendline and is in a downtrend.

The bottom line is that Germany’s market led our market lower and is still in a downtrend. If international markets are mostly falling, that is a strong headwind for our market.

The fact that the German DAX has broken a major long-term trendline suggests that their market could have much further to fall. This has negative domestic market implications.

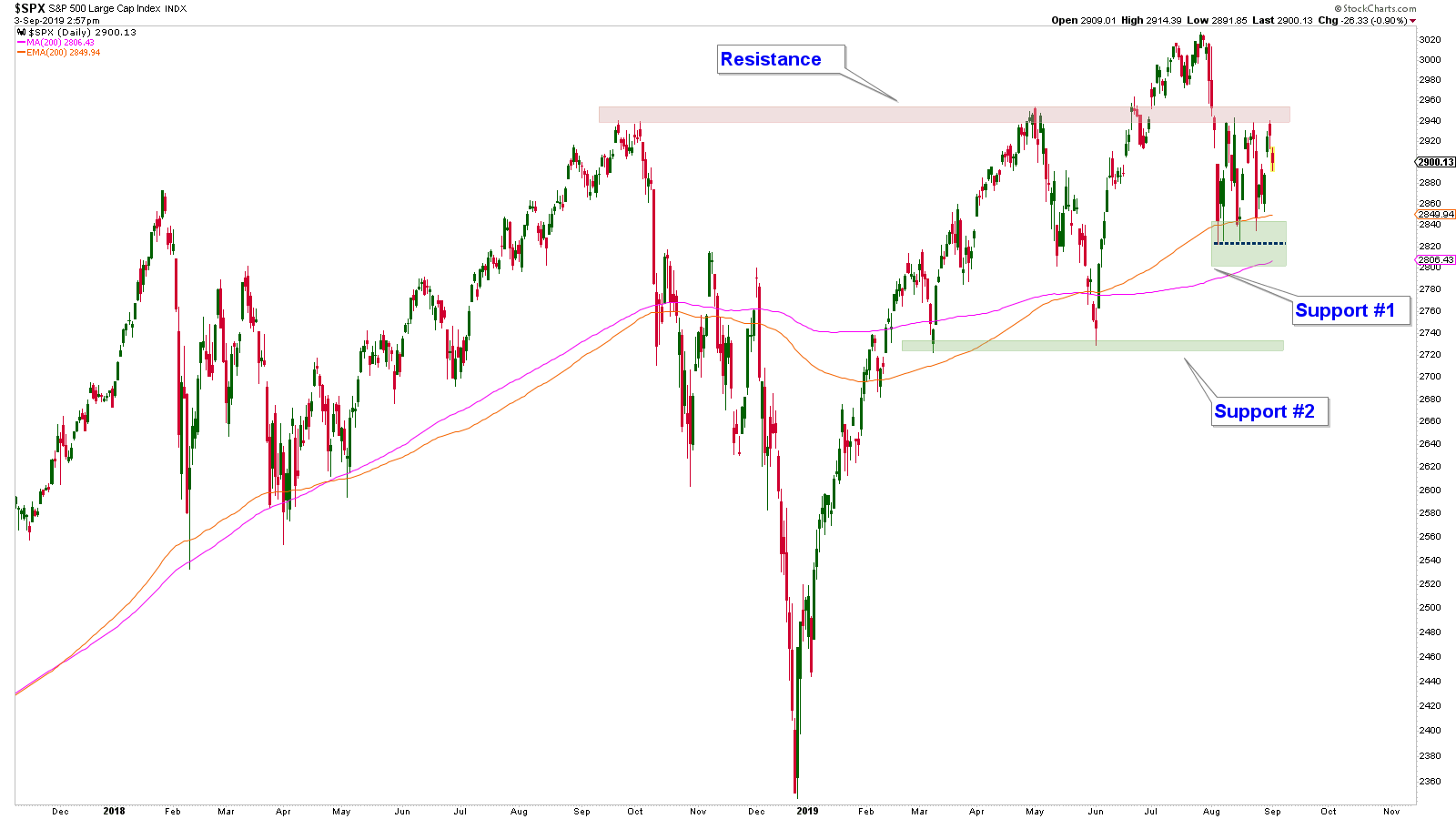

Below is a chart of the S&P 500. There are three things that I am looking for to confirm that we are transitioning into a bear market or at least a major broad stock market correction.

One – A strong, decisive break below support from all-time highs. This occurred and thus support became resistance as noted below.

Two – A break below the next level of support (Support #1) which is created from the 200-day simple and exponential moving averages and the August lows.

Third – A break below the next level of support (Support #2) which is created from the two lows of earlier this year. If this level breaks I think the odds favor a long-term period of market weakness (decline).

Of the three things that I am watching, only the first has occurred. I think the odds favor the next two occurring, but only time will tell. On the other hand, if the market advances strongly above resistance to new all-time highs, we would need to reevaluate our bearish thesis.

Client Account Update

Our client accounts are allocated extremely defensively

I substantially reduced our market exposure starting on June 25, 2019, by purchasing our first substantial short position. We then added more short positions over the following weeks.

In summary, we are long, with an over-weighting towards risk-off assets such as utilities, reit’s, gold/silver, insurance, and consumer staples. And short different indexes, and a few individual stocks.

In addition, all models own bond funds as well which are benefiting from falling bond yields.

Now is the time to reevaluate your retirement account allocations, not later after you have incurred substantial losses.

If you are worried about how your retirement accounts are allocated, shoot me an email and we can schedule a virtual meeting to review your holdings.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.