The Bottom Line

Bias:

Long-Term Positive for Stocks.

Positive for Treasury Prices and Other Interest Rate Sensitive Bonds.

- We are in a strong bull market. The recent consolidation in the market has been resolved to the upside which is bullish.

- Long-term the stock market still looks strong; therefore, any weakness in stocks that we see in the coming weeks should be viewed as a buying opportunity as long as the lows of early November are not violated.

- Yields look like they have hit a short-term top which is positive for Treasury prices and other interest rate sensitive bond prices.

Client Update

Client accounts are fully invested and margin accounts are slightly leveraged.

I will be looking to increase market exposure strategically.

Market Technicals

Not much has changed over the past week. Market internals still suggest long-term market strength; however, whichever metric you use, we are due for some type of short-term pullback. It does not make sense to try to anticipate a correction because in strong markets that is difficult.

The metrics that I will be monitoring to alert me that a short-term correction has begun are: price action, a strong advance in the VIX, a deterioration in market breadth, and falling momentum indicators. Any weakness that occurs should provide an opportunity to increase market exposure.

Stock Market Price Action – Positive

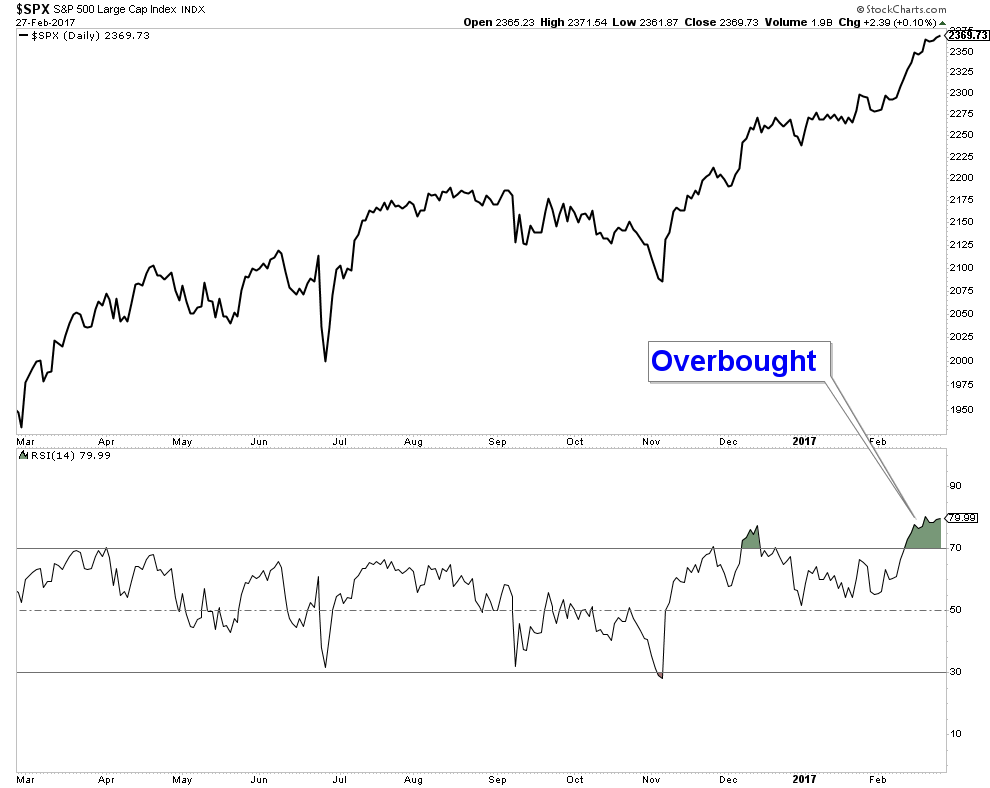

The bottom line is that the S&P 500 is at an all-time high, above both it’s 50 and 200-day moving averages, and both those averages are trending higher. This is characteristic of positive stock market price action.

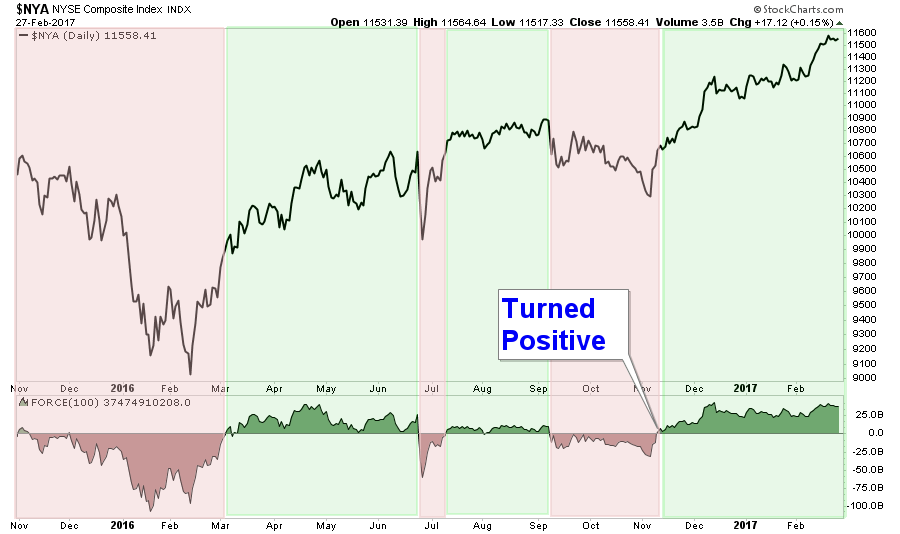

Stock Market Momentum – Long-Term Positive

In the lower panel of the chart below is a Force Index, which is a volume-based momentum indicator. We are using a 100-period time frame which is used to confirm longer-term trends.

