Stock Market Indexes

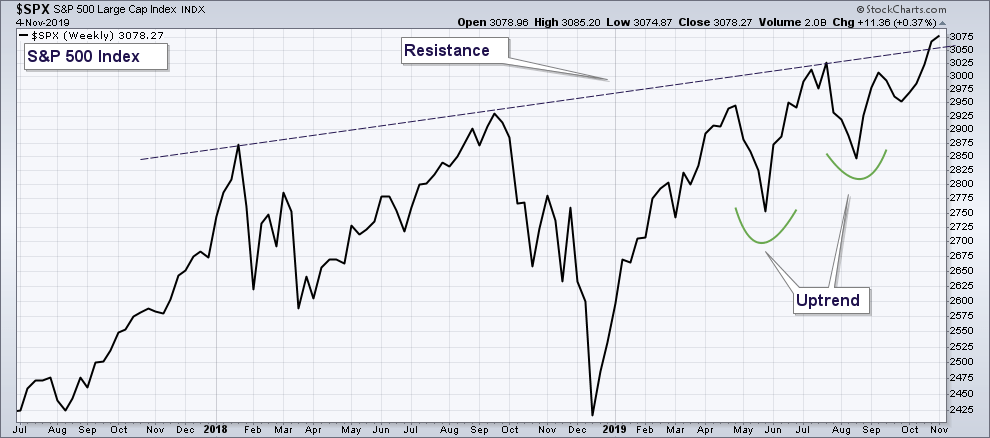

The S&P 500 Index is in an uptrend as defined by a series of higher-highs and higher-lows. Today’s close puts the index slightly above the notated uptrend line and at an all-time high. Over the past two years, each time the index has reached this uptrend line it has pulled back.

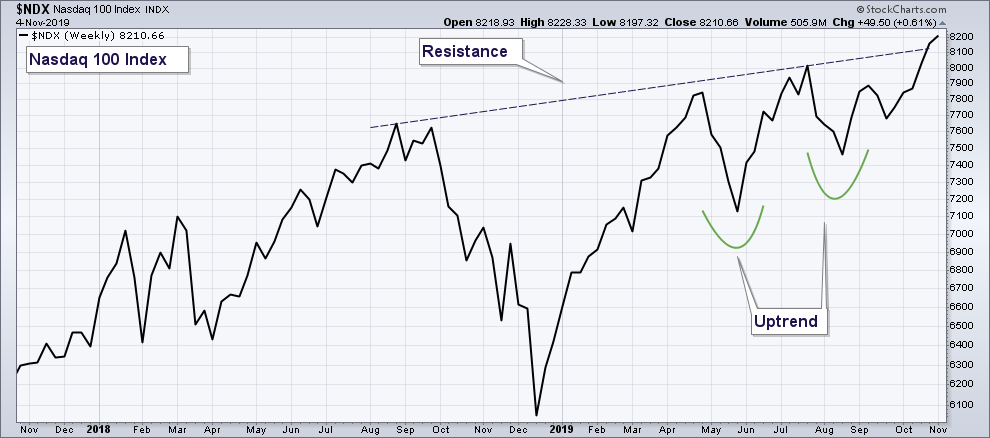

The Nasdaq 100 Index looks similar to the S&P 500 Index. It also advanced slightly above its uptrend line.

