Markets Look Scary!

Market Update

My short-term view on the stock market changed mid-July. In my July 18, 2016 newsletter I wrote:

Longer-term stock market conditions look positive; however, we could see some short-term market weakness before stocks resume trending up.

Since then, market internals have continued to deteriorate and short-term risk is still elevated, in my opinion. I view the current weakness that we are seeing in stocks as a buying opportunity that will present itself at some point; however, now is a time to be defensive.

The descending wedge pattern that formed in the S&P 500 and that we mentioned in last week’s newsletter, is still intact. Last week the index bounced off the lower boundary of the triangle (support). This is a bearish pattern and given that market internals are negative, odds favor a drop below support.

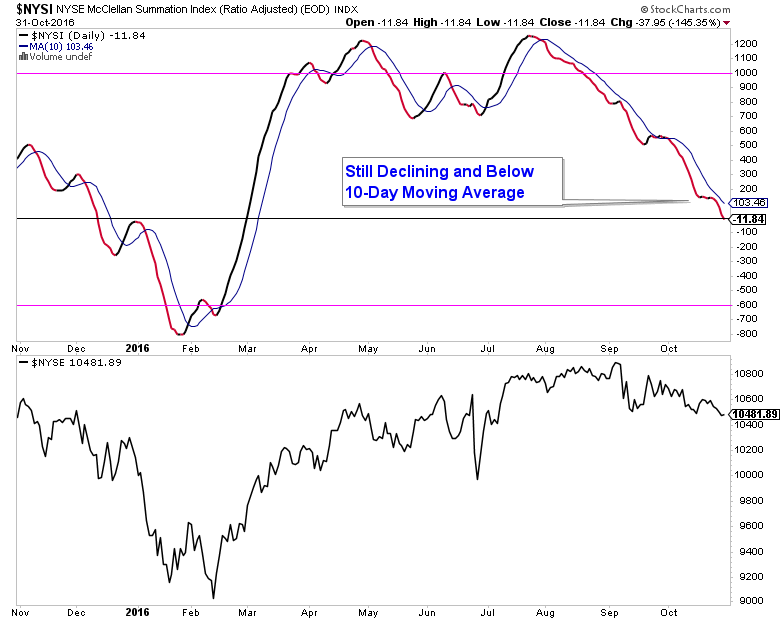

Market breadth is still negative. Below is a chart of the NYSE Summation Index (in the top panel) and it is still trending down.

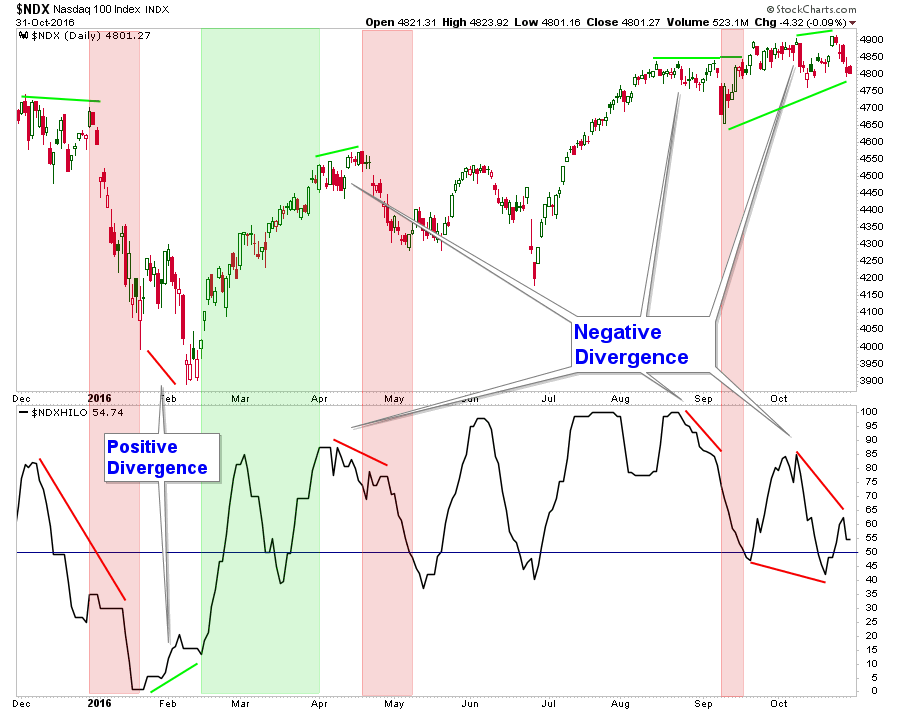

Another breadth indicator that has done a good job of forecasting market turns is the High-Low Index, shown below. Notice the negative divergences that I highlighted. This is where the High-Low indicator (in the bottom panel) turns down as the index advances or moves sideways, not confirming the strength in the index. In past cases, the index turned down soon after the divergence. Currently, the index is displaying a negative divergence relative to the market and this is another warning that we could continue to see stock market weakness in the near-term.

Market momentum is also currently negative. In last week’s newsletter, I showed two volume based momentum indicators (On Balance Volume and the Force Index). Both indicators are still decisively negative.

In summary, we have a stock market that is displaying a bearish chart pattern, has negative market breadth and volume based momentum indicators are strongly negative. Thus, short-term risk is high and odds are elevated that we could see more stock market weakness in the near-term.

The Bottom Line

Short-term stock market risk is currently high. Until Market Breadth Indicators turn positive, odds are elevated that stocks will fall or continue to churn sideways over the near-term.

Bias: Neutral (Short-term negative, long-term positive for stocks.)

- Long-term stock market price action is positive and will remain so as long as prices remain above the June 2016 lows.

- Market internals suggest a positive environment for stocks over the longer-term.

- The short-term market weakness that was signaled by market internals as far back as mid-July has been confirmed. The market is now in the process of correcting/consolidating. Short-term market risk is high.

Client Update

TD Ameritrade client accounts are between 50% to 70% invested in lower volatility funds.

I will be looking to add funds that I have identified as providing attractive risk-adjusted return characteristics once short-term internals turn positive.

10 Best Affordable Mountain Towns for Retirement

If you have any questions, please feel free to contact me.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.