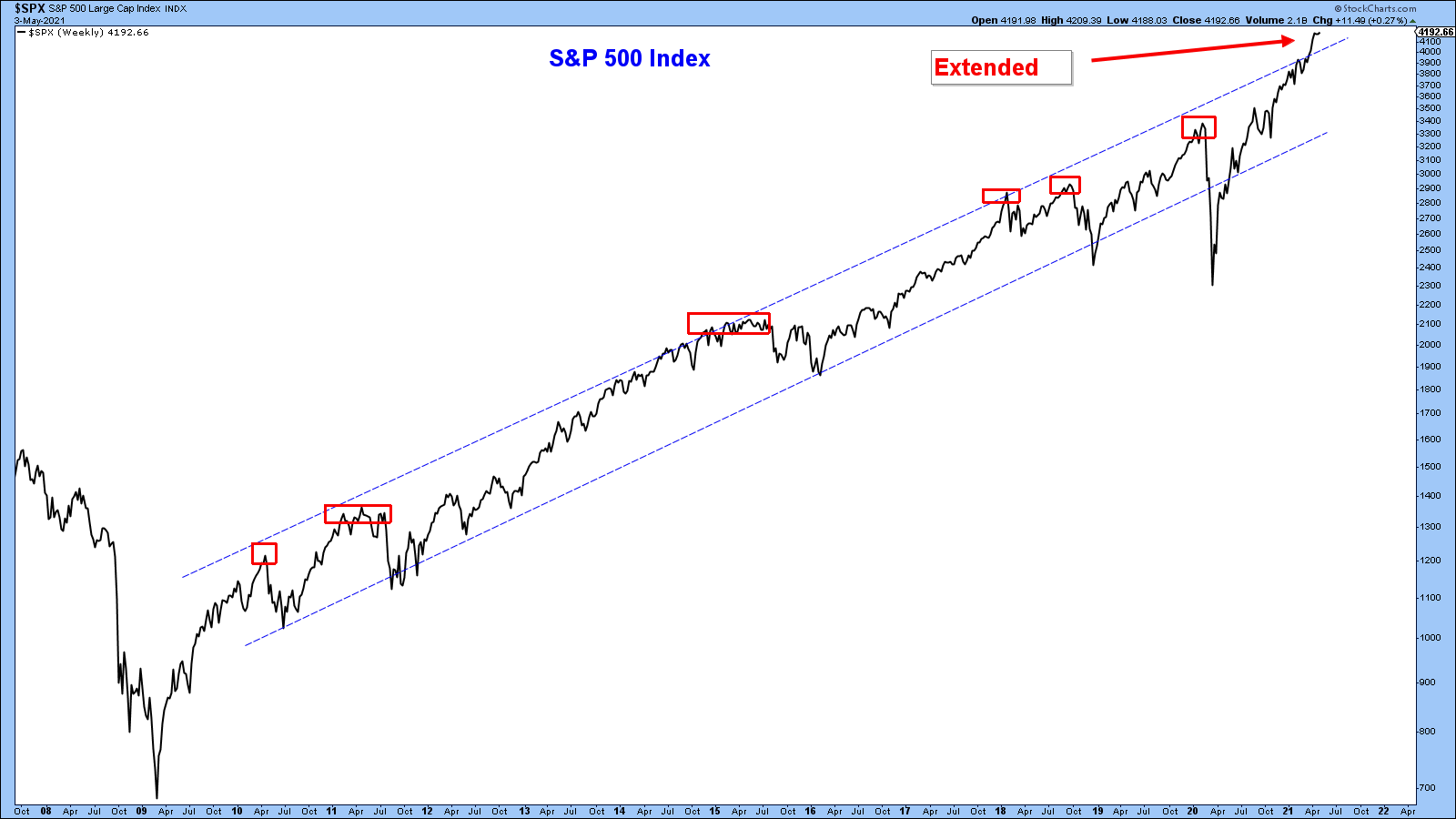

Long-term, the stock market is in an uptrend but extended as noted in the chart below which goes back to 2008. Note how every major pullback has occurred when the index has reached the top of its up-trending channel. I have notated these tops with a red box. This does not mean that the market can’t continue to advance despite being extended. Just that the odds of some type of consolidation or pullback are elevated.

