Long Term Strength – Short Term Weakness

Market Update

The S&P 500 finally broke above resistance ending its long-term trading range (see chart below). Most other indexes are still below their all-time highs, but are also trending up.

Many indicators are suggesting this stock market advance is likely to continue. However, near term, the current extreme in investor complacency/fearlessness that emerged last week plus July seasonality warn that the sharp rally off the Brexit lows is unlikely to continue much further, if at all, without at least a minor pullback first – which I believe will occur between now and month end.

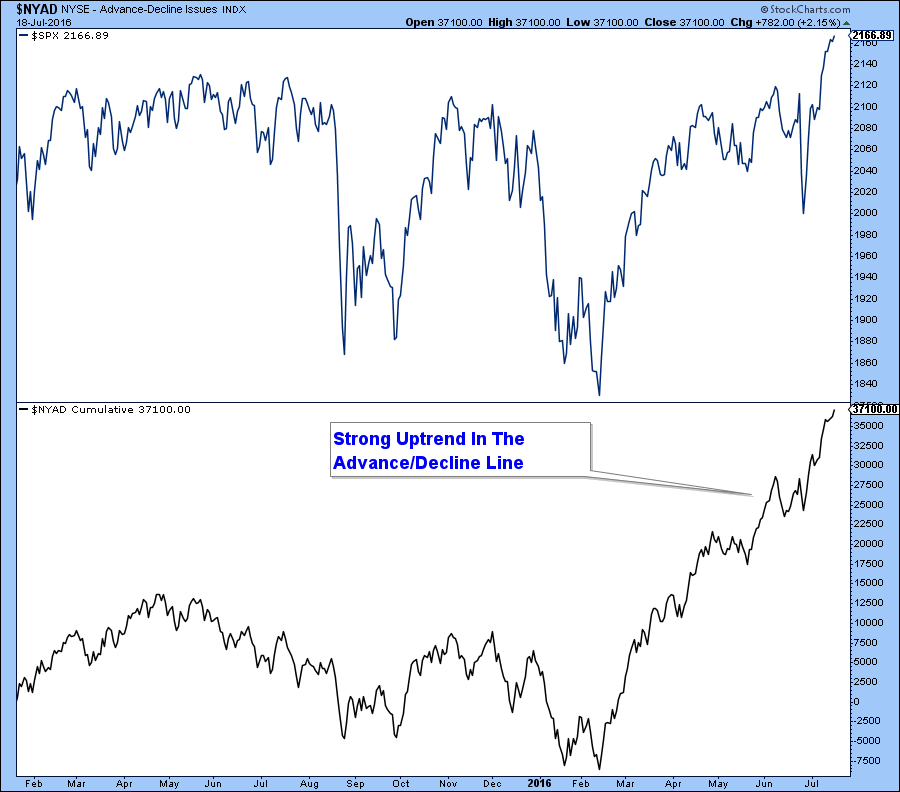

First let’s look at a couple of charts that support longer-term stock market strength. Below is a chart of the Advance/Decline line. The strength of this line suggests that the current stock market advance is occurring with the support of strong stock market breadth.