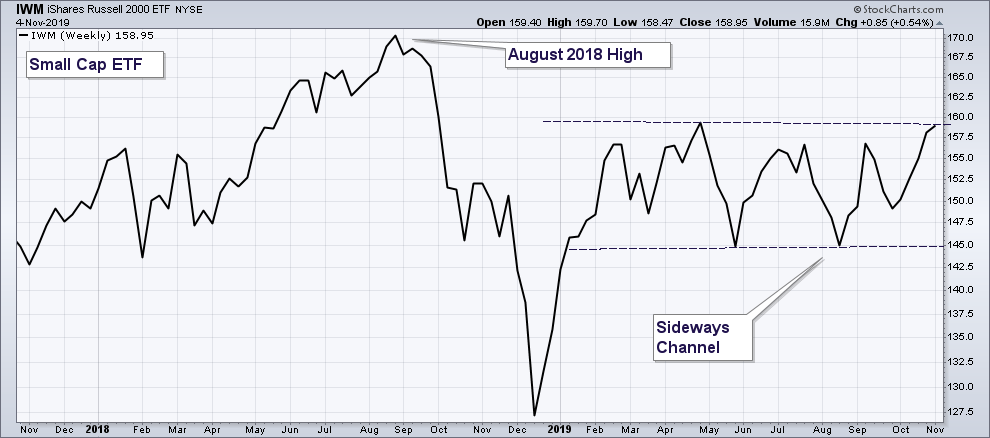

The Russell 2000 ETF (Small Cap) is below it’s high of last year and is at the upper end of it’s sideways channel.

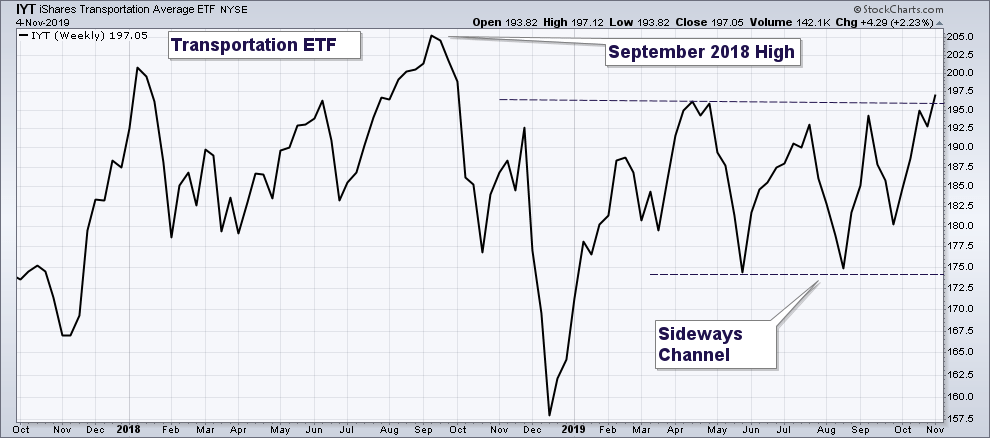

The Transportation Index ETF is trading sideways similar to the Small Cap Index. Transportation stocks are economically sensitive so the fact that they are diverging negatively with the broader market is concerning.

From a pure price perspective, the S&P Index is in an uptrend and at all-time highs. If the broader stock market is going to continue higher, I would expect small-caps and transportation stocks to advance decisively above their sideways channels.

