Red Flag

Today I read an article that I believe everyone should read. It highlights one of the biggest risks for those individuals getting ready to retire: sequence-of-return risk. This is the risk of withdrawing money from your investments during a stock/bond market decline. The article highlights why managing risk and volatility is so important for those in or nearing retirement. Left-click the link below to read the article.

Red Flags Rise In 2016 For The Recently Retired

Market Update

The S&P 500 ended the week basically flat. The neckline in the head-and-shoulder pattern I spoke about in last week’s newsletter was briefly violated. Stocks dipped just below the neckline, then bounced back above it. There is substantial support at that area which seems to be holding stocks above the neckline – so far.

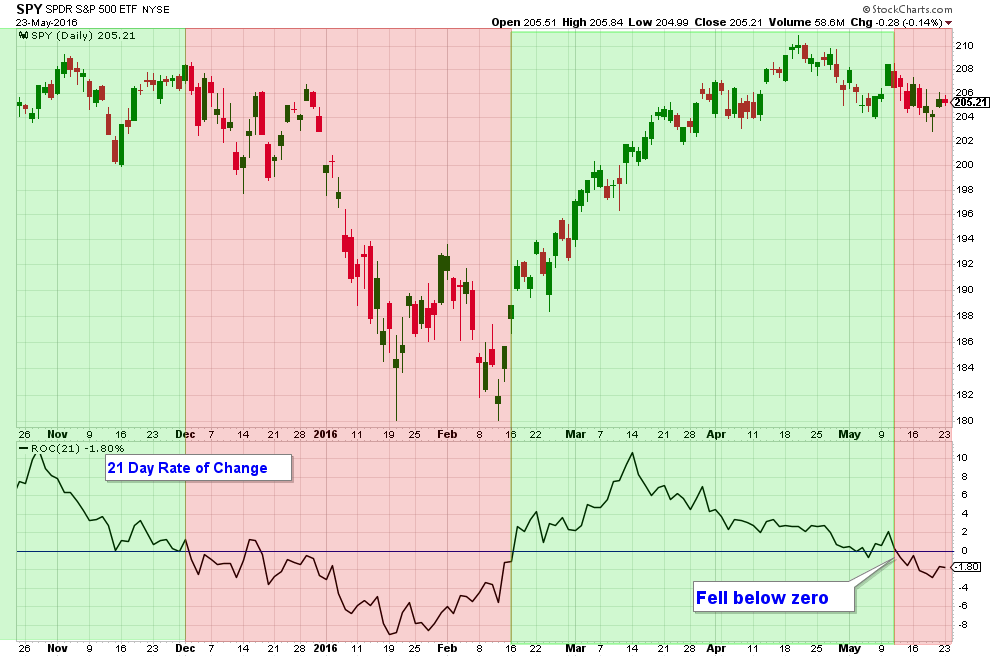

Market breadth is still bearish and suggesting elevated stock market risk.

Stock market momentum is also still suggesting further stock market weakness.

The Bottom Line

Not much has changed in the past week. The majority of the indicators that I monitor are bearish (suggesting further stock market weakness).

Client Update

Most Aggressive and Conservative accounts are fully invested in High Yield Municipal Bond and Floating Rate funds. These funds are trending up with very low volatility and have not fallen with the stock market over the past few weeks.

I am waiting for market internals to improve before reallocating client accounts into funds that are more stock market correlated.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.