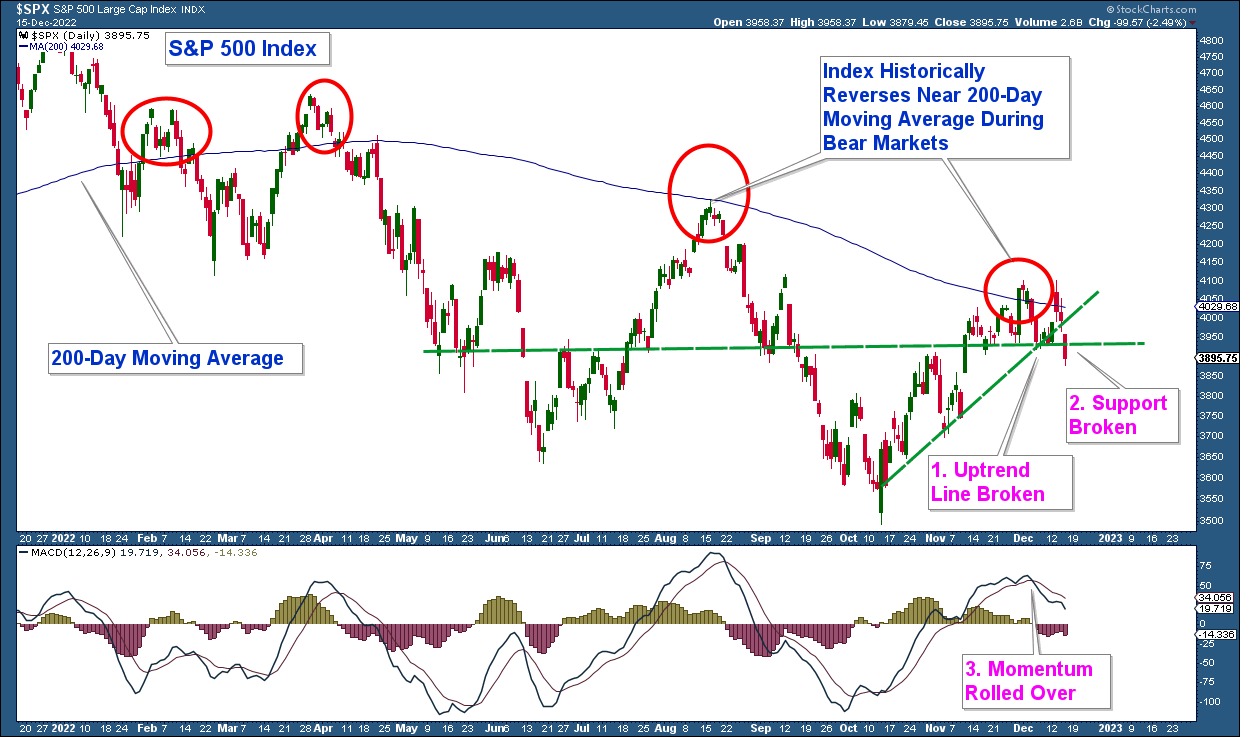

Bear market rallies tend to give people hope, only to dash those hopes with the next move lower. It can be emotionally and financially draining. The recent advance off the October lows showed none of the signs that would suggest a longer-term bottom. So, a reversal at the 200-day moving average was likely given how it has historically tended to be a strong bear market resistance area.

In last month’s newsletter, I laid out three technical factors that I was watching that would suggest the end of the rally. As of today, all three of those have occurred.

Below is the same chart that I posted in that newsletter. In the top panel is a chart of the S&P 500 Index and in the lower panel is the MACD (a momentum indicator). Here are the three factors:

- A break in the uptrend line.

- A break of support.

- The MACD rolling over.

All three have occurred which signals that the odds of more losses in stocks has risen significantly.

I have no way of knowing how far stocks are going to fall. But what I do know is that we are in a bear market with a recession likely next year. Thus downside risk is huge.

Uptrend lines and support areas can provide traders with logical exit points. Meaning they will hold long positions until those lines get broken. It is common to see strong moves lower when those lines/areas get broken as traders exit positions in mass. Once the levee of support breaks, price has nowhere to go but down.

As Robert Plant sang: When the levee breaks, have no place to stay.

If you are an investor who has lost money this year and are concerned about further losses, shoot us an email.

CAN WE HELP YOU?

HERE’S AN EASY WAY TO FIND OUT:

We want clients who are a good mutual fit. To find out, we offer a no-pressure complimentary consultation. If we can help you and you want to work with us, that’s great. But if you don’t, we will give you free asset allocation direction on your retirement accounts, at no charge and with no strings attached.

If you are interested, send us an email to set up your complimentary zoom meeting.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.