I publish our comprehensive monthly market update on the first Monday of each month. In last month’s update I highlighted the reasons for my bearish market thesis which I base on many longer-term negative divergences that continue to build, such as:

• Glaring bearish risk-off environment:

Out-Performing Risk-Off Assets – Treasuries, Consumer Staples, Utilities, Gold and REIT’s

Under-Performing Risk-On Assets – Technology, Lumber, Consumer Discretionary, Transports, Financials, Small-Cap, Energy, Broker-Dealers, and Biotech.

• Long-term negative momentum divergences AND breadth divergences that have been historically seen at previous market tops.

• Global Economic Weakness.

• Bond yields are plummeting.

• Domestic bond yield inversion which has been an extremely accurate predictor of an impending recession, albeit with varying lead times.

I am not going to include charts of all the negative divergences that I am watching, since I have included them in past updates and nothing has changed since then. If you are interested, you can view our previous market updates on our web page.

The Most Important Chart

The S&P 500 Index

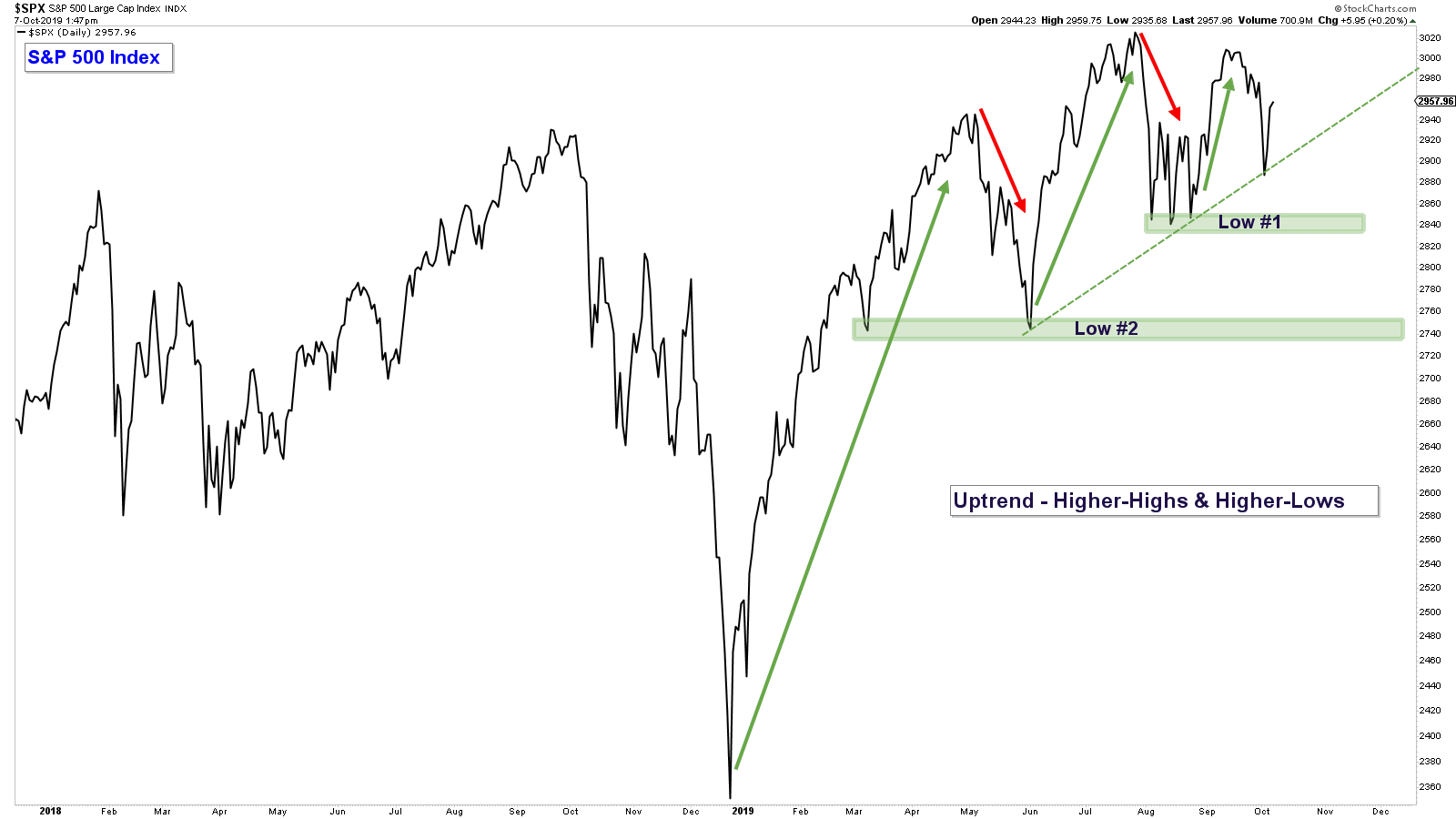

What I notice when I study previous market tops that were proceeded by similar negative divergences, is that these divergences can last for a long time and thus are just warning signs. However, when these divergences are present AND the broader market breaks below an important trendline or support level, stocks can drop quickly signaling a major change in trend.

So that is where we are at currently. Major negative divergences that continue to build, but the stock market has not broken down yet. With that in mind, let’s look at a chart of the S&P 500 to try to determine where those levels are, that if violated, could provide a downward vacuum for the stock market.

S&P 500 Index – Key Levels

Even though the stock market has chopped sideways for the past 20 months, the S&P 500 is in an uptrend as defined by a pattern of higher-highs and higher-lows (notated with red and green arrows in chart below). Therefore, even though there are boat loads of negative divergences, the market is trending higher and this is Bullish. However, if the market drops below a couple of key areas of support, that will all change.

Low #1

The uptrend would be negated by a decisive move below a previous low (Low #1). It would be a big loss for the bulls if that support level gets violated to the downside.

Low #2

The next level of support (Support #2) is created from the two lows of earlier this year. If this level gets decisively taken out, I think odds favor a long-term period of market weakness (decline).

StockCharts.com used to produce the chart above.

Client Account Update

Our client accounts are allocated defensively

Conservative accounts are mainly allocated in Bonds and Money Market funds.

Aggressive accounts are mainly allocated in Bonds, Index Shorts, and Money Market Funds.

Now is the time to reevaluate your retirement account allocations, not later after you have incurred substantial losses.

If you are worried about how your retirement accounts are allocated, shoot me an email and we can schedule a virtual meeting to review your holdings.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.