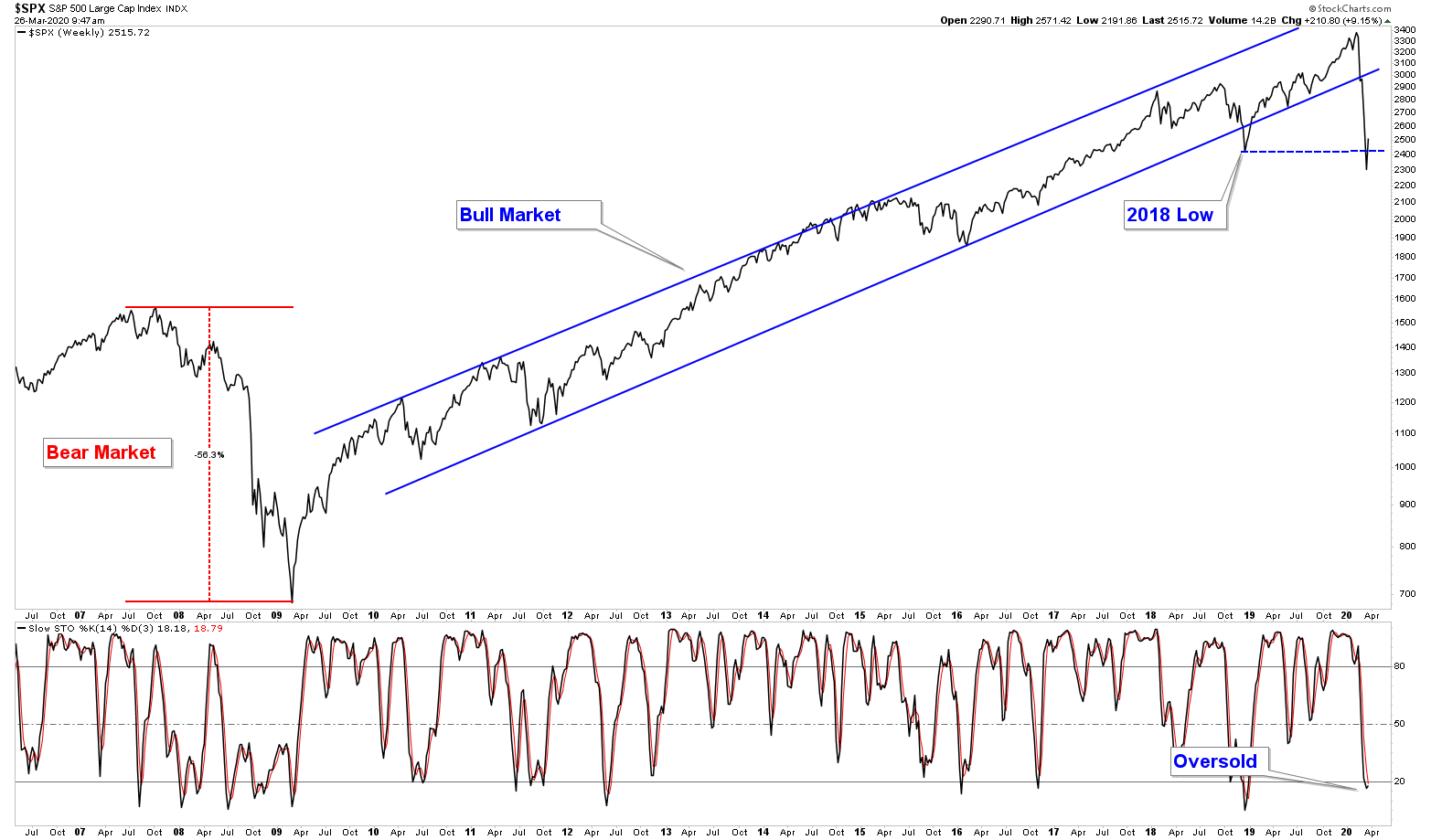

The economy and stock market are cyclical. We are no longer in a long-term uptrend or bull market. The stock market has fallen decisively below the lower end of the up-trending channel (see chart below) that has defined the advance that began in 2009.

Below is a long-term (weekly) chart of the S&P 500 going back to 2007. I have noted the last bear market with red annotations. Throughout that correction, the S&P 500 fell about 55% peak-to-trough.

Next, we had one of the longest bull market advances in history that abruptly ended this year with a strong move down below the up-trending channel.

The S&P 500 has fallen 33.9% peak-to-trough in just over 4 weeks. It is now sitting right above the lows of 2018, which is support. It would be easier to see on a shorter-term chart, but the market is trying to form a bottom here.

Also, stocks are oversold as defined by momentum indicators. In the lower panel is the Slow Stochastics momentum indicator and it is below 20 which historically has signaled some type of imminent bottom. The problem is that during times of high stock market stress those signals are not very accurate as is evident in looking back at the last bear market.

I would view the short-term advance that we have seen over the past couple of days with caution. Those sectors of the market that either led us down or have been underperforming over the past couple of years fell decisively below their 2018 lows, unlike the S&P 500. Areas such as the Transportation Index, Small Cap. Index, Industrials, and Financials all fell below their 2018 lows.

In my opinion, risk is still very high. At some point, the stock market will bottom. However, it is way too early to call a bottom here.

If you want to see what we were saying prior to the market correction, please review our two market updates: Stock Market Looking Frothy and The Long and the Short of It.

If anyone has questions or concerns, please feel free to contact me. Take care and be safe.

Craig Thompson, ChFC

Email: [email protected]

Phone: 619-709-0066

Asset Solutions Advisory Services, Inc. is a Fee-Only Registered Investment Advisor specializing in helping the needs of retirees, those nearing retirement, and other investors with similar investment goals.

We are an “active” money manager that looks to generate steady long-term returns, while protecting clients from large losses during major market corrections.

Asset Solutions may discuss and display, charts, graphs, formulas which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Most data and charts are provided by www.stockcharts.com.

Asset Solutions is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

All charts provided by: StockCharts.com