The Bottom Line

Bias:

Positive for Stocks.

- Long-term, the stock market is in a strong uptrend.

- While the summer months are typically bad for stocks and sentiment is currently negative, the weight of the evidence is Bullish for the stock market.

Client Update

Client accounts are fully invested.

Market Technicals

I am going to use this week’s newsletter to analyze the market from a longer-term perspective. I feel most people, myself included, can get overly focused on what is going on in the market over the past week or year, and lose sight of the longer-term trend. This type of narrow focus can put us in situations where we make mistakes with our investment decisions.

This is not to say that there is not value in analyzing short-term market technicals, just that knowing both the short and long-term trends in the market are important in how we allocate our investment accounts.

Stock Market Price Action – Positive

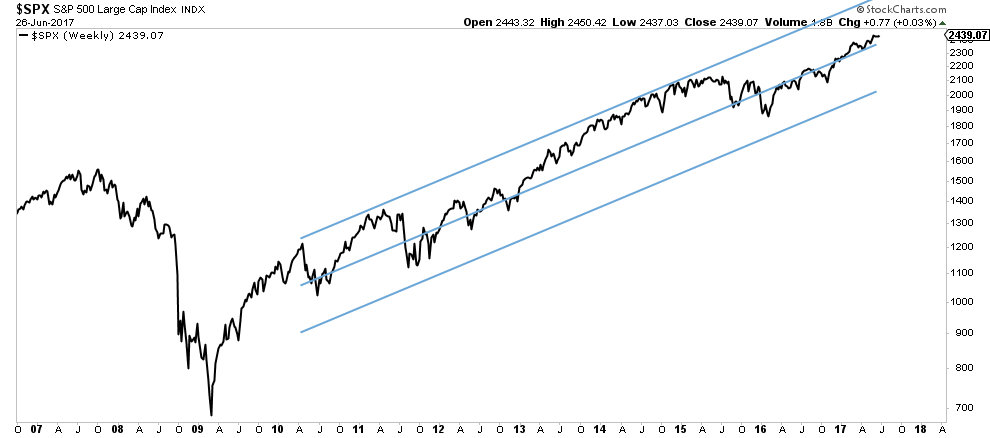

Below is a chart of the S&P 500 from 2007 to present. I have overlaid a regression channel to better determine the longer-term trend.

As you will notice, even the market correction of 2015 which saw the market fall by about 14%, didn’t change the longer-term trend.

Stock Market Breadth – Positive

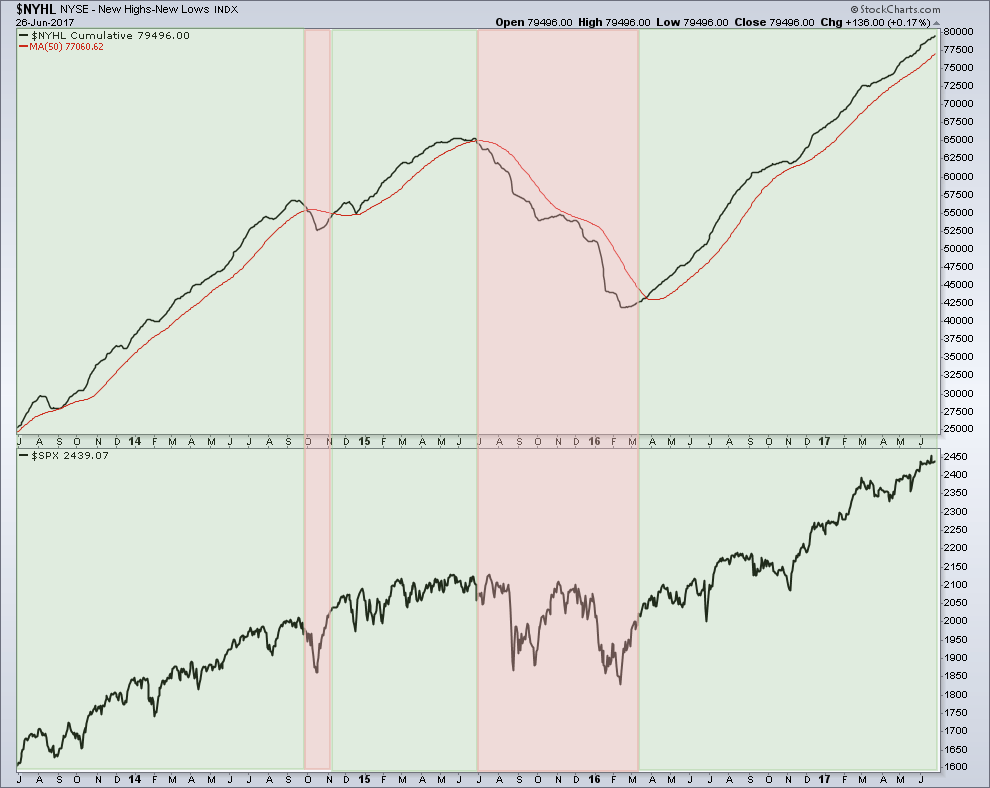

Below is a chart of the Cumulative New Highs-New Lows Line for the NYSE. It is a long-term breadth indicator and does a good job of signaling major market strength and weakness. As of right now, it is trending up, signaling positive long-term market breadth.

Long-term the stock market is in an uptrend and market breadth is positive. The weight of the evidence continues to be bullish for stocks.

If you have any questions, please feel free to contact me.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

About Asset Solutions

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.