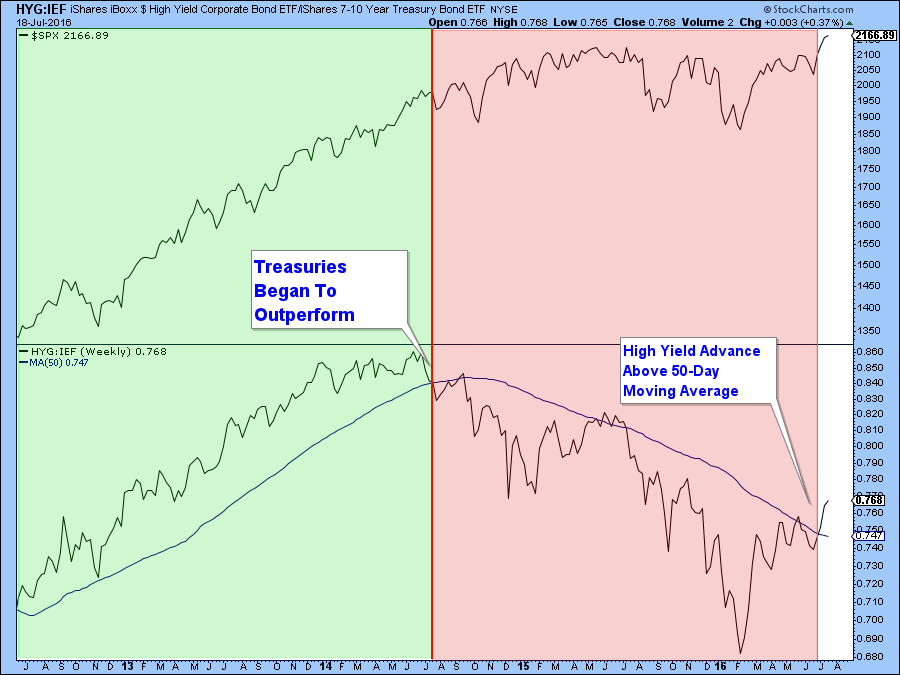

Below is a weekly chart of the relative performance of HYG (a High Yield ETF) relative to IEF (a Treasury ETF). When Treasuries are outperforming the line slopes down and when High Yield outperforms, the line advances. During periods of stock market strength investors favor higher risk High Yield securities over defensive treasuries.

As you will notice from the chart below, High Yield has been underperforming Treasuries since the middle of 2014 (red shaded area). However, recently the relative performance line advanced above the 50-day moving average line. This shift suggests longer-term stock market strength.

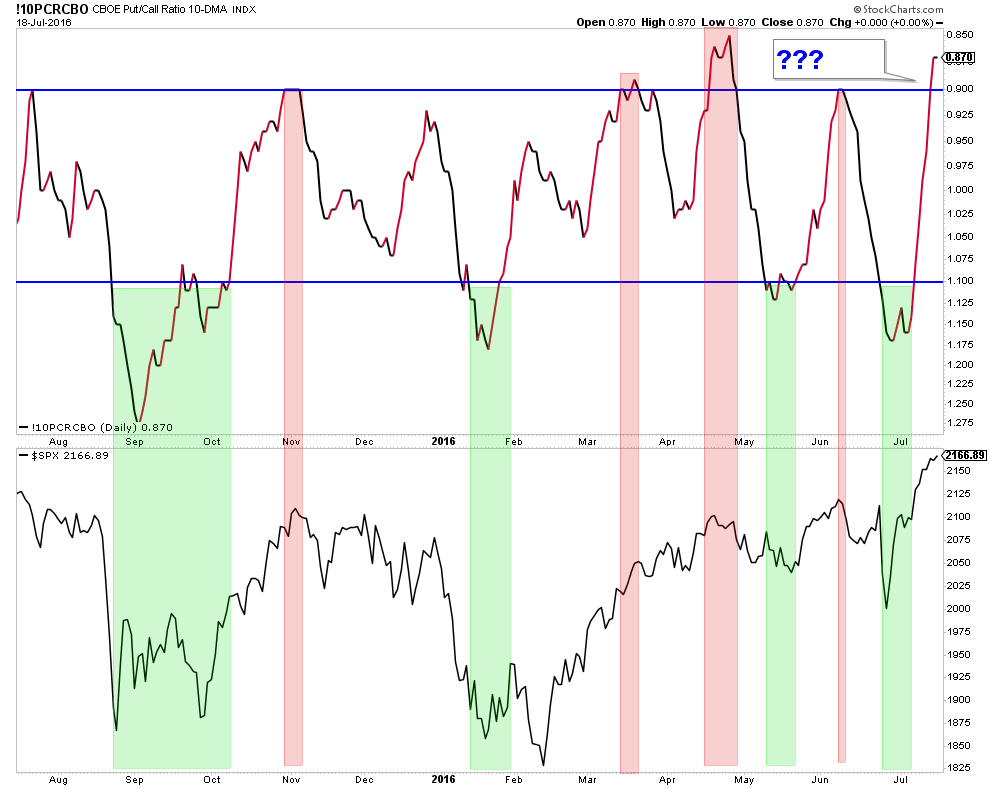

Now let’s look at a chart that supports shorter-term stock market weakness. The Put/Call Ratio (a Sentiment Indicator) chart below shows that when this ratio falls below (the chart has been inverted to make it easier to view relative to the S&P 500 chart below) .90 it usually coincides with near term stock market weakness.

The Bottom Line

Bias: Positive for Stocks

Longer-term stock market conditions look positive; however, we could see some short-term market weakness before stocks resume trending up.

Client Update

Client accounts are fully invested. Leverage has been used in Margin accounts since April 2016. For the most part, our accounts have trended up with very minor volatility this year.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.