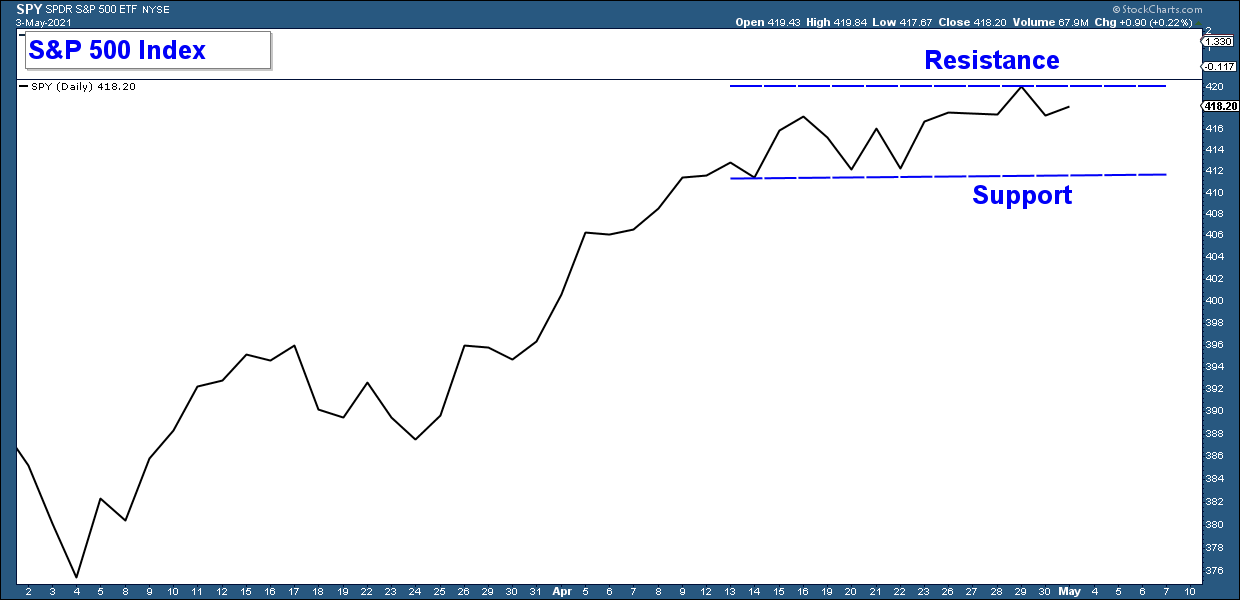

Below is a short-term chart of the S&P 500 index and notice how the index has been consolidating over the past couple of weeks. It is logical that the market would consolidate here given it is extended.

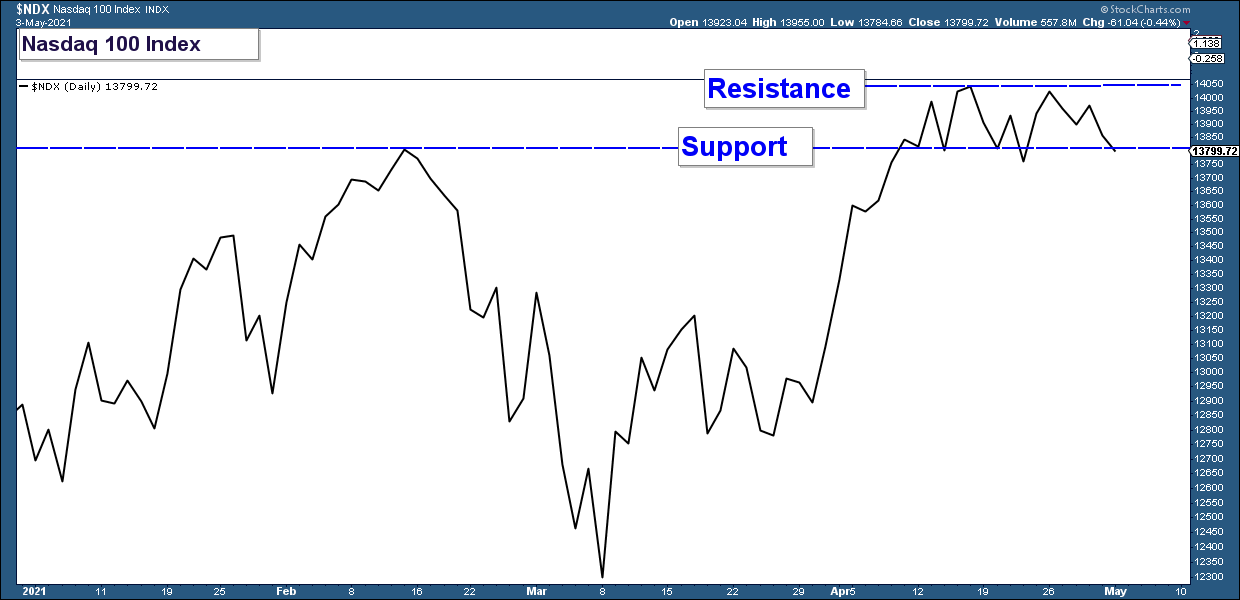

The Nasdaq 100 Index is also consolidating between support and resistance.