The index turned positive in early November and is still sitting substantially above the zero line. This suggests that longer-term momentum is positive and any market weakness should be minor unless market internals deteriorate.

At some point, stocks are going to correct on a short-term basis. Trying to forecast short-term pullbacks is difficult given that stocks frequently surprise to the upside during strong bull markets.

The recent advance has pushed RSI all the way up to almost 80, a level that has historically suggested that stocks are overbought from a price perspective.

Stock Market Breadth – Positive

Below is a chart of the S&P 500 in the top panel along with five different Summation Indexes below it. The recent surge in stock prices has all of them now trending higher.

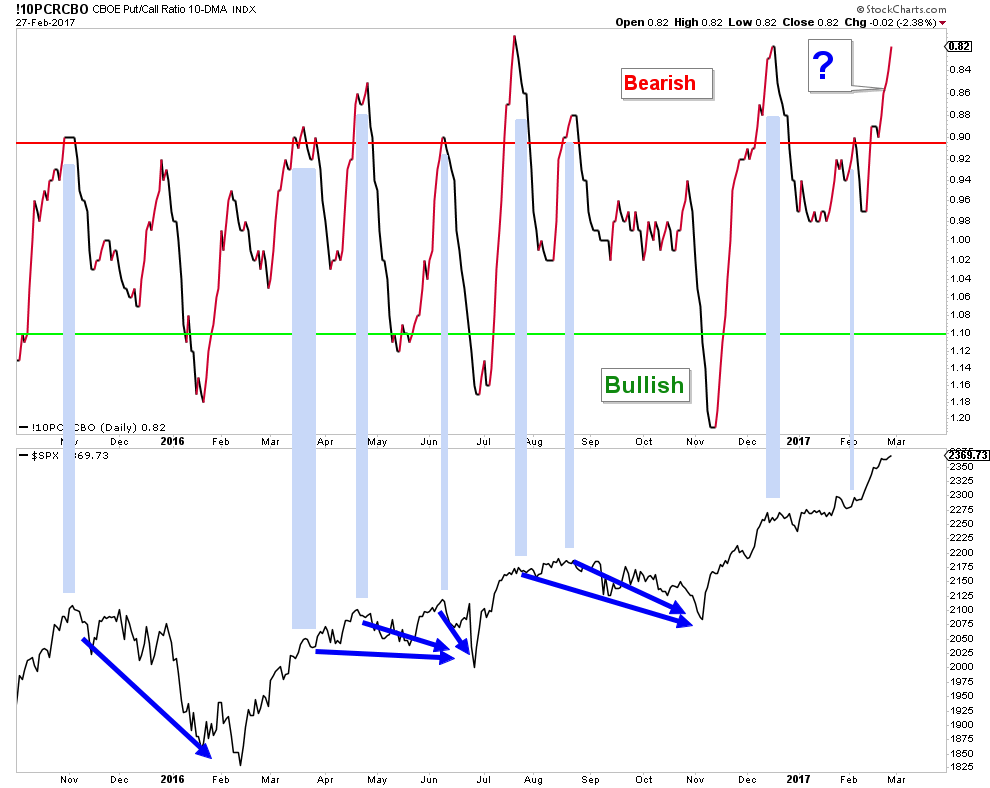

Market Sentiment – Negative

When too many investors are bullish, it is a bearish signal from a sentiment perspective. Market sentiment has done a good job over the past year in predicting market weakness; however, recently it has not. Or at least, not yet.

The strong market advance has sentiment indicators at levels that historically have accurately predicted short-term stock market weakness.

One of those indicators is the Put/Call Ratio which is displayed in the upper panel in the chart below. Notice how when it has advanced above the horizontal red line, it has accurately forewarned of impending market weakness.

Seasonality – Negative

February is the 9th seasonally strongest month of the year for the S&P 500 from 1957 – 2016.

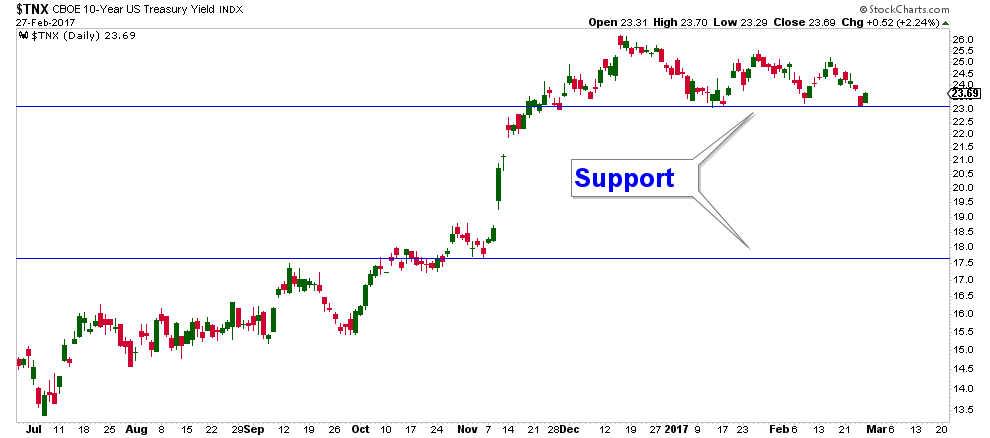

Treasury Bonds and Other Interest Rate Sensitive Bonds – Positive

After advancing strongly, Treasury Yields have trended sideways over the past 12 weeks, establishing a level of support at around the 23 level.

Given that the next level of support is all the way down at about the 18 level, there is a good amount of upside for bond prices if yields break below support.

How to Maximize Social Security Spousal Benefits – Rules and Eligibility

If you have any questions, please feel free to contact me.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.