Market Internals

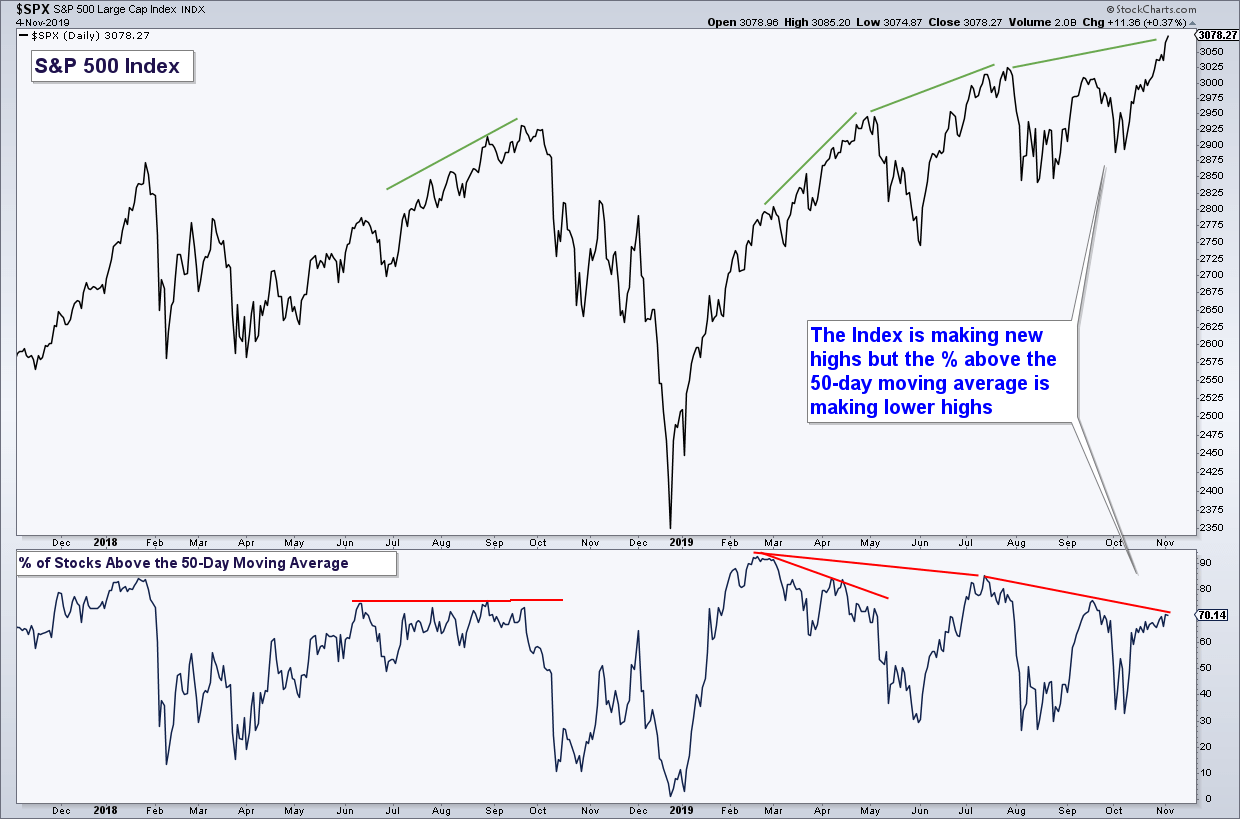

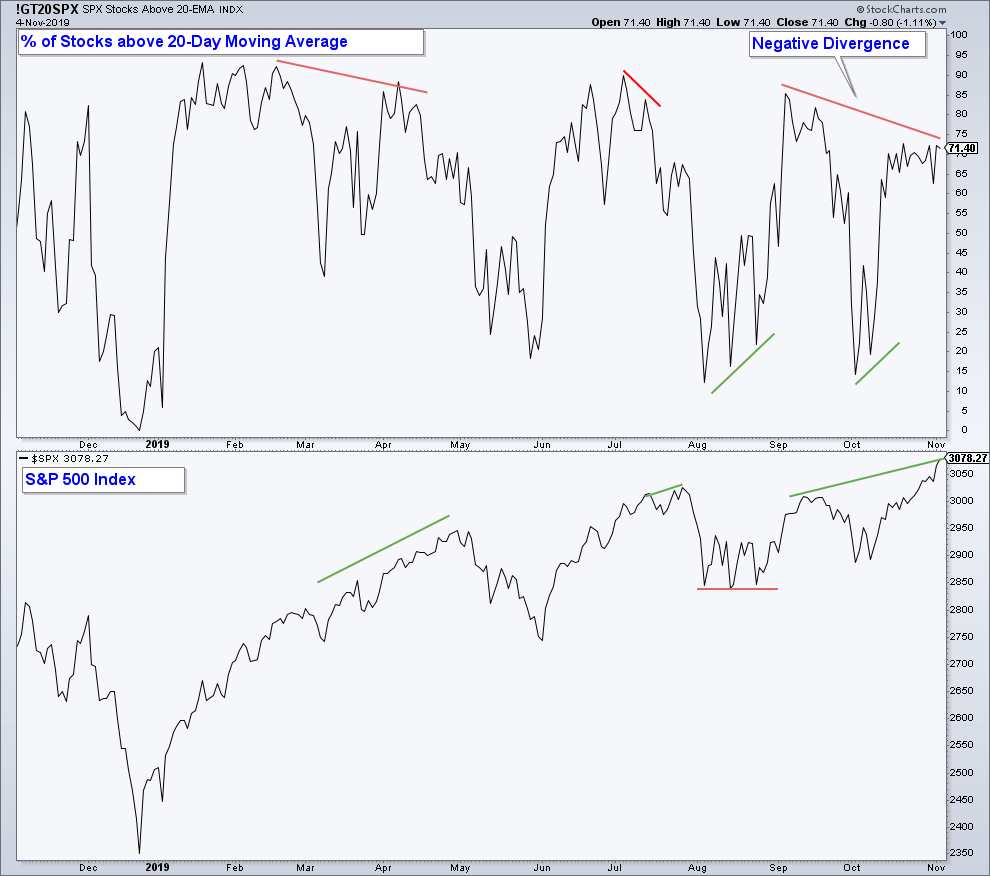

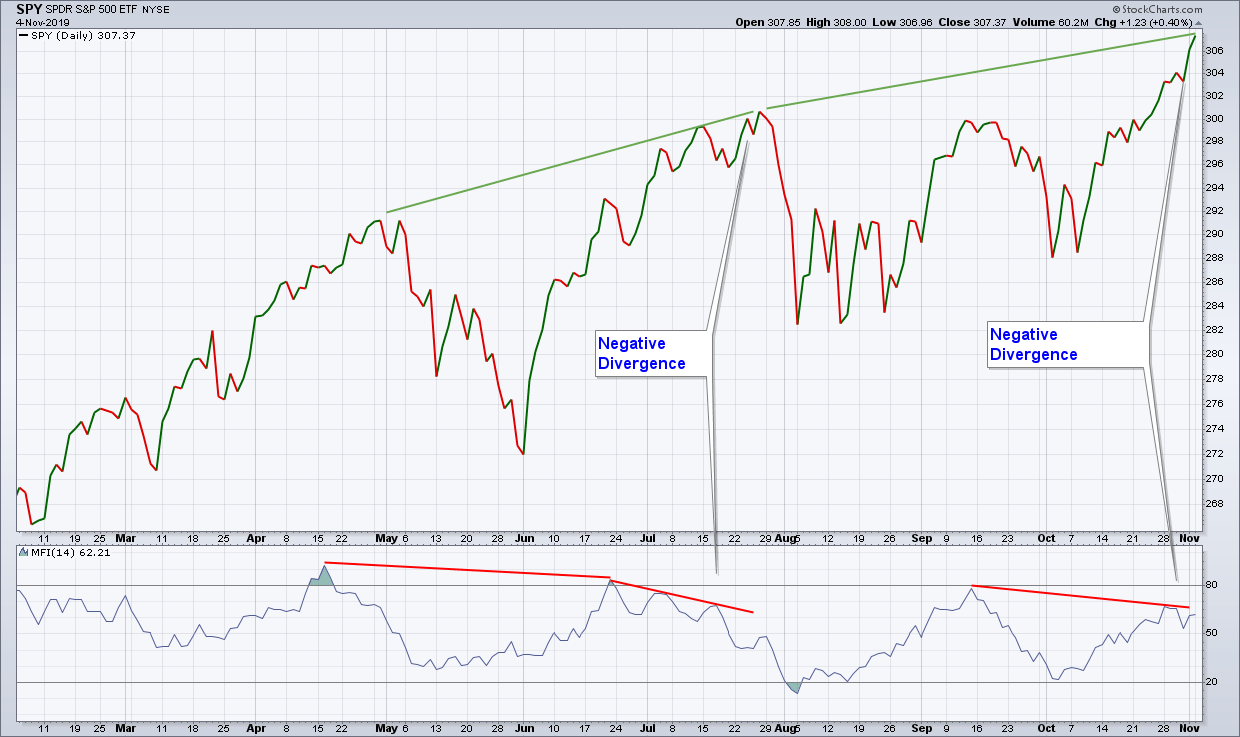

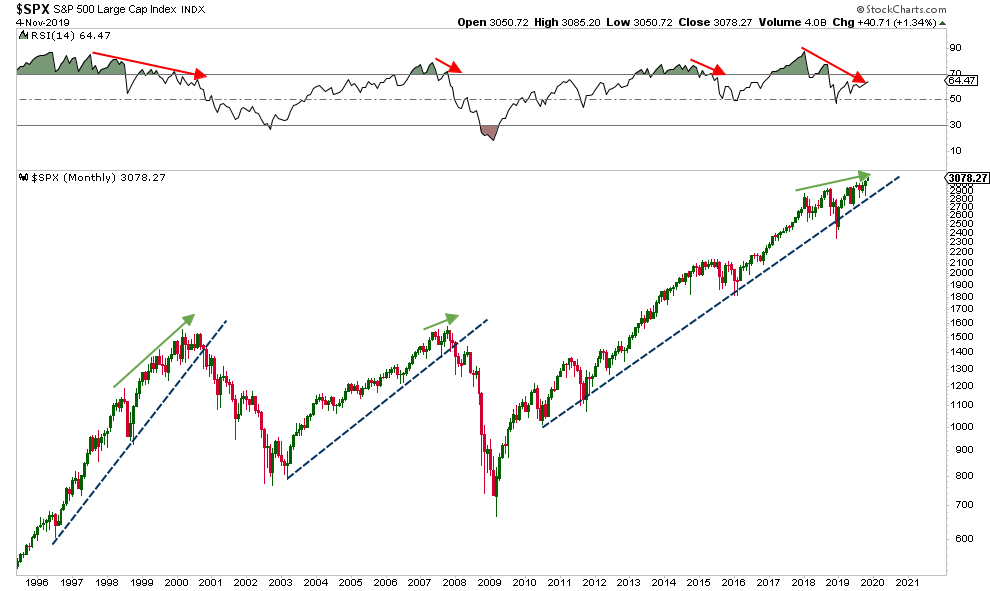

To get some perspective of the level of risk in the broader stock market and what the odds are of stocks advancing or declining going forward, we need to look at market internals. Spoiler Alert – all the negative divergences that I have been writing about for the past few months continue to persist.

If we look at the percent of stocks that are above their 20-day moving average we also see a negative divergence.

Below is a chart of a momentum/volume indicator in the lower panel and the S&P 500 in the upper panel. Momentum and volume are diverging negatively with the index.

The VIX is a sentiment indicator (lower panel) and over the past two years, market tops have occurred when the VIX was below the red shaded area. A strong move of the VIX above this level would signal that the next short-term peak is in place.

Below is a long-term chart of the S&P 500 in the lower pane and a momentum indicator in the upper panel. Notice how the momentum indicator has diverged negatively preceding the last three major market tops. Currently, momentum has been diverging negatively since January of last year.

If the S&P 500 falls below a major support level, I believe that would be all it would take for the market to enter into a major period of decline.

The Bottom Line

Given all the bearish market internals that continue to persist, I believe that the odds of a sustained market advanced are limited and risk of a major broad stock market correction is elevated.

Client Account Update

Our client accounts are allocated defensively

Conservative accounts are mainly allocated in Bonds and Money Market funds.

Aggressive accounts are mainly allocated in Bonds, Index Shorts, and Money Market Funds.

Now is the time to reevaluate your retirement account allocations, not later after you have incurred substantial losses.

If you are worried about how your retirement accounts are allocated, shoot me an email and we can schedule a virtual meeting to review your holdings.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.