With this month’s newsletter, I feel that we only need to look at one chart to get a good feel for the current stock market environment.

I believe that for most of 2021 the market has been in a stealth correction. This may surprise you given that major indexes have advanced higher. But those indexes are capitalization-weighted and the largest stocks have an outsized weighting on performance.

Internal market weakness is typical for the year after a bear market ends. Historically you see a strong advance off the bear market low with investors bidding up stocks aggressively. That advance is strong and the second year is typically a year of digesting those gains. The difference with 2021 is that the S&P 500 has trended higher; however, most stocks within that index have not performed as well on average. The good news is that the stock market has typically continued to advance higher after its 2nd-year blues.

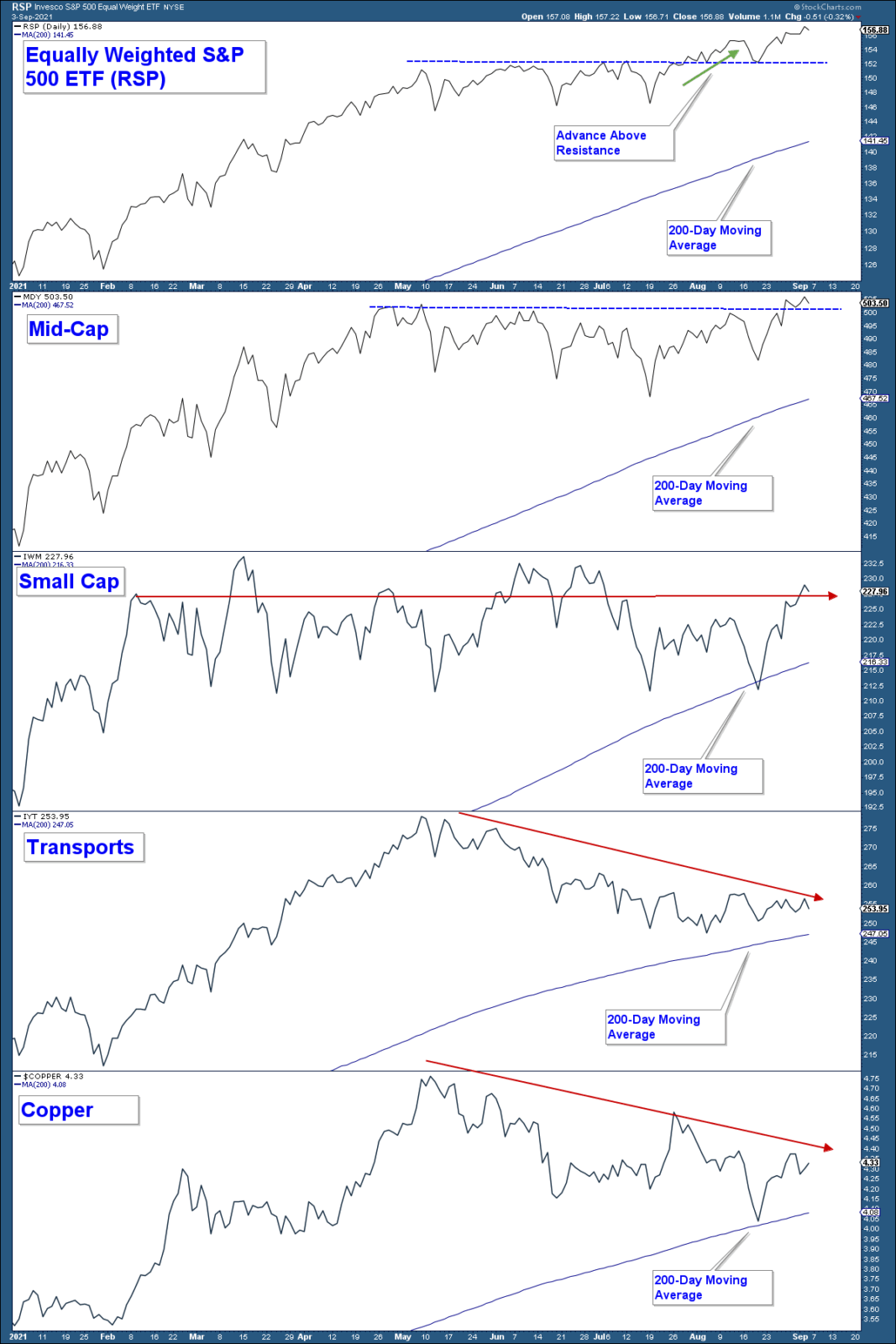

In the chart below is a year-to-date chart of RSP (an equally weighted S&P 500 Index ETF) in the upper panel. While this market proxy index has trended higher this year, mid-caps have gone nowhere since the beginning of May. Small-caps are worse having consolidated since February. What about those indexes that are economically sensitive? Both transportation stocks and copper have been falling since early May.

So, what am I looking for going forward to signal a transition to a more healthy stock market environment? I am looking for an improvement in market breadth. I want to see those lagging groups advancing.

Notice how the 200-day moving averages below are trending higher in all the charts, moving closer to price. This average commonly acts as support for price.

It will be interesting to see how price reacts as this important moving average gets closer to price. Will this moving average supply an advancing force to push price higher? If so, this would be a very bullish signal for the broader stock market. On the other hand, if these four indexes continue to consolidate or fall, it would suggest more of the same.

Client Account Update

It is important to calibrate the risk you take in your investment accounts based on the underlying risk in the market. Currently, market risk is slightly elevated and bonds are providing good risk-adjusted returns. Because of this, client accounts are nearly fully allocated with an over-allocation to bonds and an under-allocation to equities. If market internals improve, I will look to increase equity exposure.

If you have any questions, please feel free to send me an email.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

All charts provided by: StockCharts.com