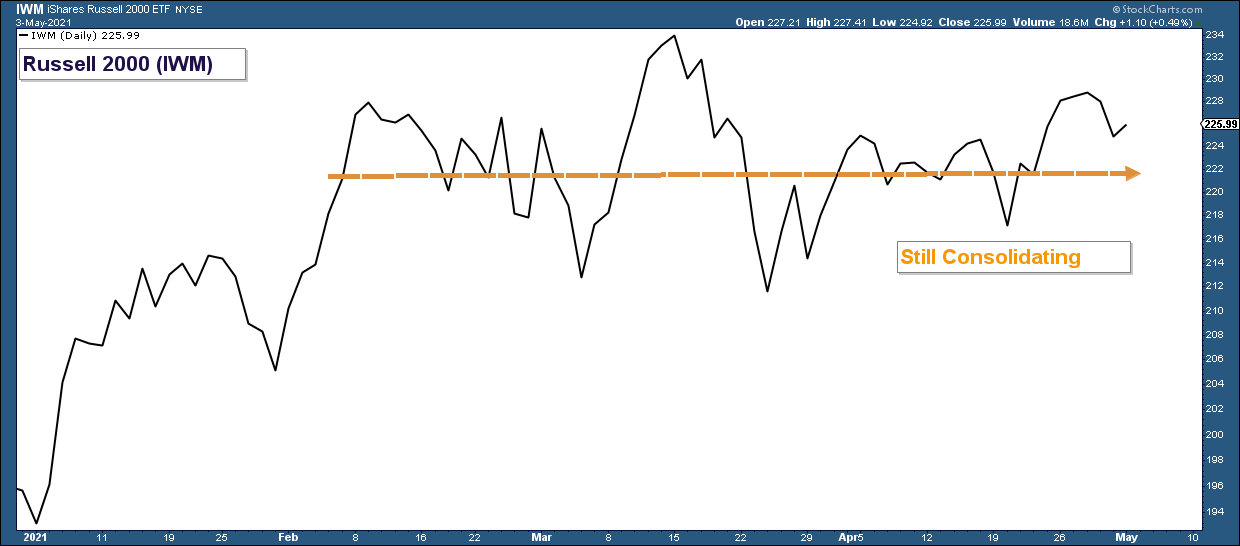

If the market is going to advance despite being overbought, I would expect Small Cap stocks to lead the charge given they have been consolidating for the past three months and are not as overbought as the S&P 500.

That has not happened yet and as you can see in the chart below, Small Caps continue to consolidate.

The Bottom Line

Long-term the market is in a confirmed uptrend. However, short-term it is extended to the upside. As a result, the market may have trouble advancing strongly in the near term without more consolidation or a pullback.

Other technicals also suggest short-term caution such as the VIX which has started to become positively correlated with the market and is starting to rise. Historically, when I have seen the VIX behave in this manner it has frequently been a precursor to a market pullback or correction.

Also, momentum indicators have been negatively diverging with the market suggesting an increase in the odds of a near-term pullback in stocks.

One of the main things that I will be watching in the coming weeks is can the market advance above resistance. If it can, that would be a strong signal that the broader market is poised for another leg higher. I think this is the lower odds scenario.

On the other hand, if these major market indexes all begin to fall below their respective levels of support, I believe that would encourage more selling and be a signal that a short-term correction could be at hand.

Client Account Update

Because my analysis suggests short-term risk is elevated, I have added four leveraged index short positions to hedge any near-term market weakness. As a result, our net long equity exposure is minimal.

If major market indexes can advance above resistance and market internals improve, I plan to sell those short hedges increasing our net long exposure. On the other hand, if the market does correct, these short positions will go up in value helping to offset any losses that would likely occur as a result of weakness in the broader stock market.

As always, I will continue to monitor market conditions and adjust our client accounts accordingly

If you have any questions, please feel free to send me an email.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

All charts provided by: StockCharts.com